STLLR Gold Intersects 1.23 g/t Au over 59.00 m at the Colomac Main Deposit and New Zones of Mineralization at Windjammer North

Toronto, Ontario--(Newsfile Corp. - June 26, 2024) - STLLR Gold Inc. (TSX: STLR) (OTCQX: STLRF) (FSE: O9D) ("STLLR" or the "Company") announces assay results from the exploration drilling at the Colomac Gold Project in the Northwest Territories and at the Tower Gold Project in the Timmins Mining Camp in Ontario.

Table 1: 2024 Exploration Drilling Highlights - Colomac Main Deposit & Windjammer North (See Figures 1-8):

Zone | Hole ID | Assay Result |

Colomac Main | C24-05 | 1.23 g/t Au over 59.00 m (incl. 3.23 g/t Au over 6.90 m) |

Windjammer North | MGH24-528 | 0.93 g/t Au over 51.00 m (incl. 1.86 g/t Au over 9.00 m) |

Windjammer North | MGH24-524 | 1.09 g/t Au over 17.35 m (incl. 2.64 g/t Au over 6.30 m) |

"g/t Au": grams per tonne gold; "m": metres | ||

Keyvan Salehi, P.Eng., MBA, President, CEO, and Director of STLLR stated: "We continue to intersect very encouraging gold mineralization outside of the known mineral resources of the Colomac Gold Project and the Tower Gold Project. We believe both Projects have the potential for continued growth in mineral resources, as the deposits remain open in several directions. More assay results are expected at both the Colomac Gold Project and the Tower Gold Project in the coming weeks."

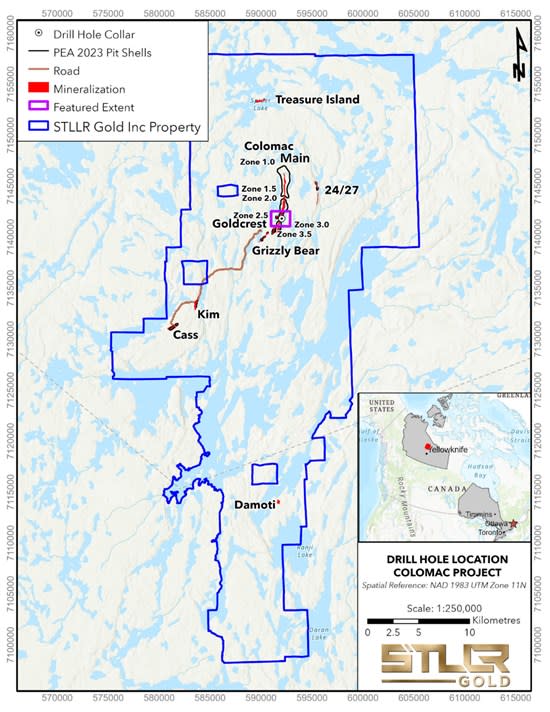

Colomac Gold Project Drilling - Colomac Main Deposit (See Figures 1-4)

The Colomac Main Deposit, the primary deposit of the Colomac Gold Project, occurs in a north-south striking differentiated mafic sill, approximately 9 km long and up to 155 m wide, bounded by mafic volcanic rocks. Mineralization is predominantly free gold spatially associated with quartz-carbonate veining and minor sulphides.

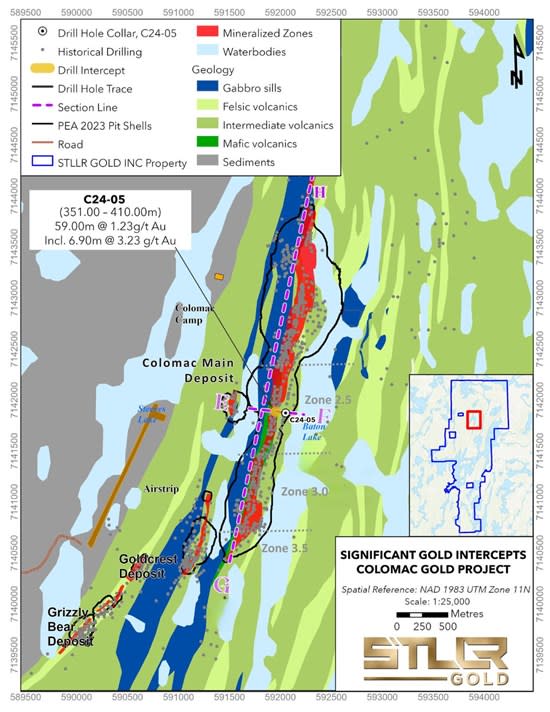

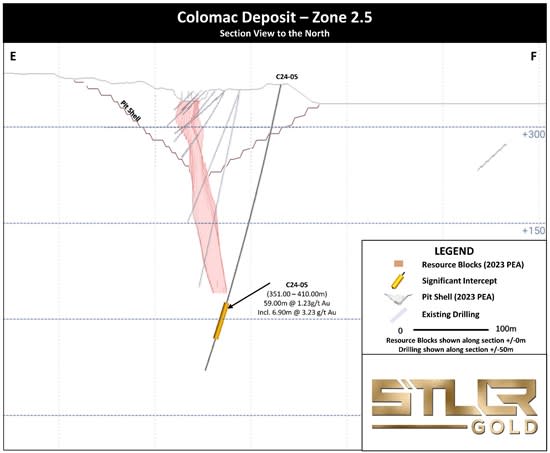

Drilling in 2024 is focused on the southern-end (Zones 2.5, 3.0, & 3.5) of the Colomac Main Deposit, targeting areas where there is a lack of drilling information and the potential to intersect higher-grade, open-pit gold mineralization. Hole C24-05 intersected new mineralization seventy-five metres to the north of Hole C24-011 in Zone 2.5. This hole tested a zone adjacent to the main deep-rooted structure believed to be the focal point for fluid flow or one of the potential "feeders" of the Colomac Main Deposit mineralization.

Figure 1: Colomac Gold Project - Property Map

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4852/214420_ce39c4ba245809cb_001full.jpg

Figure 2: Colomac Main - Exploration Results Map

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4852/214420_ce39c4ba245809cb_002full.jpg

Figure 3: Colomac Main - Exploration Drilling Long Section "G-H" Looking West

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4852/214420_ce39c4ba245809cb_003full.jpg

Figure 4: Colomac Main - Exploration Drilling Cross Section "E-F" Looking North

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4852/214420_ce39c4ba245809cb_004full.jpg

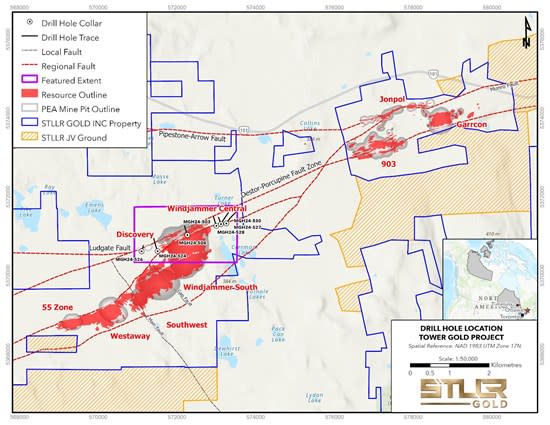

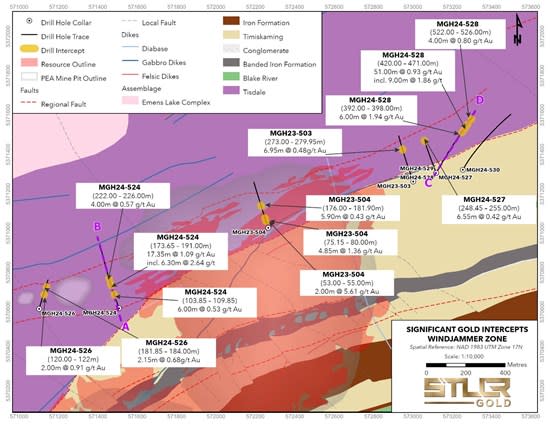

Tower Gold Project Drilling - Golden Highway Exploration Targets (See Figures 5-8)

STLLR has identified several high-potential exploration targets in the Golden Highway area of the Tower Gold Project (See Figure 5 for the Drill Location Map). These targets are located outside the known mineralization and drilling will test either potential extensions of the known mineralization or areas where geological interpretation appears favourable for new gold discoveries.

Windjammer North

Windjammer North is located within the North Corridor volcanics of the northern branch of the Destor Porcupine Fault Zone. Gold mineralization is associated with pyrite-rich white to light grey quartz-carbonate veining hosted by massive-to-brecciated ultramafic metavolcanics that have been altered to a green fuchsite-carbonate assemblage. Hole MGH24-524 intersected mineralization in the ultramafic units, where there was a gap in data. Hole MGH24-528 was a significant step-out (0.5 km) to the east of the Windjammer North Deposit, intersecting mineralization in the same lithological and structural trend as the deposit.

Figure 5: Tower Gold Project - Drill Location Map

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4852/214420_ce39c4ba245809cb_005full.jpg

Figure 6: Windjammer North - Exploration Results Map

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4852/214420_ce39c4ba245809cb_006full.jpg

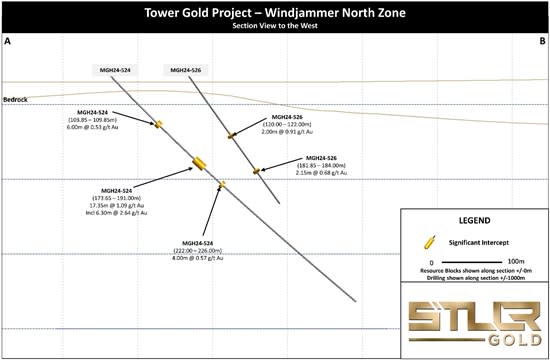

Figure 7: Windjammer North - Exploration Drilling Cross Section "A-B" Looking West

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4852/214420_ce39c4ba245809cb_007full.jpg

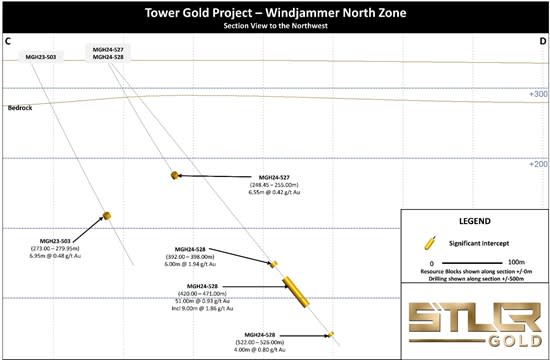

Figure 8: Windjammer North - Exploration Drilling Cross Section "C-D" Looking Northwest

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4852/214420_ce39c4ba245809cb_008full.jpg

Table 2: Exploration Drilling Intercepts

Target | Hole ID | From | To | Interval | Grade | Metal Factor |

Windjammer North | MGH23-503 | 273.00 | 279.95 | 6.95 | 0.48 | 3.34 |

Windjammer North | MGH23-504 | 53.00 | 55.00 | 2.00 | 5.61 | 11.22 |

Windjammer North | and | 75.15 | 80.00 | 4.85 | 1.36 | 6.60 |

Windjammer North | and | 176.00 | 181.90 | 5.90 | 0.43 | 2.54 |

Windjammer North | MGH24-524 | 103.85 | 109.85 | 6.00 | 0.53 | 3.18 |

Windjammer North | and | 173.65 | 191.00 | 17.35 | 1.09 | 18.91 |

Windjammer North | including | 184.70 | 191.00 | 6.30 | 2.64 | 16.63 |

Windjammer North | and | 222.00 | 226.00 | 4.00 | 0.57 | 2.28 |

Windjammer North | MGH24-526 | 120.00 | 122.00 | 2.00 | 0.91 | 1.82 |

Windjammer North | and | 181.85 | 184.00 | 2.15 | 0.68 | 1.46 |

Windjammer North | MGH24-527 | 248.45 | 255.00 | 6.55 | 0.42 | 2.75 |

Windjammer North | MGH24-528 | 392.00 | 398.00 | 6.00 | 1.94 | 11.64 |

Windjammer North | and | 420.00 | 471.00 | 51.00 | 0.93 | 47.43 |

Windjammer North | including | 459.00 | 468.00 | 9.00 | 1.86 | 16.74 |

Windjammer North | and | 522.00 | 526.00 | 4.00 | 0.80 | 3.20 |

Windjammer North | MGH24-529 | No Significant Intervals | ||||

Windjammer North | MGH24-530 | No Significant Intervals | ||||

Colomac 2.5 | C24-05 | 351.00 | 410.00 | 59.00 | 1.23 | 72.57 |

including | 355.00 | 361.90 | 6.90 | 3.23 | 22.29 | |

Note: All intercepts are calculated using a 0.30 g/t Au cut-off, a maximum of 5m internal dilution and no top cap applied. Drill intercepts are not true widths. | ||||||

Table 3: Exploration Drill Hole Details

Zone | Hole ID | Easting | Northing | Elevation | Azimuth | Inclination | End of Hole Depth (m) |

Windjammer North | MGH23-503 | 573002.32 | 5371261.99 | 334.17 | 340.03 | -51.98 | 390.00 |

Windjammer North | MGH23-504 | 572266.00 | 5371027.27 | 335.12 | 340.02 | -50.08 | 369.00 |

Windjammer North | MGH24-524 | 571508.55 | 5370616.75 | 349.68 | 340.09 | -47.20 | 462.00 |

Windjammer North | MGH24-526 | 571105.99 | 5370613.90 | 351.11 | 14.97 | -50.13 | 240.00 |

Windjammer North | MGH24-527 | 573119.47 | 5371302.61 | 355.20 | 340.04 | -45.09 | 261.00 |

Windjammer North | MGH24-528 | 573120.01 | 5371302.45 | 355.25 | 30.07 | -50.04 | 546.00 |

Windjammer North | MGH24-529 | 573119.77 | 5371302.03 | 355.41 | 30.04 | -65.07 | 546.00 |

Windjammer North | MGH24-530 | 573255.78 | 5371321.26 | 365.48 | 30.03 | -49.92 | 600.00 |

Colomac 2.5 | C24-05 | 592051.00 | 7141873.00 | 366.00 | 280.00 | -78.00 | 462.00 |

Quality Control Procedures

NQ drill core is oriented and cut with half sent to ALS Laboratories Inc. (ALS) for drying and crushing to -2 mm, with a 1.00 kg split pulverized to -75 µm (200#). ALS is an ISO 17025 accredited laboratory. A 50 g charge at Tower and 30 g charge at Colomac are Fire Assayed and analyzed using an AAS finish for Gold. Samples above 10.00 g/t Au are analyzed by Fire Assay with a gravimetric finish and selected samples with visible gold or high-grade mineralization are assayed by Metallic Screen Fire Assay on a 1.00 kg sample. STLLR inserts independent certified reference material and blanks with the samples and assays routine pulp repeats and coarse reject sample duplicates, as well as completing routine third-party check assays at Bureau Veritas Commodities Canada Ltd.

Qualified Person

John McBride, MSc., P.Geo., Vice President of Exploration for STLLR, who is the "Qualified Person" as defined by NI 43-101 for this project, has reviewed and approved of the technical disclosure contained in this news release.

About STLLR Gold

STLLR Gold Inc. (TSX: STLR) (OTCQX: STLRF) (FSE: O9D) is a Canadian gold development company actively advancing two cornerstone gold projects in Canada: The Tower Gold Project in the Timmins Mining Camp in Ontario and the Colomac Gold Project located north of Yellowknife, Northwest Territories. Each of these two projects has the potential for a long-life and large-scale operation and are surrounded by exploration land with favourable upside potential. STLLR's experienced management team, with a track record of successfully advancing projects and operating mines, is working towards rapidly advancing these projects.

Contact Us

STLLR Gold Investor Relations

+1 (416) 863-2105 | investors@stllrgold.com | www.STLLRgold.com

Forward-Looking Information

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking information includes, but is not limited to the potential expansion of the known mineralization at the Tower Gold Project and Colomac Gold Project, the discovery of new gold mineralization, the timing of the release of the assay results, the goals, synergies, strategies, opportunities, profile, mineral resources and potential production, project timelines, prospective shareholding, integration and comparables to other transactions, the future financial or operating performance of STLLR and STLLR's mineral properties and project portfolios, the advancement of the Tower Gold and Colomac Gold Projects, long-life and large-scale potential of the Tower and Colomac Gold Projects and exploration upside of the land packages. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "accelerate", "add" or "additional", "advancing", "anticipates" or "does not anticipate", "appears", "believes", "can be", "conceptual", "confidence", "continue", "convert" or "conversion", "deliver", "demonstrating", "estimates", "encouraging", "expand" or "expanding" or "expansion", "expect" or "expectations", "fast-track", "forecasts", "forward", "goal", "improves", "increase", "intends", "justification", "leading", "plans", "potential" or "potentially", "pro-forma", "promise", "prospective", "prioritize", "reflects", "re-rating", "robust", "scheduled", "stronger", "suggesting" or "suggests", "support", "updating", "upside", "will be" or "will consider", "work towards", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might", or "will be taken", "occur", or "be achieved".

Forward-looking information is based on the opinions and estimates of management at the date the information is made, and is based on a number of assumptions and is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of STLLR to be materially different from those expressed or implied by such forward-looking information, including risks associated with required regulatory approvals, the exploration, development and mining such as economic factors as they effect exploration, future commodity prices, changes in foreign exchange and interest rates, actual results of current exploration activities, government regulation, political or economic developments, the ongoing wars and their effect on supply chains, environmental risks, COVID-19 and other pandemic risks, permitting timelines, capex, operating or technical difficulties in connection with development activities, employee relations, the speculative nature of gold exploration and development, including the risks of diminishing quantities of grades of reserves, contests over title to properties, and changes in project parameters as plans continue to be refined as well as those risk factors discussed in the Company's Annual Information Form for the year ended December 31, 2023, available on www.sedarplus.ca. Although STLLR has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. STLLR does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

_________________________

1Please refer to the STLLR June 13, 2024 news release for more details.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/214420

Yahoo Finance

Yahoo Finance