Stock market news live: S&P 500, Nasdaq have record closes

U.S. stocks climbed Wednesday, building on a rally from Tuesday that sent the Nasdaq to a record closing high.

4:02 p.m. ET S&P 500, Nasdaq have record closes

Here’s where the major indices had settled as of 4:02 p.m. ET:

S&P 500 (^GSPC): +1.13% or +37.11 points to 3,334.70

Dow (^DJI): +1.68% or +482.75 points to 29,290.38

Nasdaq (^IXIC): +0.43% or +40.71 points to 9,508.68

Crude oil (CL=F): +2.90% or +1.44 to 51.05 a barrel

Gold (GC=F) +0.35% or +5.40 to 1,560.90 per ounce

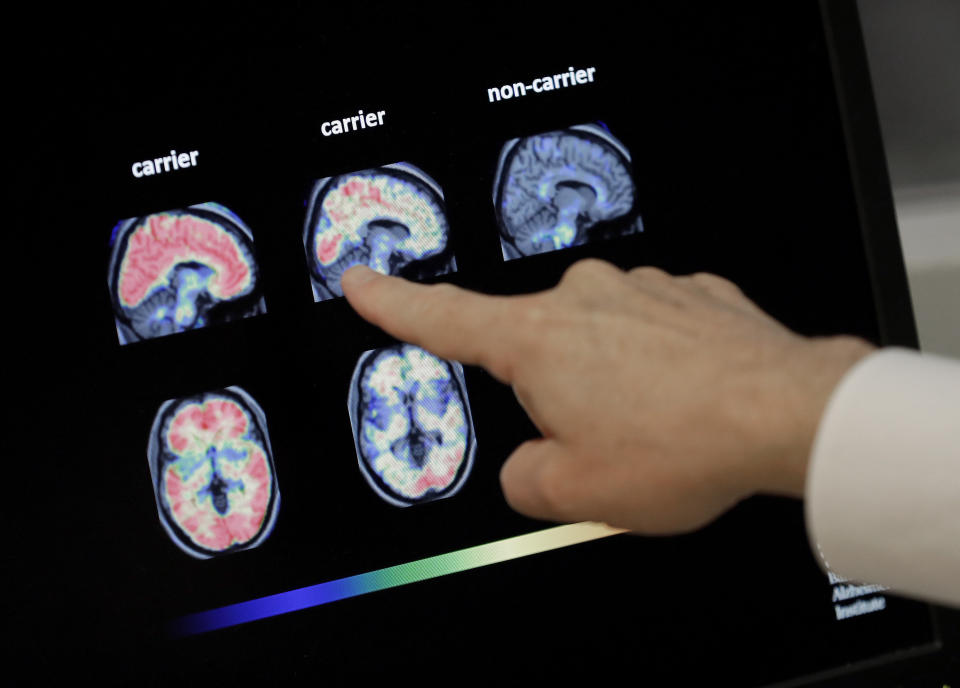

3:20 p.m. ET: Biogen spikes over 16% on lawsuit relief rally

A key patent ruling in Biogen’s (BIIB) favor has brought out the stock’s bulls, with the shares rocketing as much as 30% at the day’s peak. Bloomberg notes that Biogen is now higher than it was before it lost a quarter of its market value in March 2019, in the wake of the failure of its Alzheimer drug efforts. In late trading, the stock changed hands above $330, after having scaled to near $375.

—

3:15 p.m. ET: Stocks add to gains, reversing coronavirus losses

Traders head into the closing bell with a full head of steam, sending major benchmarks to session highs and completing the 180-degree reversal from the coronavirus sell-off. The S&P 500 Index (^GSPC) has set a new intraday record, and the Dow (^DJI) is up nearly 500 points on the day.

—

1:21 p.m. ET: Tesla on pace for worst day ever

Tesla (TSLA) stock has fallen about 20% Wednesday, wiping out $47.7 billion in market cap since Tuesday’s all-time high. If the Tesla closes more than 19.33% down, it will be the stock’s worst day ever.

—

12:30 p.m. ET: Stocks hold highs as coronavirus fears dissipate

Major benchmarks stay in the green as hopes grow for a coronavirus breakthrough. Here were the main moves in markets, as of midday:

S&P 500 (^GSPC): +0.86% or +28.39 points to 3,325.98

Dow (^DJI): +1.05%, or +302.68 points to 29,110.31

Nasdaq (^IXIC): +0.35%, or +32.75, to 9,500.86

Crude oil (CL=F): +3.83%, or +$1.90 to $51.51 per barrel

Gold (GC=F) +$6.30 or +0.41% to $1,561.80 per ounce

—

12:00 p.m. ET: LinkedIn CEO to resign

Jeff Weiner, the long-serving chief of the professional network who presided over the company’s acquisition by Microsoft, is leaving the building.

Weiner broke the news in a LinkedIn post (of course), saying that it was time for his “next play” and that he’d turn over the reins to global head of product Ryan Roslansky:

While I’ve been thinking about the timing of this transition for some time, over the last year or so, several factors converged that led me to conclude now is the right time to make this change. For starters, our business has never been better, our culture has never been stronger, and our future has never been clearer. Additionally, my passion for initiatives beyond my day-to-day role as CEO has continued to grow. Most importantly, after working with Ryan for nearly two decades, spanning two companies and countless roles, it’s become clear to me that going forward, his vision, drive and passion are exactly what the role requires.

Microsoft’s stock shed 0.35% in midday trading, holding around $179.48.

—

10:37 a.m. ET: ISM non-manufacturing index tops expectations, showing re-accelerating economic growth, Capital Economics says

The Institute of Supply Management’s non-manufacturing index climbed in January to a six-month high of 55.5, topping expectations for 55.1, according to Bloomberg consensus data. In December, the ISM non-manufacturing index registered at 54.9.

The report points to ongoing strength in the U.S. services sector, with readings above the neutral level of 50 indicating expansion in sector activity.

January’s advance was led by a jump of 3.9 points in the business activity index, as well as a 0.9 point rise in the new orders index. However, the inventory change index fell to a seven-year low 46.5 from 60.0 the prior month.

The report “provides further evidence that domestic demand growth is recovering,” Capital Economics senior U.S. economist Michael Pearce wrote in a note. “With the risks of a domestic epidemic from the coronavirus well contained, we expect economic growth to gradually re-accelerate over the course of 2020.”

—

10:00 a.m. ET: Dow climbs 300+ points after market open

Stocks surged Wednesday morning, pointing to a third consecutive session of advances.

Gains in the Dow were led by shares of UnitedHealth and Exxon Mobil. The energy sector led gains in the S&P 500, with domestic crude oil prices jumping more than 3.5% and paring some of the past week’s losses.

Here were the main moves in markets, as of 10:00 a.m. ET:

S&P 500 (^GSPC): +0.86% or +28.39 points to 3,325.98

Dow (^DJI): +1.05%, or +302.68 points to 29,110.31

Nasdaq (^IXIC): +0.6%, or +56.7, to 9,524.68

Crude oil (CL=F): -3.53%, or +$1.75 to $51.36 per barrel

Gold (GC=F) +$2.40, or +0.15% to $1,557.90 per ounce

—

8:31 a.m. ET: S&P 500 earnings growth is so far topping expectations for 4Q19, Credit Suisse says

Growth for aggregate S&P 500 earnings per share has topped expectations among companies that have reported fourth-quarter 2019 results so far, according to an analysis by Credit Suisse analyst Jonathan Golub.

Consensus analysis had headed into fourth-quarter earnings season expecting EPS to contract by 0.3%, or 2.5% excluding corporate buybacks. But with more than two-thirds of S&P 500 companies now having reported, EPS is pacing toward 3.0% growth, or 0.8% growth excluding share repurchases.

Here’s what Golub had to say in a note Wednesday:

70.2% of the S&P 500's market cap has reported 4Q results. Earnings are beating by 4.6%, with 61% of companies exceeding their bottom-line estimates. This compares to 5.2% and 71% over the past 3 years.

4Q expectations are for revenues, earnings, and EPS growth of 2.8%, -0.3%, and +1.9%, respectively. EPS is on pace for +3.0%, assuming a typical beat rate for the remainder of the season.

—

8:15 a.m. ET: Private payrolls surge more than expected in January, according to ADP/Moody’s

Private payrolls rose by 291,000 in January, far exceeding expectations, according to a report by ADP/Moody’s released Wednesday. This marked the best month for private payroll gains since May 2015.

This follows a slightly downwardly revised 199,000 payrolls added in December, from the 202,000 reported previously for the month. Consensus economists had expected private payrolls to rise by 157,000 in January, according to Bloomberg-compiled data.

January’s gains were led by the service-providing sector, which added 237,000 payrolls. Leisure and hospitality industries added 96,000 payrolls, leading advances. Education and health services also posted among the steepest gains, with payrolls totaling 70,000. None of the industries within services registered declines in jobs during the month.

The goods-producing sector posted net gains of 54,000, which included a loss of 2,000 jobs from natural resources and mining industries. Construction industries added 47,000 payrolls during the month, and manufacturing added 10,000.

ADP/Moody’s report comes two days before the Department of Labor is due to release its official January jobs report. Consensus economists expect this report will reflect 162,000 new jobs added in January, including 150,000 private payrolls. In December, non-farm payroll gains had come in slightly lower than expected at the time, at 145,000.

The ADP/Moody’s report, while one measure of month-to-month employment trends in the U.S., has typically been an imperfect indicator of the Department of Labor’s jobs print due to differences in survey methodology.

—

7:45 a.m. ET: Stock futures follow global shares higher amid coronavirus treatment reports

Contracts on each of the S&P 500, Dow and Nasdaq rose Wednesday morning, following equities in Europe and Asia higher. Multiple reports of a possible breakthrough in a coronavirus treatment helped send risk assets higher.

Reuters cited a Chinese TV report that researches at Zhejiang University had found a drug to treat people with the coronavirus. Meanwhile, the UK’s Sky News said a team at Imperial College London had made a “significant breakthrough” in searching for a potential treatment for the coronavirus.

The World Health Organization has so far said there is no specific medicine recommended to prevent or treat the coronavirus.

Here were the main moves during the pre-market session, as of 7:45 a.m. ET:

S&P futures (ES=F): 3,323.75, up 24.25 points or 0.73%

Dow futures (YM=F): 29,010, up 221 points or 0.77%

Nasdaq futures (NQ=F): 9,439.25, up 84.25 points or 0.9%

Crude oil (CL=F): $50.77 per barrel, up $1.16 or 2.34%

Gold (GC=F): $1,558.00 per ounce, up $2.50 or 0.16%

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Find live stock market quotes and the latest business and finance news

Yahoo Finance

Yahoo Finance