Stablecoin Issuer Circle Cancels Plan to Go Public

Circle, the company behind stablecoin USDC, has terminated its agreement with special purpose acquisition company (SPAC) Concord Acquisition Corp, thereby stepping back on its plan to go public.

The firm said on Monday that the decision to cancel the agreement has been approved by the board of both companies.

The stablecoin issuer had announced plans to go public in July of 2021, with a valuation of $4.5 billion. The valuation was later doubled when the firms amended their terms in February of this year.

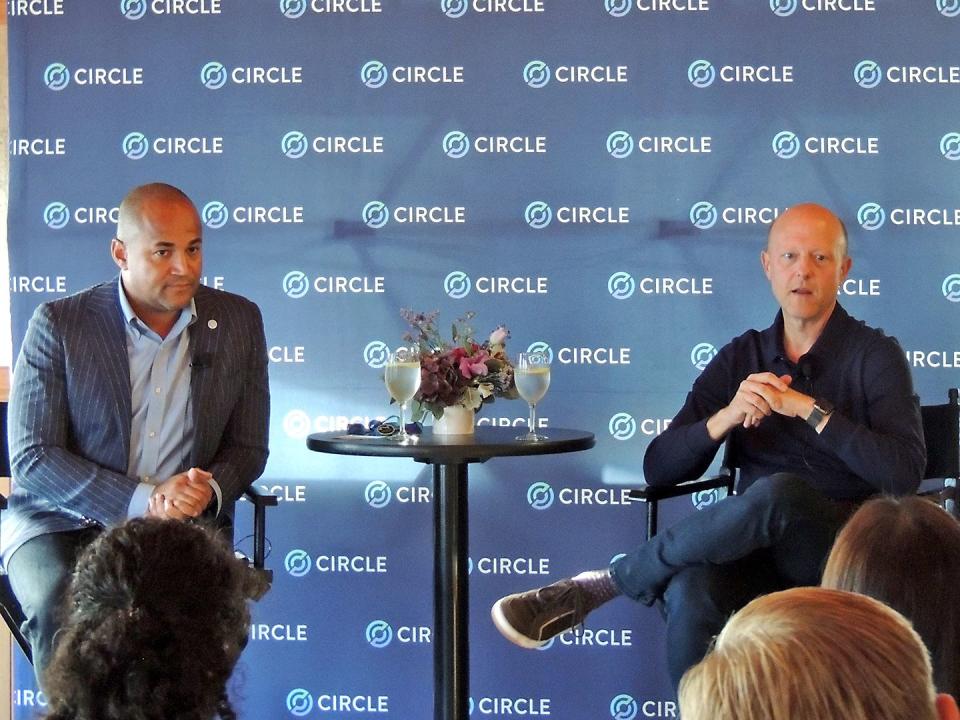

Circle CEO Jeremy Allaire attributed the termination to not completing the U.S. Securities and Exchange Commission's (SEC) "qualification in time" in a Twitter post.

1/ Some big @circle news. This morning, we announced the termination of our proposed deSPAC transaction. While disappointing that we did not complete SEC qualification in time, we remain focused on building a long-term public company. https://t.co/R0XYfCFD54

— Jeremy Allaire (@jerallaire) December 5, 2022

"I believe that the SEC has been rigorous and thorough in understanding our business and many novel aspects of this industry," he added. "This kind of review is necessary to ultimately provide trust, transparency and accountability for major companies in crypto."

The firm also said that it turned profitable in the third quarter of this year and ended the quarter with almost $400 million in unrestricted cash.

The termination follows similar high-profile crypto firms cancelling plans to go public via a SPAC, such as trading platform eToro in July and bitcoin miner PrimeBlock in August.

SPACs have became a common means of companies going public in recent years, with the SEC reporting in March that they accounted for half of all initial public offerings (IPOs) in 2020-21.

The SEC said it would propose “specialized disclosure requirements with respect to, among other things, compensation paid to sponsors, conflicts of interest, dilution and the fairness of these business combination transactions," in a sign that such listings would be subjected to greater regulatory scrutiny.

Read more: Circle CEO Calls for Clear US Laws on Stablecoins to 'Unleash' Their Potential

UPDATE (Dec. 5, 13:44 UTC): Adds additional background information.

Yahoo Finance

Yahoo Finance