Stella International Holdings And Two More Leading Dividend Stocks

Amidst a backdrop of fluctuating global markets, the Hong Kong stock market has experienced its own set of challenges, notably marked by a significant 4.83% drop in the Hang Seng Index. This volatility underscores the importance for investors to consider stable dividend-paying stocks as part of their investment strategy, which can offer potential income and lower relative risk in uncertain times. In this context, companies like Stella International Holdings have garnered attention for their ability to sustain dividends, making them potentially attractive options for those looking to navigate through current market conditions effectively.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

Chongqing Rural Commercial Bank (SEHK:3618) | 8.10% | ★★★★★★ |

CITIC Telecom International Holdings (SEHK:1883) | 9.66% | ★★★★★★ |

Consun Pharmaceutical Group (SEHK:1681) | 8.58% | ★★★★★☆ |

S.A.S. Dragon Holdings (SEHK:1184) | 9.19% | ★★★★★☆ |

China Electronics Huada Technology (SEHK:85) | 7.72% | ★★★★★☆ |

Playmates Toys (SEHK:869) | 8.70% | ★★★★★☆ |

Bank of China (SEHK:3988) | 6.58% | ★★★★★☆ |

China Mobile (SEHK:941) | 6.40% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 4.07% | ★★★★★☆ |

International Housewares Retail (SEHK:1373) | 8.55% | ★★★★★☆ |

Click here to see the full list of 87 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

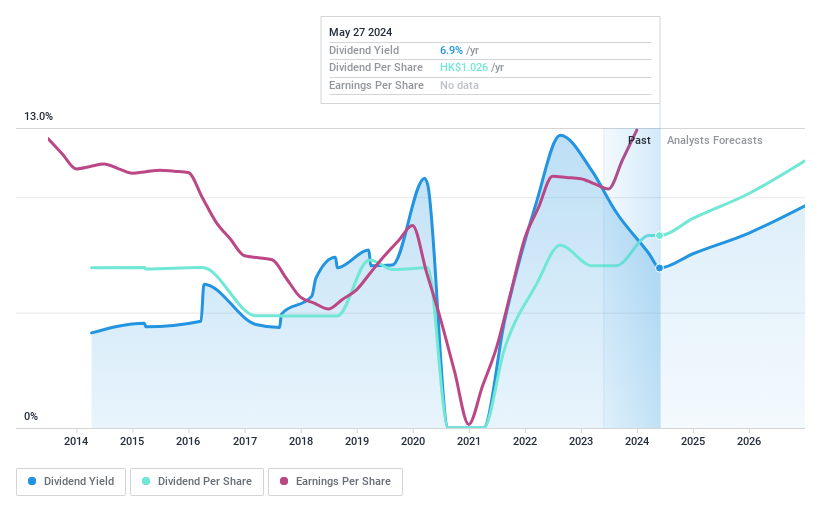

Stella International Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Stella International Holdings Limited is an investment holding company that specializes in the development, manufacture, and sale of footwear products and leather goods across North America, China, Europe, Asia, and other international markets, with a market capitalization of approximately HK$11.95 billion.

Operations: Stella International Holdings Limited generates revenue primarily through its manufacturing segment, which brought in $1.49 billion, and a smaller retailing and wholesaling segment that contributed $4.61 million.

Dividend Yield: 6.9%

Stella International Holdings, while trading 21.3% below its estimated fair value, presents a mixed dividend profile. Its dividends, with a yield of 6.93%, are lower than the top quartile in Hong Kong's market at 7.56%. Despite this, dividends have shown growth over the past decade but have been marked by volatility and unreliability during the same period. Earnings coverage stands at 74.1%, and cash flow coverage at 61.3%, indicating that current payments are well-supported though past fluctuations may concern cautious investors.

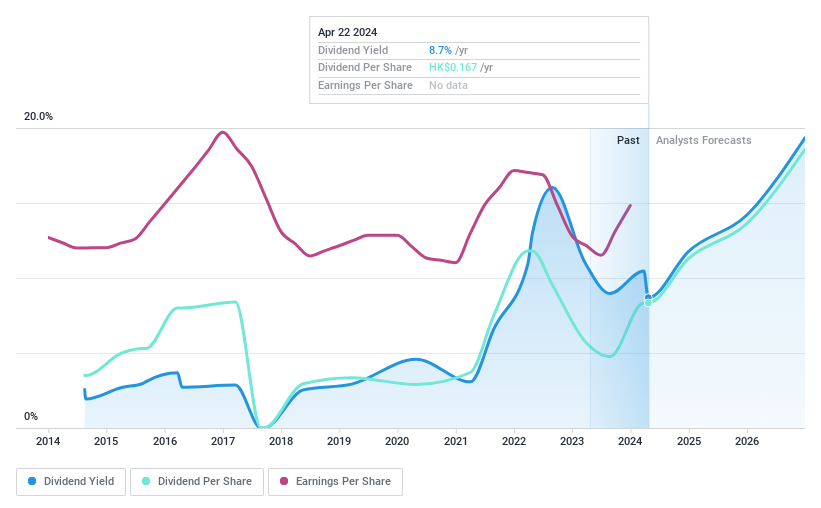

Best Pacific International Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Best Pacific International Holdings Limited operates in the manufacturing, trading, and selling of elastic fabric, elastic webbing, and lace, with a market capitalization of approximately HK$2.45 billion.

Operations: Best Pacific International Holdings Limited generates revenue primarily through two segments: HK$834.34 million from the manufacturing and trading of elastic webbing, and HK$3.37 billion from the manufacturing and trading of elastic fabric and lace.

Dividend Yield: 7.1%

Best Pacific International Holdings has demonstrated a fluctuating dividend history, with recent increases including a proposed final dividend of HK$0.1138 per share for 2023. Despite this, its dividend yield of 7.07% remains slightly below the market's top quartile at 7.56%. The company's dividends are sustainably covered by earnings and cash flows, with payout ratios at 50% and 23.9%, respectively. Additionally, earnings have grown by 15.9% over the past year, suggesting potential stability ahead despite historically volatile share prices and dividends.

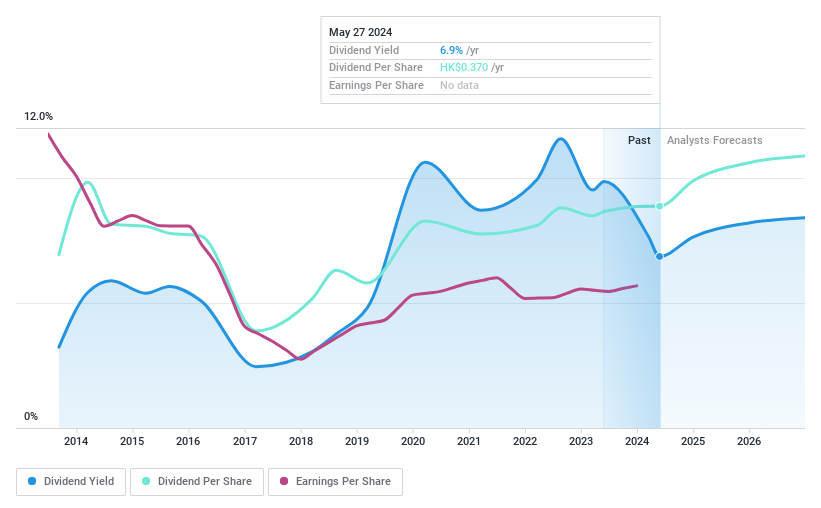

SINOPEC Engineering (Group)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SINOPEC Engineering (Group) Co., Ltd. offers engineering, procurement, and construction (EPC) contracting services across China and internationally, with a market capitalization of approximately HK$23.74 billion.

Operations: SINOPEC Engineering (Group) Co., Ltd. generates revenue primarily through Construction (CN¥25.28 billion), EPC Contracting (CN¥31.99 billion), and smaller contributions from Equipment Manufacturing (CN¥0.73 billion) and Engineering, Consulting, and Licensing (CN¥3.82 billion).

Dividend Yield: 6.9%

SINOPEC Engineering (Group) Co., Ltd. offers a dividend yield of 6.86%, which is below the top quartile for Hong Kong dividend stocks at 7.56%. The company's dividends are supported by a payout ratio of 65% and a cash payout ratio of 71.3%, ensuring coverage from both earnings and cash flows despite its volatile dividend history over the past decade. Recent corporate actions include executive changes and adjustments to company bylaws, reflecting ongoing governance adjustments which could impact future performance and stability in dividend payouts.

Taking Advantage

Navigate through the entire inventory of 87 Top Dividend Stocks here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1836 SEHK:2111 and SEHK:2386.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance