It's A Story Of Risk Vs Reward With Wolftank-Adisa Holding AG (ETR:WAH)

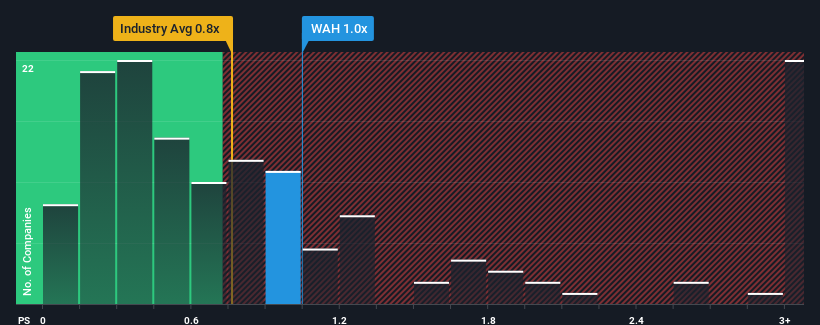

With a median price-to-sales (or "P/S") ratio of close to 0.6x in the Commercial Services industry in Germany, you could be forgiven for feeling indifferent about Wolftank-Adisa Holding AG's (ETR:WAH) P/S ratio of 1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Wolftank-Adisa Holding

How Wolftank-Adisa Holding Has Been Performing

Recent times have been advantageous for Wolftank-Adisa Holding as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Wolftank-Adisa Holding.

What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Wolftank-Adisa Holding's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 37%. Revenue has also lifted 22% in aggregate from three years ago, mostly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 18% per annum during the coming three years according to the dual analysts following the company. That's shaping up to be materially higher than the 5.8% per year growth forecast for the broader industry.

In light of this, it's curious that Wolftank-Adisa Holding's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does Wolftank-Adisa Holding's P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite enticing revenue growth figures that outpace the industry, Wolftank-Adisa Holding's P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

You should always think about risks. Case in point, we've spotted 2 warning signs for Wolftank-Adisa Holding you should be aware of.

If these risks are making you reconsider your opinion on Wolftank-Adisa Holding, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance