SPS Commerce Inc (SPSC) Q1 2024 Earnings: Revenue Surpasses Estimates, EPS Falls Short

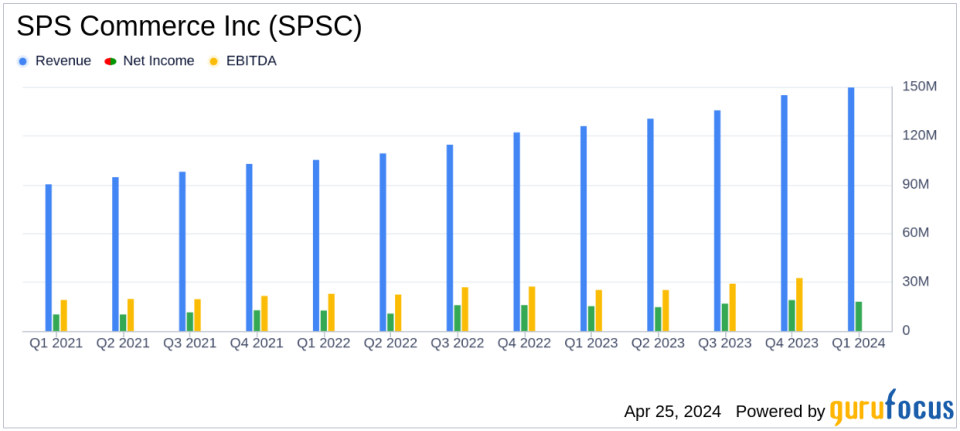

Revenue: Reported $149.6 million, up 19% year-over-year, surpassing estimates of $146.56 million.

Net Income: Achieved $18.0 million, below the estimated $27.68 million.

Earnings Per Share (EPS): Recorded at $0.48 per diluted share, falling short of the estimated $0.74.

Adjusted EBITDA: Increased 20% to $44.4 million from the previous year.

Recurring Revenue: Grew by 19% from the same quarter last year, indicating strong customer retention.

Share Repurchases: Totalled $20 million in the first quarter, reflecting confidence in financial stability and future growth.

Non-GAAP Income Per Diluted Share: Rose to $0.86 from $0.67 in the first quarter of 2023, highlighting improved profitability.

On April 25, 2024, SPS Commerce Inc (NASDAQ:SPSC) released its 8-K filing, announcing the financial results for the first quarter ended March 31, 2024. The company reported a significant revenue growth, marking its 93rd consecutive quarter of top-line increase, with revenues reaching $149.6 million, a 19% increase year-over-year and surpassing the analyst estimates of $146.56 million. However, earnings per share (EPS) stood at $0.48, falling short of the estimated $0.74.

SPS Commerce Inc is a leading provider of cloud-based supply chain management services, enhancing retail performance through its comprehensive platform that includes solutions such as Fulfillment and Analytics. The company's revenue primarily derives from recurring monthly fees and setup fees, reflecting a robust business model in the dynamic retail supply chain sector.

Financial and Operational Highlights

The first quarter saw SPS Commerce achieving a net income of $18.0 million, an increase from $15.3 million in the previous year. The non-GAAP income per diluted share was $0.86, up from $0.67, indicating effective management and operational efficiency. Adjusted EBITDA also saw a healthy growth of 20%, amounting to $44.4 million.

CEO Chad Collins highlighted the company's unique market position and ongoing investments in supply chain management as key drivers of growth. CFO Kim Nelson emphasized the strategic initiatives to enhance customer experience and expand the company's competitive edge in the market.

Challenges and Forward-Looking Guidance

Despite the positive revenue growth, the EPS did not meet analyst expectations, which could be attributed to increased operational costs and ongoing investments in technology and market expansion. For Q2 2024, the company forecasts revenue to be between $150.9 million and $151.7 million and EPS between $0.45 and $0.46. The full-year guidance anticipates revenue growth of 15% to 16%, with an EPS range of $1.99 to $2.02.

Strategic Investments and Market Position

SPS Commerce continues to invest in enhancing its technological capabilities and expanding its customer base, which is evident from its robust revenue growth and extensive network of over 120,000 companies globally. The company's focus on customer-centric solutions and strategic partnerships has solidified its position as a leader in the retail supply chain sector.

In conclusion, SPS Commerce Inc's first quarter results reflect a strong revenue performance with challenges in meeting EPS expectations. The company's forward-looking strategies and market positioning suggest a positive outlook, with continued focus on growth and operational efficiency.

Explore the complete 8-K earnings release (here) from SPS Commerce Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance