Star Group LP (SGU) Reports Decline in Q1 Revenue Amid Warmer Weather and Lower Demand

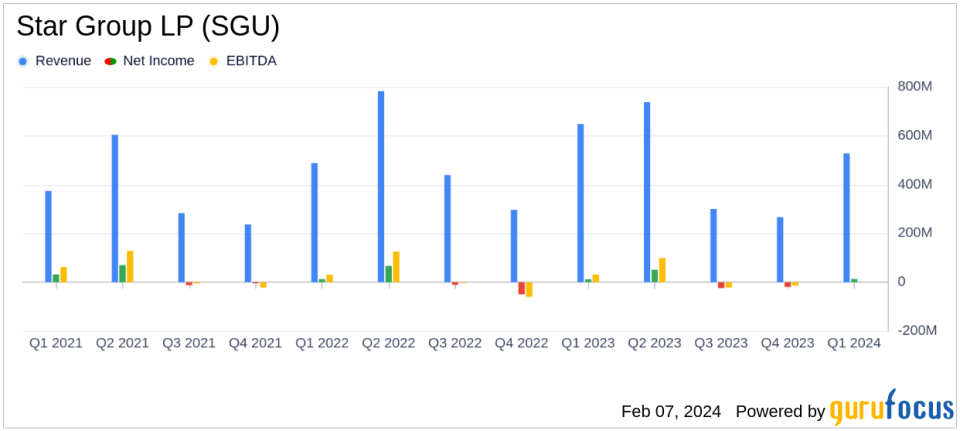

Total Revenue: Decreased by 18.5% to $528.1 million in Q1.

Net Income: Slight decrease to $13.0 million compared to the previous year.

Home Heating Oil and Propane Volume: Dropped by 10.2% due to warmer weather and customer attrition.

Adjusted EBITDA: Remained virtually unchanged at $49.0 million.

Strategic Acquisitions: Two new acquisitions post-Q1 to strengthen market presence.

On February 7, 2024, Star Group LP (NYSE:SGU), a leading home energy distributor and services provider, released its 8-K filing, detailing the financial results for the first quarter of fiscal year 2024, which ended on December 31, 2023. The company, which operates primarily in the Northeast and Mid-Atlantic regions of the U.S., reported a notable 18.5% decrease in total revenue, amounting to $528.1 million, compared to $648.2 million in the same period of the prior year.

Performance Overview

The decline in revenue is attributed to a 10.2% reduction in the volume of home heating oil and propane sold, totaling 80.1 million gallons, and lower selling prices for petroleum products. The warmer weather, as reported by the National Oceanic and Atmospheric Administration, and net customer attrition played significant roles in this downturn. Despite these challenges, Star Group LP managed to maintain its Adjusted EBITDA at $49.0 million, nearly identical to the previous year, thanks to increased per-gallon margins, higher service and installation profitability, and lower operating costs.

Net income saw a marginal decrease to $13.0 million, influenced by an unfavorable non-cash change in the fair value of derivative instruments and higher depreciation and amortization expenses. However, this was partially offset by reduced interest expenses and a decrease in income tax expense.

Financial Achievements and Strategic Moves

Star Group LP's ability to keep its Adjusted EBITDA stable despite lower volumes underscores the company's resilience and effective cost management in the face of industry challenges. The oil and gas sector is particularly sensitive to fluctuations in product costs and consumer demand, making the company's performance noteworthy.

President and CEO Jeff Woosnam commented on the quarter's results, stating:

"The beginning of fiscal 2024 has provided both challenges and opportunities, which we believe we have navigated well. While product costs declined, providing relief to customers, warmer temperatures resulted in lower demand and, thus, reduced overall volumes. However, by employing strong cost discipline, a weather hedge benefit, and achieving higher per-gallon margins, Adjusted EBITDA was nearly equivalent to the prior-year period."

Furthermore, the company has made strategic moves to bolster its market position with two acquisitions in February, subsequent to the close of the first quarter, enhancing its presence on Long Island.

Key Financial Metrics

Star Group LP's financial stability is further evidenced by its balance sheet and cash flow activities. The company's current assets stood at $329.5 million, with property and equipment netting $105.2 million. The total assets were reported at $944.9 million. On the liabilities side, current liabilities totaled $435.8 million, with long-term debt at $123.3 million.

The income statement reflects the company's adept handling of costs, with a total sales decrease aligned with the reduced volume of products sold. The cost of product sold and service installations remained in check, contributing to the company's ability to manage profitability.

Looking Ahead

While Star Group LP faced a challenging quarter due to external factors such as weather conditions, the company's strategic acquisitions and consistent Adjusted EBITDA highlight its potential for growth and stability. Investors and stakeholders can anticipate how these developments might influence performance in the upcoming quarters.

For more detailed information, investors are encouraged to review the full 8-K filing and attend the webcast and conference call scheduled for February 8, 2024, where management will discuss the quarter's results and outlook for the future.

Explore the complete 8-K earnings release (here) from Star Group LP for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance