Stanley Black & Decker: A Dividend Aristocrat With Value Potential

Many long-term investors prefer investing in companies with a long history of paying uninterrupted, increasing dividends. These Dividend Aristocrats offer shareholders both annual dividend income and long-term potential upside. This analysis will delve into Stanley Black & Decker Inc. (NYSE:SWK), which has an amazing dividend payment record. It has been paying uninterrupted dividends for 147 years and increasing dividends for 56 years.

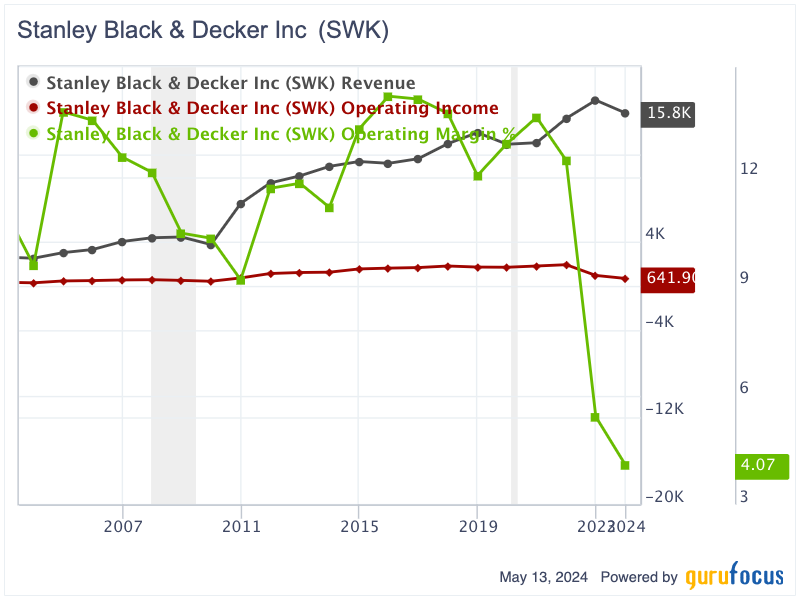

Growing revenue and operating profit

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

Stanley Black & Decker dates back to 1843, more than 180 years. Most are probably familiar with its DeWalt and Craftsman lines of tool products. It is amazing to think that its 50 products are sold every minute. In fact, 95% of automobiles and light trucks in the Europe and U.S. use its fasteners.

The company has two segments, Tools & Outdoor and Industrial. The bigger segment is Tools & Outdoor, contributing 85% of the total revenue and 72% of the profit. Its products are primarily sold through home centers and big-box stores in the U.S. and Europe. The biggest customers are Lowe's (NYSE:LOW) (14% of 2023 net sales) and The Home Depot (NYSE:HD) (13% of 2023 revenue).

In the past 20 years, Stanley Black & Decker's revenue soared to $15.78 billion in 2023 - more than six times as much as in 2003. However, its operating income has only risen about 2.70 times to $641.90 million from $237.30 million. This indicates the operating margin has been shrinking. Its operating margin had been between 9.15% and 14.19% for 2003 to 2021. Then it slid to 5.39% in 2022 and further to 4.07% in 2023.

This significant drop in operating income happened because of lower gross margins and large non-cash asset impairment charges. These lower gross margins were due to rising commodity prices and higher supply chain costs. Additionally, large non-cash asset impairment charges affected the Irwin and Troy-Bilt brands, as well as the infrastructure and oil and gas businesses.

Operating income figures did not include interest expenses. After adjusting for 2023 interest expenses, which were 3.40 times higher than 2022, the company's 2023 pre-tax income swung to losses of $376 million. However, its cash flow from operations stayed unaffected as the 2023 pre-tax loss was mostly driven by non-cash asset impairment charges. Its operating cash flow was good in 2023 at close to $1.20 billion.

In response, Stanley Black & Decker launched a global cost savings program in mid-2022, targeting substantial reductions in selling, general and administrative expenses by $500 million and a transformative $1.50 billion in supply chain efficiencies.

These initiatives have delivered $1.2 billion in total run-rate savings as of first-quarter 2024 and expect gross margins to climb to 30% this year and 35% by end of 2025. With these strategic adjustments, Stanley Black & Decker will see a significant improvement in operating performance over the next two years.

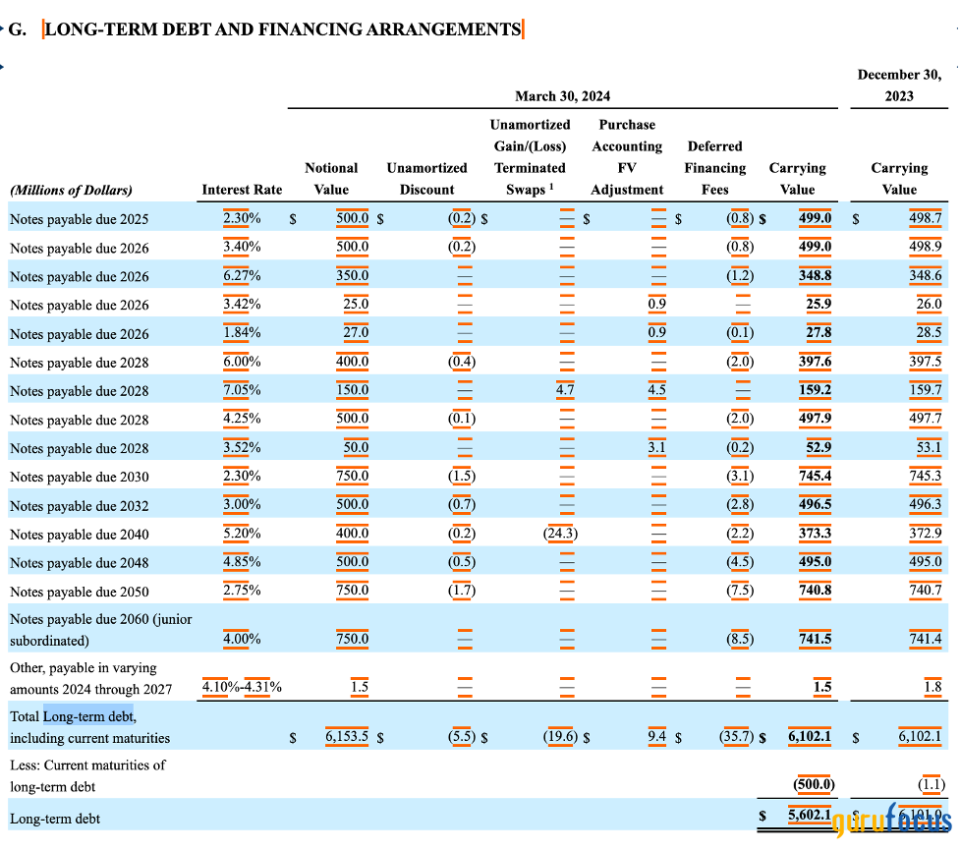

Decent balance sheet strength

Stanley Black & Decker has a good balance sheet. It had booked almost $8.88 billion in shareholders' equity and $476.6 million in cash and cash equivalents as of March 2024. The interest-bearing debt stood at $7.84 billion. Hence its debt-to-equity ratio was 0.88. The debt-to-operating cash flow ratio was high at 6.50.

Looking closer, the debt maturities spread out as far as 2060. The debt principals would be only $499 million in 2025, $900 million in 2026 and $1.10 billion in 2028. So an annual operating cash flow of $1.20 billion will cover its debt and interest obligations easily. However, in my view, it will be best if the company utilizes its cash flow to bring down the debt to a far more conservative level so the business is better able to endure tough times.

Source: Stanley Black & Decker's 10-K filing

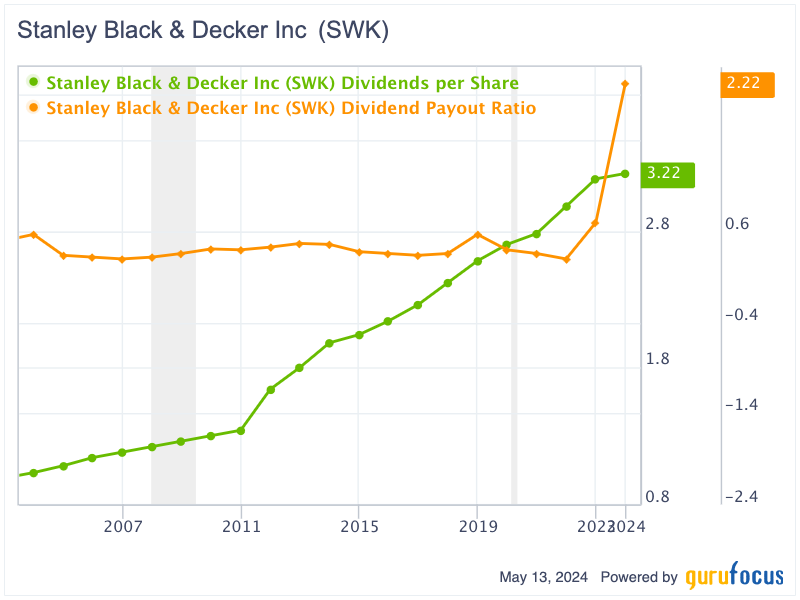

Nearly six decades of uninterruped dividend increases

Stanley Black & Decker has increased its dividend payout each year for 56 years. Its dividend per share went up from $1.03 in 2003 to $3.22 in 2023 at a compound growth rate of 5.86%. The dividend payout ratio had been steady between 2003 and 2022, from 0.29 to 0.69. Its dividend payout ratio hit 2.22 in 2023, paying more than twice the year's profits. This could be seen as quite unsustainable.

However, as discussed previously, its 2023 profitability has been adversely affected by asset impairment charges. As these charges were non-cash, only accounting profitability, not cash flow, was affected. Its 2023 operating cash flow of $1.20 billion was more than enough to cover $483 million in dividend payments. Thus, in contrast with a seemingly extremely high payout ratio, its 2023 dividend can be considered to be quite sustainable.

Potential risks

Stanley Black & Decker has made a large number of acquisitions over the years, accumulating high goodwill and intangible assets. Goodwill and intangible assets were the difference between its purchase prices and its targets' book values. Its goodwill and intangible assets as of March 2024 were as high as $11.86 billion. If some of its acquisitions did not work out as planned, Stanley Black & Decker would need to write down its intangible assets and goodwill. This would definitely hurt its bottom line and share prices at that time.

Potential upside

We will use the Gordon Growth Model to value Stanley Black & Decker. This valuation method is quite suitable for companies that consistently increase their dividends. We will assume the company will grow its dividend at 5% per year in perpetuity. Applying an 8% discount rate, the estimated intrinsic value of the company can be determined as follows:

P = Expected Dividend for 2024 / (Required Rate of Return - Dividend Growth Rate)

= $3.38 *(1+5%) / (8%5%)

= $118.30

Applying the Gordon Growth Model, Stanley Black & Decker's intrinsic value is estimated at around $118.30 per share, indicating a potential 32% upside from the current trading price.

Key takeaway

Stanley Black & Decker has been paying uninterrupted, increasing dividends for nearly six decades. Although the company has recently taken asset impairment charges in the past two years, those charges are non-cash and do not affect its strong cash flow generation. Using the Gordon Growth Model, we estimate its intrinsic value at around $118.3 per share, suggesting a potential 32% upside from the current trading price. Long-term income investors could take this opportunity to invest in this Dividend Aristocrat, which currently offers a 3.60% dividend yield and potential upside.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance