Strong week for NETGEAR (NASDAQ:NTGR) shareholders doesn't alleviate pain of three-year loss

NETGEAR, Inc. (NASDAQ:NTGR) shareholders should be happy to see the share price up 27% in the last month. Meanwhile over the last three years the stock has dropped hard. Regrettably, the share price slid 62% in that period. So it's good to see it climbing back up. After all, could be that the fall was overdone.

On a more encouraging note the company has added US$47m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

View our latest analysis for NETGEAR

NETGEAR isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over the last three years, NETGEAR's revenue dropped 22% per year. That means its revenue trend is very weak compared to other loss making companies. Arguably, the market has responded appropriately to this business performance by sending the share price down 17% (annualized) in the same time period. Bagholders or 'baggies' are people who buy more of a stock as the price collapses. They are then left 'holding the bag' if the shares turn out to be worthless. It could be a while before the company repays long suffering shareholders with share price gains.

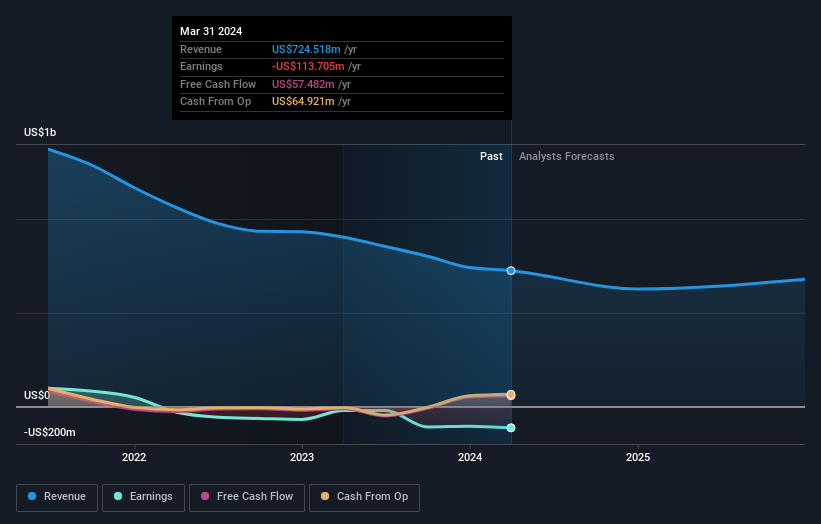

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling NETGEAR stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

NETGEAR shareholders are up 8.3% for the year. But that was short of the market average. But at least that's still a gain! Over five years the TSR has been a reduction of 7% per year, over five years. It could well be that the business is stabilizing. It's always interesting to track share price performance over the longer term. But to understand NETGEAR better, we need to consider many other factors. For example, we've discovered 1 warning sign for NETGEAR that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance