Fed's Fischer warns: Low rates could lead to 'longer and deeper recessions'

“Low interest rates make the economy more vulnerable to adverse shocks that can put it in a recession,” Fed Vice Chair Stanley Fischer warned. “The limitation on monetary policy imposed by low trend interest rates could therefore lead to longer and deeper recessions when the economy is hit by negative shocks.”

Fischer’s comments were made during a luncheon at the Economic Club of New York.

He added that low rates are a signal that “long-run growth prospects are dim.” He further warned that low rates “threaten financial stability as some investors reach for yield and compressed net interest margins make it harder for some financial institutions to build up capital buffers.”

Since the financial crisis, the Federal Reserve and its central bank peers around the world have employed loose monetary policy in the form of near-zero percent interest rates in their efforts to stimulate growth.

Fischer, however, warns that this type of policy also comes with its dangers.

Why not just raise rates?

“Now, I am sure that the reaction of many of you may be, ‘Well, if you and your Fed colleagues dislike low interest rates, why not just go ahead and raise them? You are the Federal Reserve, after all,'” he said.

He continued by arguing that unfortunately it’s just not that simple.

“Changes in factors over which the Federal Reserve has little influence — such as technological innovation and demographics — are important factors contributing to both short- and long-term interest rates being so low at present,” he said.

4 forces are keeping rates low

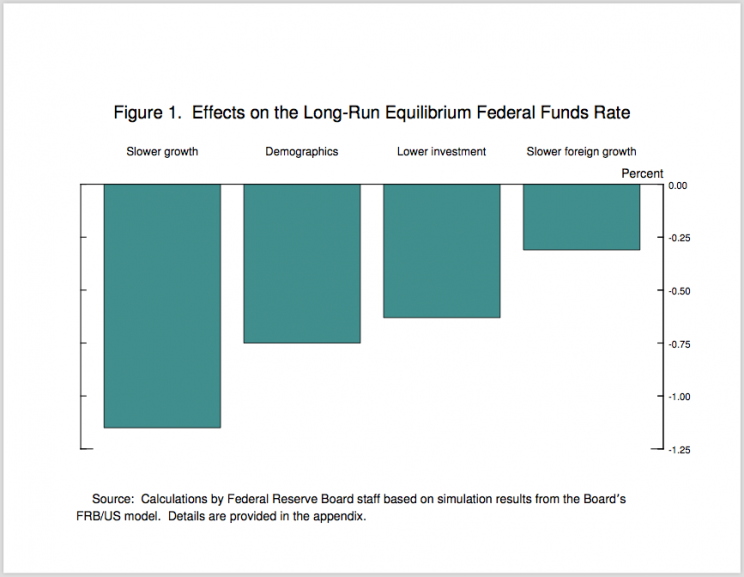

Fischer explained interest rates are low because “the interest rate that equilibrates investment and saving when the economy is at full employment” is low.

So, what’s behind this?

“The economy’s growth prospects must be at the top of the list,” Fischer said. “Among the factors affecting economic growth, gains in productivity and growth of the labor force are particularly important. Second, an increase in the average age of the population is likely pushing up household saving in the U.S. economy. Third, investment has been weak in recent years, especially given the low levels of interest rates. Fourth and finally, developments abroad, notably a slowing in the trend pace of foreign economic growth, may be affecting U.S. interest rates.”

Fischer hit on America’s low productivity problem, citing the work of Northwestern University professor Robert Gordon.

“Lower long-run trend productivity growth, and thus lower trend output growth, affects the balance between saving and investment through a variety of channels,” he said. “A slower pace of innovation means that there will be fewer profitable opportunities in which to invest, which will tend to push down investment demand. Lower productivity growth also reduces the future income prospects of households, lowering their consumption spending today and boosting their demand for savings. Thus, slower productivity growth implies both lower investment and higher savings, both of which tend to push down interest rates.”

How can we get rates up?

All hope is not lost, though.

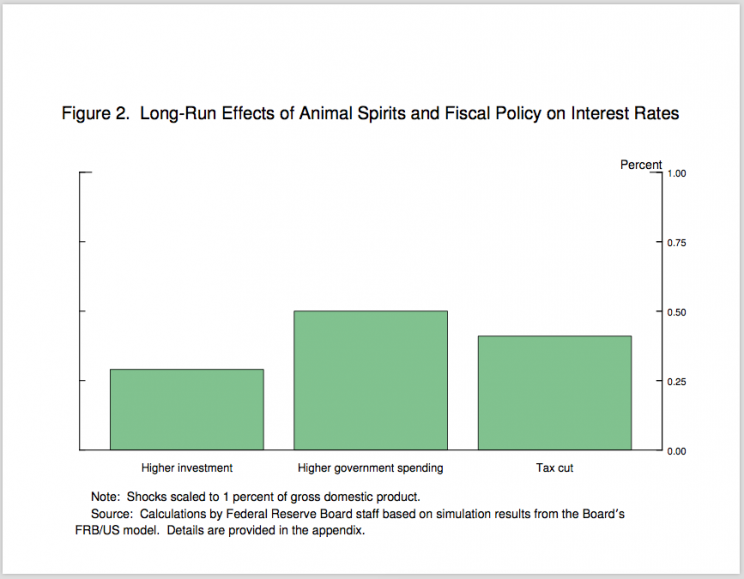

“One development that would boost the equilibrium interest rate would be a further waning in the investor precaution that seems to have been holding back investment —in Keynesian terms, an improvement in animal spirits,” he said.

Another popular way to boost rates: expansionary fiscal policy.

From his speech: “To illustrate this possibility, the next two bars on the slide show the estimated effect on interest rates of two possible expansionary fiscal policies, one that boosts government spending by 1 percent of GDP and another that cuts taxes by a similar amount. According to the FRB/US model, both policies, if sustained, would lead to a substantial increase in the equilibrium federal funds rate. Higher spending of this amount would raise equilibrium interest rates by about 50 basis points; lower taxes would raise equilibrium rates by 40 basis points.”

“A variety of factors have been holding down interest rates and may continue to do so for some time,” he said. “But economic policy can help offset the forces driving down longer-run equilibrium interest rates. Some of these policies may also help boost the economy’s growth potential.”

—

Read more:

The most controversial use of corporate cash could hit $1 trillion this year

America’s labor market just crossed a historic milestone

The next selloff could be triggered by something we’re not discussing right now

Yahoo Finance

Yahoo Finance