SSE plc (LON:SSE) Delivered A Better ROE Than The Industry, Here’s Why

The content of this article will benefit those of you who are starting to educate yourself about investing in the stock market and want to begin learning the link between company’s fundamentals and stock market performance.

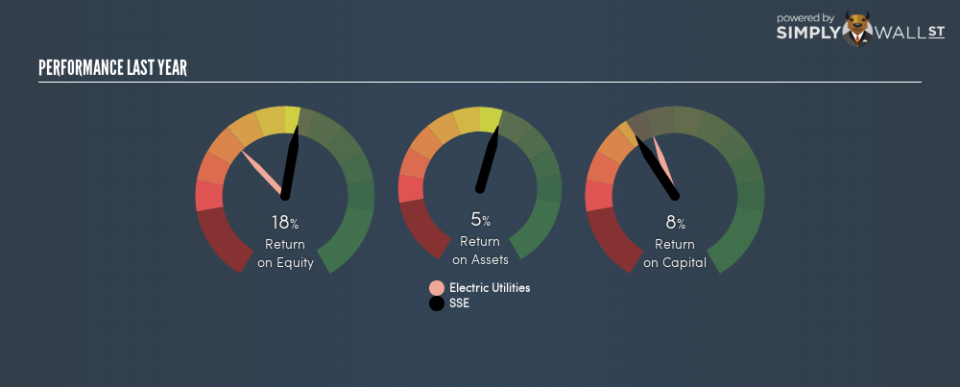

SSE plc (LON:SSE) delivered an ROE of 17.6% over the past 12 months, which is an impressive feat relative to its industry average of 8.7% during the same period. While the impressive ratio tells us that SSE has made significant profits from little equity capital, ROE doesn’t tell us if SSE has borrowed debt to make this happen. In this article, we’ll closely examine some factors like financial leverage to evaluate the sustainability of SSE’s ROE.

View our latest analysis for SSE

Peeling the layers of ROE – trisecting a company’s profitability

Return on Equity (ROE) is a measure of SSE’s profit relative to its shareholders’ equity. It essentially shows how much the company can generate in earnings given the amount of equity it has raised. Generally speaking, a higher ROE is preferred; however, there are other factors we must also consider before making any conclusions.

Return on Equity = Net Profit ÷ Shareholders Equity

ROE is measured against cost of equity in order to determine the efficiency of SSE’s equity capital deployed. Its cost of equity is 8.8%. Since SSE’s return covers its cost in excess of 8.8%, its use of equity capital is efficient and likely to be sustainable. Simply put, SSE pays less for its capital than what it generates in return. ROE can be dissected into three distinct ratios: net profit margin, asset turnover, and financial leverage. This is called the Dupont Formula:

Dupont Formula

ROE = profit margin × asset turnover × financial leverage

ROE = (annual net profit ÷ sales) × (sales ÷ assets) × (assets ÷ shareholders’ equity)

ROE = annual net profit ÷ shareholders’ equity

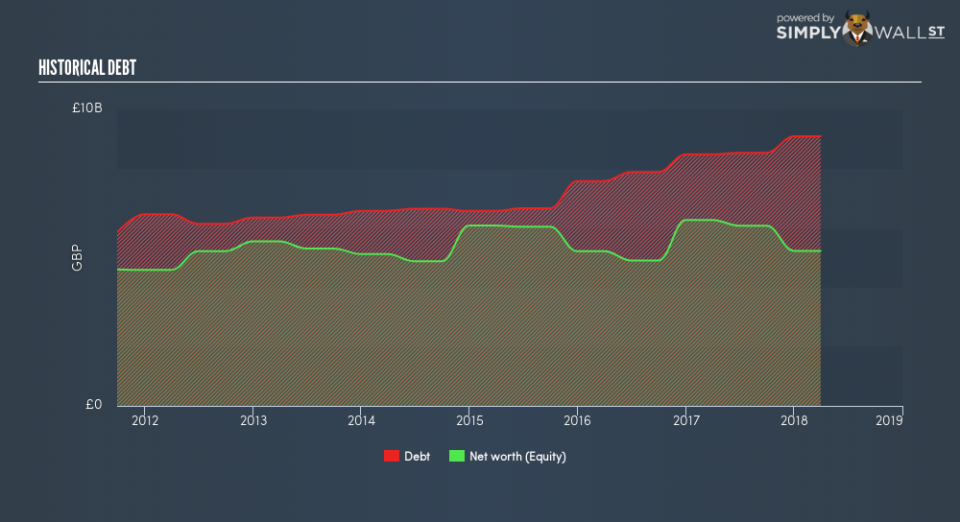

Basically, profit margin measures how much of revenue trickles down into earnings which illustrates how efficient the business is with its cost management. Asset turnover reveals how much revenue can be generated from SSE’s asset base. Finally, financial leverage will be our main focus today. It shows how much of assets are funded by equity and can show how sustainable the company’s capital structure is. Since financial leverage can artificially inflate ROE, we need to look at how much debt SSE currently has. The debt-to-equity ratio currently stands at a high 174%, meaning the above-average ratio is a result of a large amount of debt.

Next Steps:

While ROE is a relatively simple calculation, it can be broken down into different ratios, each telling a different story about the strengths and weaknesses of a company. SSE’s ROE is impressive relative to the industry average and also covers its cost of equity. Its high debt level means its strong ROE may be driven by debt funding which raises concerns over the sustainability of SSE’s returns. ROE is a helpful signal, but it is definitely not sufficient on its own to make an investment decision.

For SSE, I’ve put together three essential aspects you should look at:

Financial Health: Does it have a healthy balance sheet? Take a look at our free balance sheet analysis with six simple checks on key factors like leverage and risk.

Valuation: What is SSE worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether SSE is currently mispriced by the market.

Other High-Growth Alternatives : Are there other high-growth stocks you could be holding instead of SSE? Explore our interactive list of stocks with large growth potential to get an idea of what else is out there you may be missing!

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance