The stock market is embarrassing Wall Street pros everywhere

There are many reasons why investors are reluctant to be long risk in the financial markets, especially with the stock market rallying to new all-time highs seven years into the bull market.

The investment environment in 2016 has been hit with volatility exacerbated by geopolitical uncertainty. From the United Kingdom’s vote to leave the European Union to the upcoming US presidential election, there is no shortage of political risks that could mean big changes for the markets.

There are also concerns over central bank monetary policy. In the eight years since the financial crisis, interest rates have remained at or near zero, and in some parts of the world they’re negative.

In this environment, many hedge fund managers have become increasingly concerned about the market topping out, and even worse, the market selling off sharply.

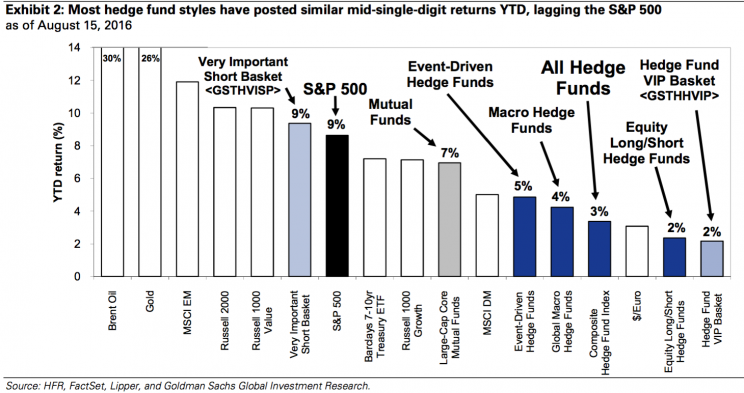

Unfortunately, that has meant that fund managers have been missing out on market gains. As the above chart from Goldman Sachs Investment Research shows, many hedge funds just aren’t performing.

Broadly speaking, hedge funds have struggled to beat the market, with the average fund up 3% in the first half of the year, while the S&P 500 has rallied 9%.

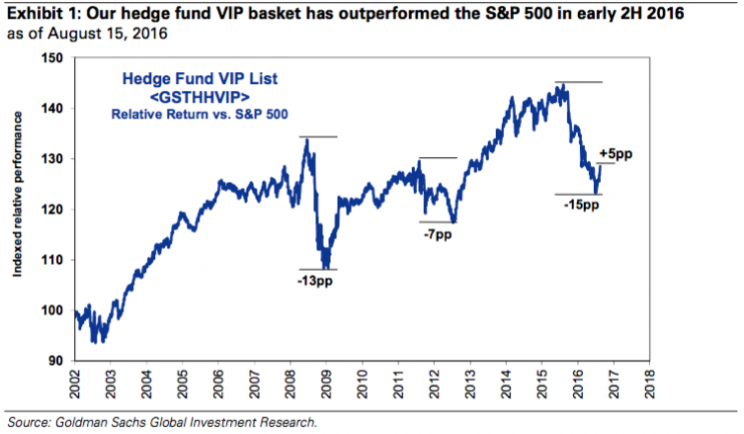

Goldman Sachs points out that the 50 most popular hedge funds stocks — featured as part of the bank’s “VIP basket” that includes names like Amazon (AMZN), Charter Communications (CHTR), Facebook (FB), and Allergan (AGN) — reversed their 11-month under-performance against the S&P. That didn’t really help hedge funds recuperate much, though.

There are many different types of hedge fund strategies ranging from long/short equity to event-driven to global macro. And for the most part, the goal is not necessarily to beat the generic S&P 500 index. That said, it’s likely to be disheartening for investors paying big hedge fund fees to get lackluster returns.

“Even with the recent rally in the most popular long positions, the average hedge fund has returned just 3% YTD, lagging the S&P 500 for the eighth year in a row. Many active managers continue to struggle in 2016, with the average large-cap core mutual fund also lagging the S&P 500. Among hedge fund styles, although most have posted similar returns, event-driven funds have fared best (+5%) while equity long/short funds trail (+2%),” the Goldman note said.

Hedge fund investors — i.e. pensions, endowments, and foundations — might be disappointed with the lackluster performance, and justifiably so. What’s more is it only fuels the argument in favor of passive index investing.

Of course, the goal isn’t necessarily to always beat the market. Markets could go down and correlations can go up, benefiting the strategies offered by hedge funds.

—

Read more:

Legends of finance have big bets on the market going down

Tiger Global ditches its billion-dollar Netflix stake, cuts Apple

Here’s what hedge fund titans have been buying and selling

Hedge fund billionaire Dan Loeb bought a bunch of Facebook

Warren Buffett ramps up his huge bet on Apple, cuts back Walmart

Yahoo Finance

Yahoo Finance