Strategic Moves by T Rowe Price Equity Income Fund with a Spotlight on UnitedHealth Group

Insightful Portfolio Adjustments in Q2 2024 Highlighting a Major Stake in UnitedHealth Group

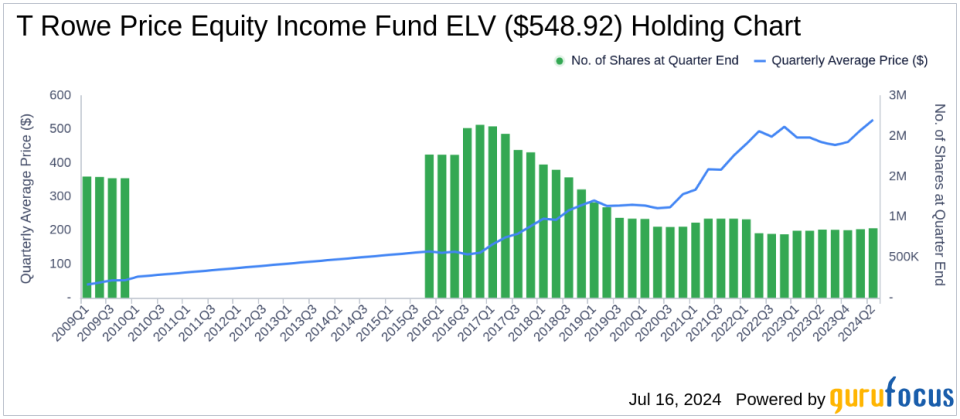

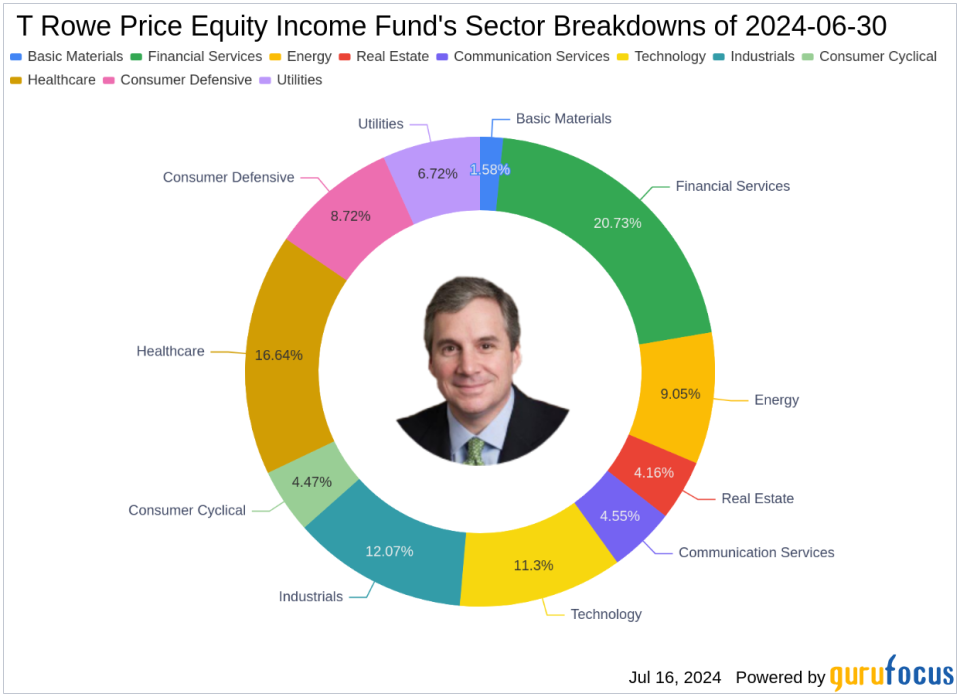

Established in 1985, the T. Rowe Price Equity Income Fund is renowned for its conservative, value-oriented investment strategy. Managed by John Linehan since November 2015, the fund focuses on achieving high dividend income and long-term capital growth. It primarily invests in large-cap stocks that are either dividend-rich or undervalued. The fund's recent N-PORT filing for the second quarter of 2024 reveals significant transactions that underline its strategic investment moves.

Summary of New Buys

The T Rowe Price Equity Income Fund (Trades, Portfolio) expanded its portfolio by adding five new stocks. Key acquisitions include:

UnitedHealth Group Inc (NYSE:UNH) with 523,000 shares, making up 1.53% of the portfolio and valued at $266.34 million.

GE Vernova Inc (NYSE:GEV) with 640,000 shares, representing 0.63% of the portfolio, valued at $109.77 million.

Marathon Oil Corp (NYSE:MRO) with 1,590,000 shares, accounting for 0.26% of the portfolio, valued at $45.59 million.

Key Position Increases

The fund also increased its stakes in 43 stocks, with notable enlargements in:

MetLife Inc (NYSE:MET), where an additional 885,000 shares were purchased, bringing the total to 4,695,000 shares. This adjustment increased the share count by 23.23%, impacting the portfolio by 0.36%, and bringing the total value to $329.54 million.

Comcast Corp (NASDAQ:CMCSA), with an additional 1,450,000 shares, bringing the total to 2,650,000 shares. This represents a 120.83% increase in share count, valued at $103.77 million.

Summary of Sold Out Positions

The fund completely exited positions in five stocks during the quarter, including:

International Flavors & Fragrances Inc (NYSE:IFF), selling all 380,000 shares, impacting the portfolio by -0.18%.

Constellation Brands Inc (NYSE:STZ), liquidating all 70,000 shares, causing a -0.11% impact on the portfolio.

Key Position Reductions

Reductions were made in 54 stocks, with significant cuts in:

Qualcomm Inc (NASDAQ:QCOM), reduced by 1,090,000 shares, a -34.12% decrease, impacting the portfolio by -1.03%. The stock traded at an average price of $188.89 during the quarter and has returned 24.72% over the past three months and 46.11% year-to-date.

Wells Fargo & Co (NYSE:WFC), reduced by 2,420,000 shares, a -25.99% reduction, impacting the portfolio by -0.78%. The stock traded at an average price of $59.04 during the quarter and has returned 5.69% over the past three months and 21.98% year-to-date.

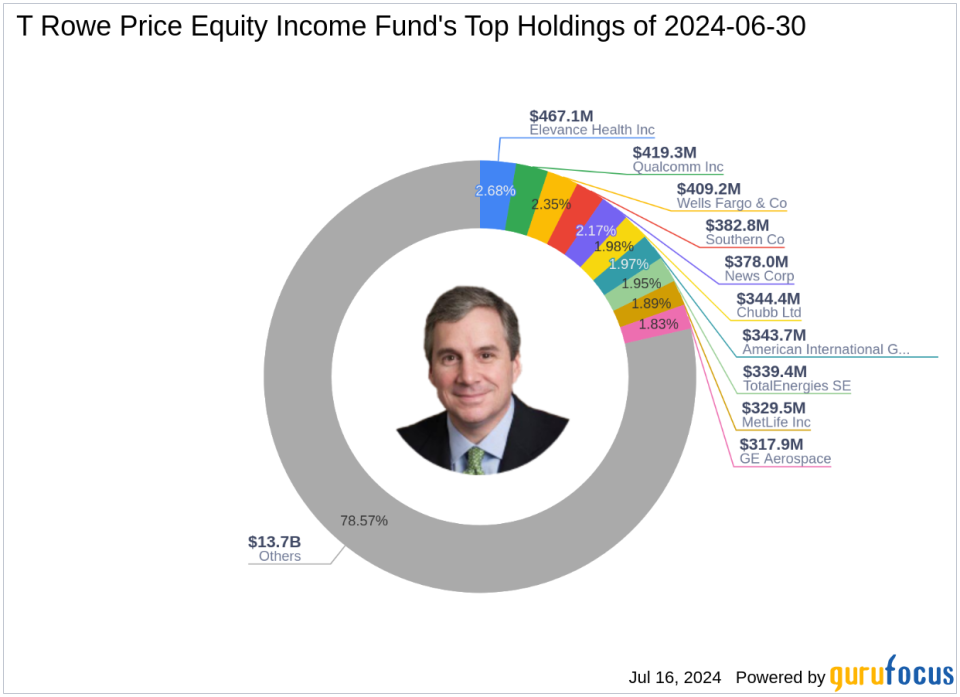

Portfolio Overview

As of the second quarter of 2024, the T Rowe Price Equity Income Fund (Trades, Portfolio)'s portfolio included 116 stocks. Top holdings were 2.68% in Elevance Health Inc (NYSE:ELV), 2.41% in Qualcomm Inc (NASDAQ:QCOM), 2.35% in Wells Fargo & Co (NYSE:WFC), 2.2% in Southern Co (NYSE:SO), and 2.17% in News Corp (NASDAQ:NWSA). The holdings are predominantly concentrated across 11 industries, reflecting a diverse and strategic allocation.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance