Is Starbucks Undervalued?

Shares of Starbucks Corp. (NASDAQ:SBUX) have delivered a total return of approximately -18% over the past year. Comparably, the S&P 500 has delivered a total return of roughly 27% over the same period.

Key drivers for the recent drop include disappointing earnings results, concerns regarding a potential slowdown in China and multiple contraction.

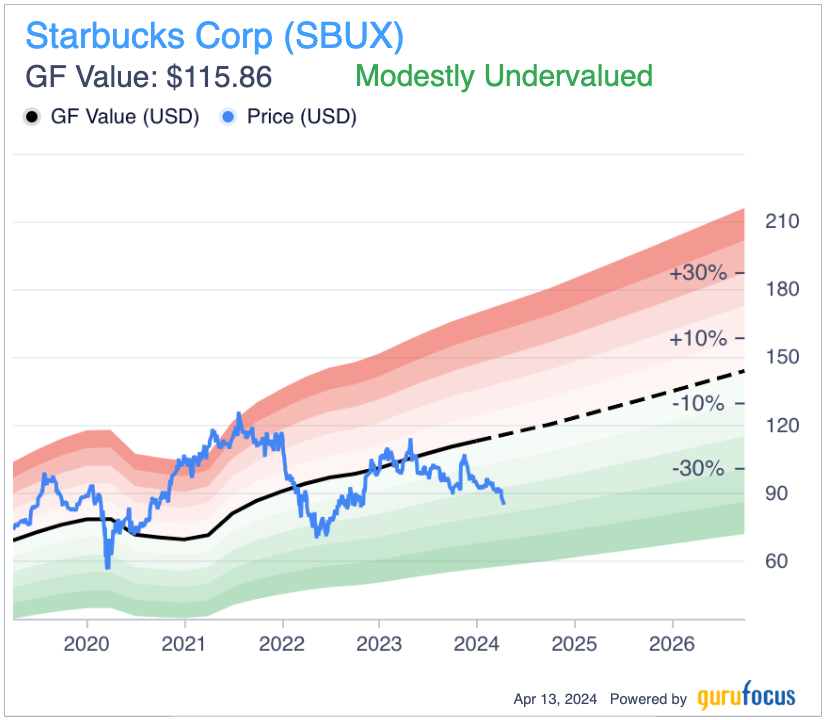

While the company faces a number of challenges in its business, I believe the recent sell-off has created an attractive opportunity as the stock is now trading toward the lower end of its historical valuation range and is attractive relative to the broader market.

Company overview

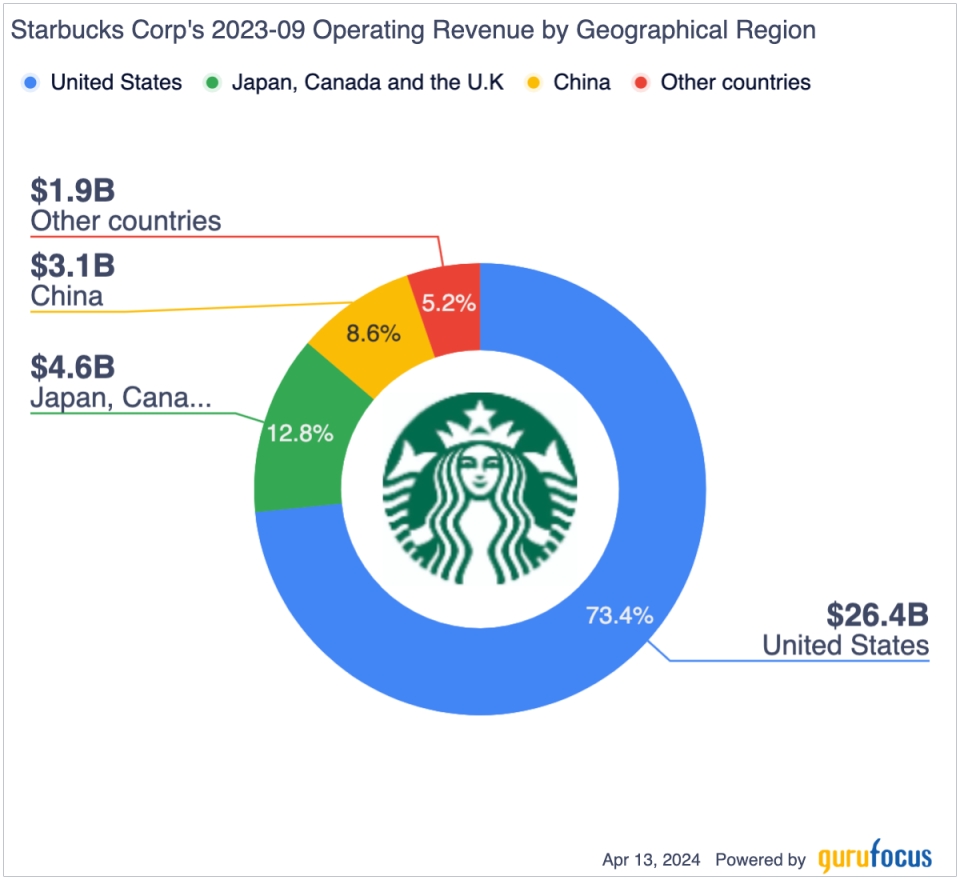

Starbucks is a leading retailer of specialty coffee with operations in 86 countries. The Seattle-based company operates approximately 38,000 stores, with roughly 52% being company owned and the remaining 48% licensed to other operators. Around 82% of the company's net revenue is derived from company-owned stores with key markets being the U.S., China, Japan and Canada.

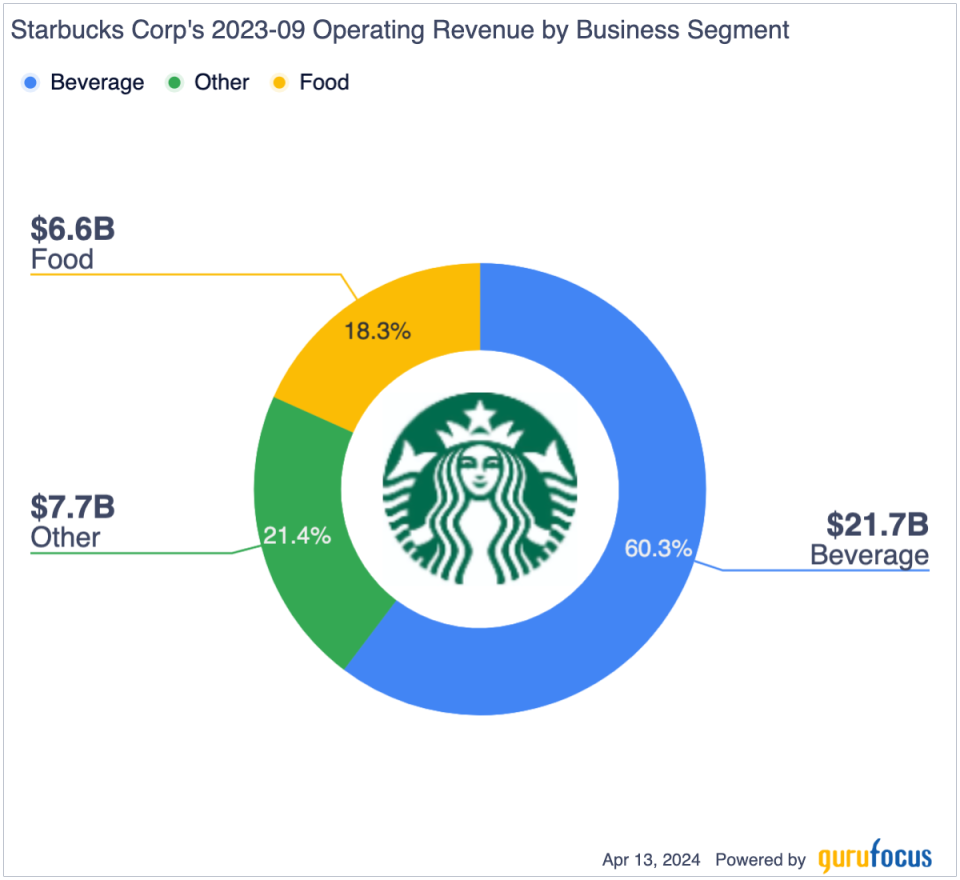

While the company's biggest business is beverages, it also derives a significant portion of revenue from its food and other segments (includes sales of packaged single sale coffees and teas, ready-to-drink beverages and other items). In addition to providing its products in its coffee shops, Starbucks also sells them through grocery stores and other retailers as part of its channel development segment.

Competitive advantages

The coffee and quick-service restaurant businesses are highly competitive. Starbucks competes with a number of large players such as Dunkin' Donuts (DNKN)), Tim Hortons, Luckin Coffee (LKNCY) and many others. Additionally, the company faces competition from smaller local coffee chains. Starbucks products sold via the channel development segment also compete with other coffee products sold at grocery stores and other retailers.

Starbucks, however, has built a competitive advantage in the marketplace by focusing on quality and customer experience as opposed to cost. This strategy has been very successful for the company and allowed it to develop a very strong global brand, which has given it solid pricing power despite operating in a highly competitive space.

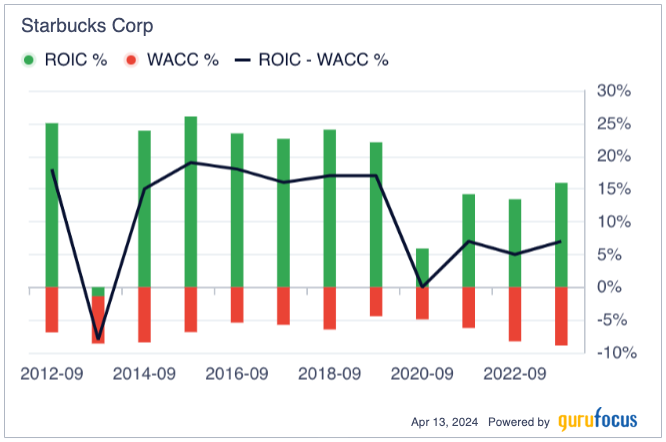

As shown by the chart below, historically, Starbucks has generated strong returns on invested capital well in excess of its cost of capital.

Recent challenges

On Jan. 30, Starbucks reported fiscal first-quarter 2024 results that missed estimates. The company reported annual revenue growth of 8% compared to estimates for 10% growth. Adjusted earnings came in at 90 cents per share, which was below the 93 cents analysts had been expecting. The company also lowered full-year 2024 revenue growth guidance to a range of 7% to 10% from 10% to 12% previously. However, Starbucks reaffirmed its guidance that it expects margin expansion and earnings per share growth of 15% to 20% for the year.

One challenge for Starbucks has been a slower-than-expected recovery of its China business due to cautious consumer spending. Additionally, the company faced challenges in its Middle East business due to ongoing geopolitical tensions. Of these challenges, I view weakness in China as a more significant headwind given the company's large footprint and continued focus on driving growth in the region. However, despite a challenging business environment, Starbucks still was able to grow its China same-store sales by 10% on a year-over-year basis.

Growth plans

The key driver of growth for Starbucks over the next few years is likely to be new store openings. In particular, the company expects much of its store growth to come in international markets. By 2030, Starbucks plans to have 35,000 stores outside of North America, up from roughly 20,228 stores currently. Over the long term, the company believes it can grow comparable store revenue at a 5%-plus annual rate, overall revenue at a 10%-plus rate and earnings per share at a 15%-plus rate.

Currently, Wall Street appears to believe the company can hit these targets. Fiscal 2024 through 2028 consensus estimates call for mid-teens annual earnigns per share growth, which is in line with the company's long-term guidance.

Attractive valuation

Starbucks currently trades around 21 times 2024 earnings per share. Comparably, the S&P 500 also trades at approximately 21 times earnings. While Starbucks is trading at a market multiple, the company has superior growth prospects driven by its international growth strategy.

Over the medium term, I believe the S&P 500 is likely to grow annual earnings by a high single-digit annual rate, which is roughly in line with historical norms. Comparably, I believe Starbucks can deliver double-digit annual earnings growth over the next several years, driven by increased global penetration. Thus, on a relative basis, I view the stock as attractively valued versus the broader market.

In addition to trading at an attractive valuation relative to the broader market, Starbucks is also trading at an attractive level versus its own history. The current forward price-earnings multiple of 21 represents a significantly more reasonable valuation than the 31 times forward earnings multiple the stock traded at a year ago. Overall, the stock has a GF Value of nearly $116, which suggests shares are significantly undervalued at current levels.

Risks to consider

One risk to consider is a potential economic slowdown. Given Starbucks' position as a premium coffee chain, the company is exposed to potential slowdown in global economic conditions which would likely impact consumer spending. While an economic slowdown would likely result in weaker-than-expected near-term earnings, I believe such an impact would be short term in nature.

Another risk to consider is that the company experiences increasing unionization of its workforce. Currently, around 400 stores have unionized workforces, so many more may follow. While this level of unionization is not a significant challenge for the company right now, a larger unionization movement has the potential to be much bigger obstacle. Ultimately, a unionized workforce has the potential to result in increased labor costs for the company and potential margin pressures.

Conclusion

Starbucks shares have performed poorly over the past year as the company has faced a number of headwinds and the stock's valuation multiple has reset lower.

Despite operating in a highly competitive industry, Starbucks has created competitive advantages due to its strong global brand. Historically, the company has generated strong earnings growth and has delivered solid returns on invested capital.

The company has solid growth prospects due primarily to international growth opportunities. Despite having better growth prospects than the broader market, its shares trade at a market multiple. In addition to being attractive versus the broader market, Starbucks' current valuation is also attractive relative to its own historical norms.

For these reasons, I view Starbucks as undervalued at current levels and an attractive investment opportunity.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance