Steven Cohen Bolsters Position in Lumentum Holdings Inc

Overview of Recent Transaction

On July 1, 2024, Steven Cohen (Trades, Portfolio)'s firm added significantly to its stake in Lumentum Holdings Inc (NASDAQ:LITE), a key player in the optical and photonic products industry. The firm acquired an additional 684,494 shares at a price of $51.43 per share, increasing its total holdings to 3,382,398 shares. This transaction not only reflects a substantial investment but also marks a notable increase in the firm's portfolio, with Lumentum now representing a 0.43% position.

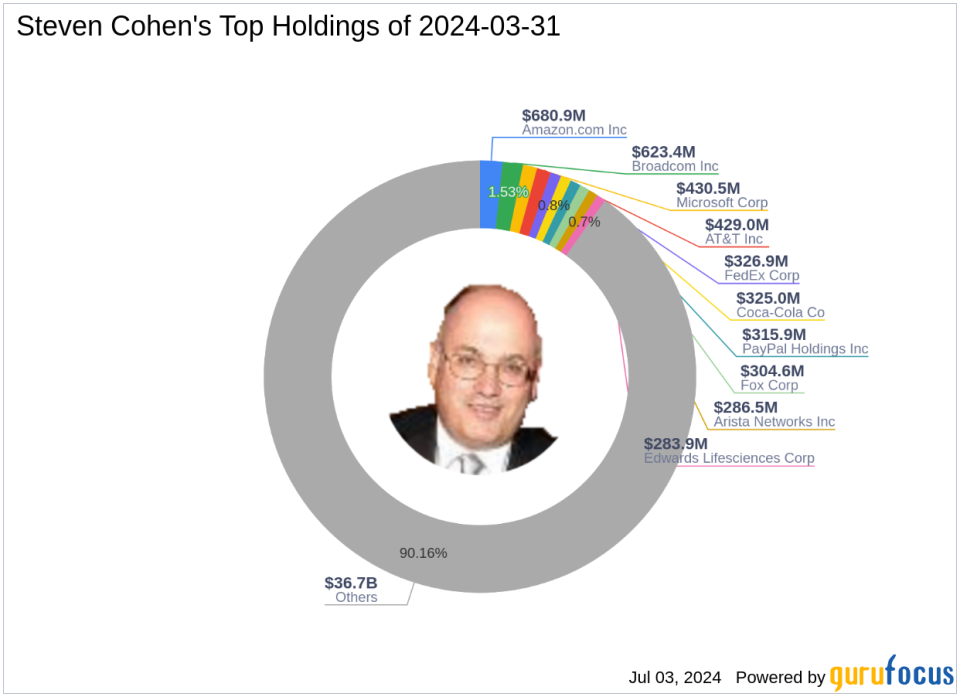

Profile of Steven Cohen (Trades, Portfolio)

Steven A. Cohen, Chairman and CEO of Point72, has been a prominent figure in the investment world, founding S.A.C. Capital Advisors in 1992 and later transitioning to Point72. Cohen's investment philosophy centers on a long/short equity strategy, utilizing a multi-manager platform to enhance decision-making. His firm's approach is deeply rooted in fundamental research, aiming to capitalize on both macroeconomic trends and individual company performance. Under Cohen's leadership, Point72 has grown into a significant entity with a diverse portfolio emphasizing technology and healthcare sectors.

Introduction to Lumentum Holdings Inc

Lumentum Holdings Inc, established in 2015, operates within the technology sector, focusing on innovative optical and photonic products. The company's offerings are crucial in various applications, from telecommunications to 3-D sensing technologies used in consumer electronics. With its primary revenue coming from the OpComms segment, Lumentum is strategically positioned in high-growth areas, catering to both industrial and networking needs.

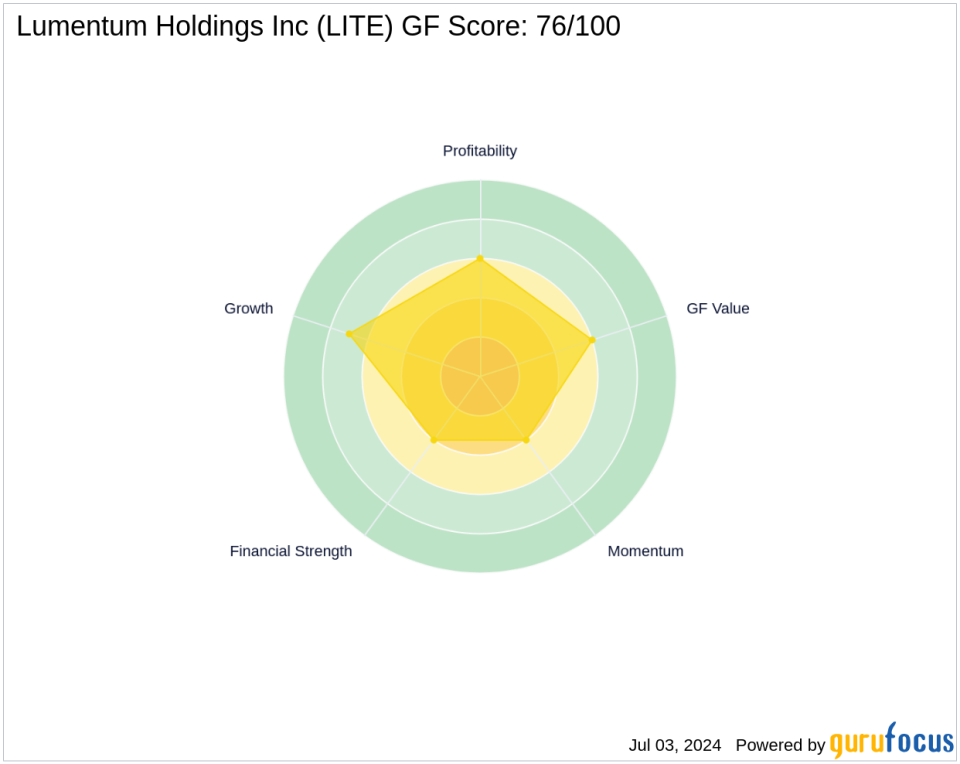

Financial and Market Analysis of Lumentum Holdings Inc

Currently, Lumentum's market capitalization stands at approximately $3.65 billion, with a stock price of $53.94, reflecting a 4.88% increase since the recent transaction by Cohen's firm. Despite a challenging financial metric with a PE Ratio of 0, indicating losses, the company is deemed "Fairly Valued" with a GF Value of $50.29. The stock's performance relative to its intrinsic value shows a slight premium, with a Price to GF Value ratio of 1.07.

Impact of the Trade on Steven Cohen (Trades, Portfolio)s Portfolio

The recent acquisition of Lumentum shares has a modest yet strategic impact on Cohen's portfolio, enhancing its exposure to the technology sector, which is a top holding category alongside healthcare. This move aligns with the firm's investment philosophy of targeting high-growth potential areas through rigorous fundamental analysis.

Sector and Market Considerations

The technology and healthcare sectors, where Cohen's firm predominantly invests, continue to show robust growth and innovation. These sectors are critical in the current economic landscape, driven by technological advancements and increasing healthcare needs. Lumentum's strategic position in optical technologies, essential for next-generation networking and industrial applications, makes it a valuable addition to Cohen's technology-oriented investments.

Comparative Analysis with Other Gurus

Other notable investors in Lumentum include Fisher Asset Management, LLC, and Keeley-Teton Advisors, LLC (Trades, Portfolio). Each investor's approach varies, but Cohen's recent increase in stake highlights a strong conviction in Lumentum's growth prospects compared to his peers.

Conclusion

Steven Cohen (Trades, Portfolio)'s recent transaction in Lumentum Holdings Inc underscores a strategic enhancement to his portfolio, focusing on a company poised for growth in the evolving tech landscape. This move not only reflects Cohen's confidence in Lumentum but also aligns with broader market trends favoring innovative optical technologies. As the market continues to evolve, the significance of this investment may become increasingly apparent, potentially setting a precedent for future transactions in the technology sector.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance