Have stocks really become cheaper?: Morning Brief

Wednesday, March 11, 2020

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

The forward P/E is down because of the P, not the E

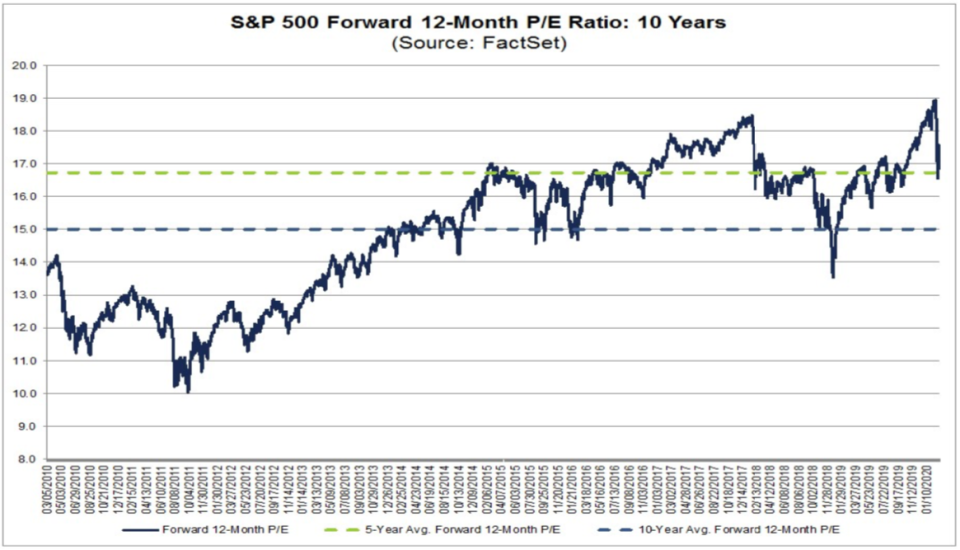

The stock market was looking expensive going into 2020 with the S&P 500’s (^GSPC) forward price/earnings (P/E) multiple trading significantly above its historical averages.

But with the S&P plummeting 19.4% from its Feb. 19 high of 3,393.52 to its March 9 low of 2,734.43, that P/E has come down sharply.

“The S&P 500 multiple just experienced one of the largest multiple de-ratings in the last 30-years,” JPMorgan’s Dubravko Lakos-Bujas observed on Tuesday in a note to clients titled Risk/Reward Improving. “Over the last 1-month its multiple de-rated by ~3.5 turns, which is comparable to the dot com bubble recession and the global financial crisis. The index multiple is currently at 16x (assuming a conservative earnings growth of 3-4% in 2020), putting it in-line with its long-term median.”

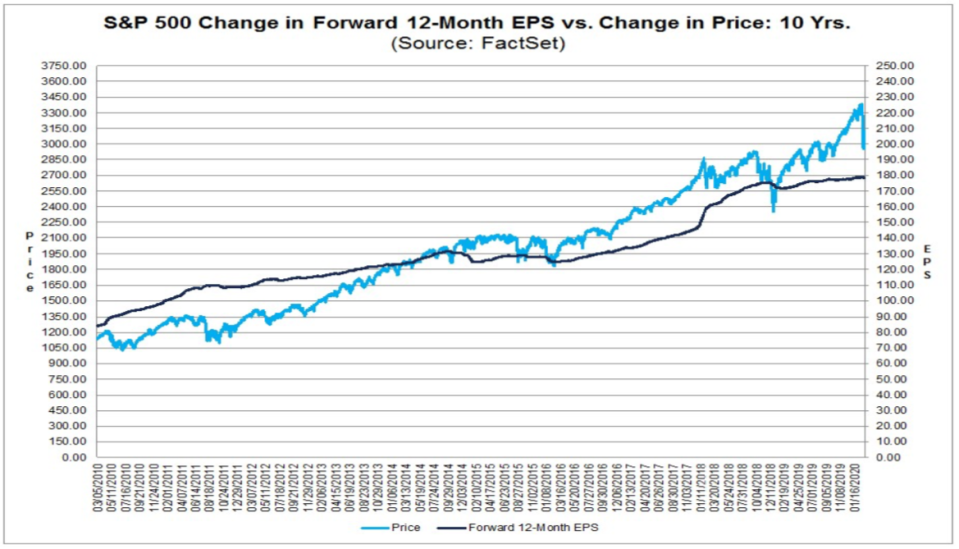

What’s interesting about the recent move is analysts have yet to make any material adjustments to their earnings forecasts. In other words, the drop in P/E was all about the P and not the E.

“Despite the price weakness and subsequent move in valuations, the NTM EPS growth rate for the S&P 500 index moved only a touch lower during the month while our earnings revisions composite has also been pretty stable, currently hovering around the 50% mark,” BMO’s Brian Belski noted on Thursday. “This suggests to us that the longer-term fundamental outlooks for S&P 500 companies overall has largely remained intact.”

In other words, if you are wagering that stocks have gotten cheaper based on P/Es, then you are also wagering that the outlook for earnings will hold up.

This dynamic is a bit ironic. Not long ago, Wall Street’s top stock market strategist were warning that forward earnings expectations needed to come down. And that was before the outbreak of COVID-19.

And keep in mind, the P doesn’t have to go up for stocks to become expensive again. P/Es rise when the E comes down. That’s just math.

To be sure, Wall Street isn’t blind to this.

“Equity multiples typically decline well before a potential decline in earnings,” UBS’s Keith Parker noted earlier this month. Looking back at recent slowdowns and downturn he observed, “Earnings for S&P 500 on a forward basis have fallen through three reference periods: 2000-2002 (-17%), 2007-09 (-39%) and 2014-15 (-4%).“

Indeed, as you can see in the chart above from FactSet, analysts’ forward earnings estimates have yet to move materially. But with expectations for a U.S. recession up sharply, it’d be prudent for investors to consider the risk that those numbers come down sharply.

“The downward earnings revisions have just begun,” Morgan Stanley’s Mike Wilson wrote on Monday. “To date, company guidance has generally been lacking precision on the impacts of the virus but as it further affects consumption and supply chains we would expect further management commentary to pull analyst estimates lower.”

And to be fair to JPM’s Lakos-Bujas, he isn’t exactly telling clients to go all in.

“We do acknowledge the potentially extreme binary outcome as we work through the impact of COVID-19, but still hold the view that policy supports should ultimately outlast the outbreak,” he said. “If COVID-19 intensifies and proliferates well beyond JPM base case scenario and the anticipated counter-policy responses turn out to be underwhelming, the S&P500 will most likely face further downside.

“Under this pessimistic scenario, the equity multiple may not find a bottom until it hits 14-15x and EPS growth turns negative—implying a recession case of ~2,300 level for S&P500,” he added. “Even in such a downside scenario we expect earnings recession to be relatively shallow by historical standards, given relatively healthy balance sheets of US consumers and key corporate sectors.“

So, how bad is the virus hitting the economy, and in turn what does it mean for earnings?

Unfortunately, it’ll be a while before we get any confirmation in the economic data.

By Sam Ro, managing editor. Follow him at @SamRo

What to watch today

Economy

7:00 a.m. ET: MBA Mortgage Applications, week ended March 6 (15.1% prior)

8:30 a.m. ET: CPI month-on-month, February (0.0% expected, 0.1% in January)

8:30 a.m.ET: CPI excluding food & energy month-on-month, February (0.2% expected, 0.2% in January)

8:30 a.m. ET: CPI year-on-year, February (2.2% expected, 2.5% in January)

8:30 a.m. ET: CPI excluding food & energy year-on-year, February (2.3% expected, 2.3% in January)

2:00 p.m. ET: Monthly Budget Statement, February (-$248.1 billion expected, -$234.0 billion in January)

Top News

Bank of England cuts interest rate to 0.25% in coronavirus response [Yahoo Finance UK]

UK economy flatlined in January before coronavirus swept Europe [Yahoo Finance UK]

Google recommends all North America employees to work from home [Reuters]

US Treasury will likely extend deadline for filing tax due to coronavirus: WSJ [Reuters]

YAHOO FINANCE HIGHLIGHTS

Trump's re-election chances plunge amid rise in coronavirus fears, according to major oddsmaker

Walmart implements emergency leave policy after associate tests positive for COVID-19

Why now could be a 'golden opportunity' to own Apple

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay

Yahoo Finance

Yahoo Finance