Specialty Equipment Distributors Stocks Q1 Recap: Benchmarking H&E Equipment Services (NASDAQ:HEES)

As the Q1 earnings season comes to a close, it’s time to take stock of this quarter's best and worst performers in the specialty equipment distributors industry, including H&E Equipment Services (NASDAQ:HEES) and its peers.

Historically, specialty equipment distributors have boasted deep selection and expertise in sometimes narrow areas like single-use packaging or unique lighting equipment. Additionally, the industry has evolved to include more automated industrial equipment and machinery over the last decade, driving efficiencies and enabling valuable data collection. Specialty equipment distributors whose offerings keep up with these trends can take share in a still-fragmented market, but like the broader industrials sector, this space is at the whim of economic cycles that impact the capital spending and manufacturing propelling industry volumes.

The 11 specialty equipment distributors stocks we track reported a mixed Q1; on average, revenues were in line with analyst consensus estimates. Inflation progressed towards the Fed's 2% goal at the end of 2023, leading to strong stock market performance. The start of 2024 has been a bumpier ride, as the market switches between optimism and pessimism around rate cuts due to mixed inflation data, and specialty equipment distributors stocks have had a rough stretch, with share prices down 14.5% on average since the previous earnings results.

H&E Equipment Services (NASDAQ:HEES)

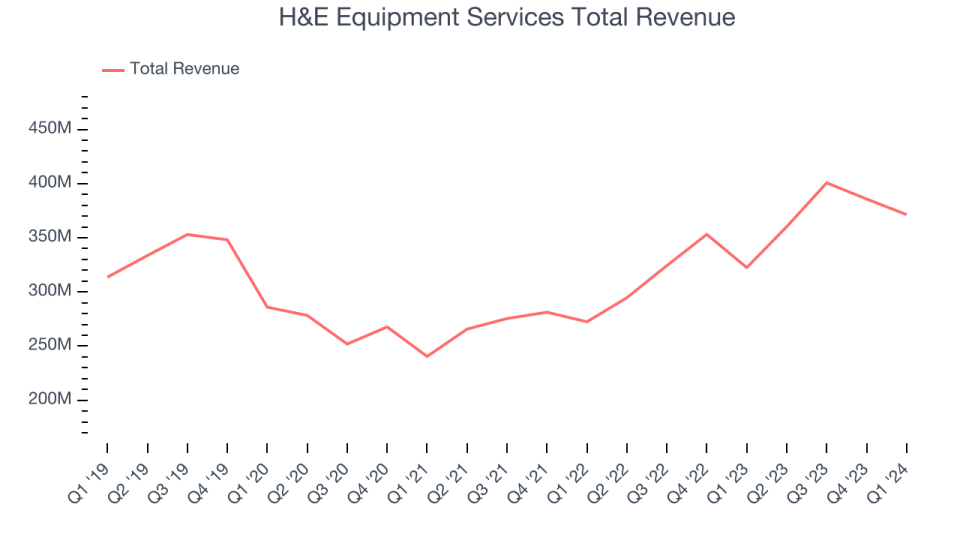

Founded in 1961, H&E Equipment Services (NASDAQ:HEES) provides equipment rental, sales, and maintenance services to construction and industrial sectors.

H&E Equipment Services reported revenues of $371.4 million, up 15.2% year on year, exceeding analysts' expectations by 5.3%. Overall, it was a mixed quarter for the company.

Summarizing the Company’s first quarter results, Brad Barber, chief executive officer of H&E stated, “Rental revenues grew 12.8% on a year-over-year basis, supported by a modest improvement in rental rates and successful growth activities. Rental rates advanced 2.9% when compared to the year-ago quarter, while on a sequential quarterly basis, rates experienced a negligible decrease of 0.2%...”

The stock is down 26% since reporting and currently trades at $43.81.

Is now the time to buy H&E Equipment Services? Access our full analysis of the earnings results here, it's free.

Best Q1: Hudson Technologies (NASDAQ:HDSN)

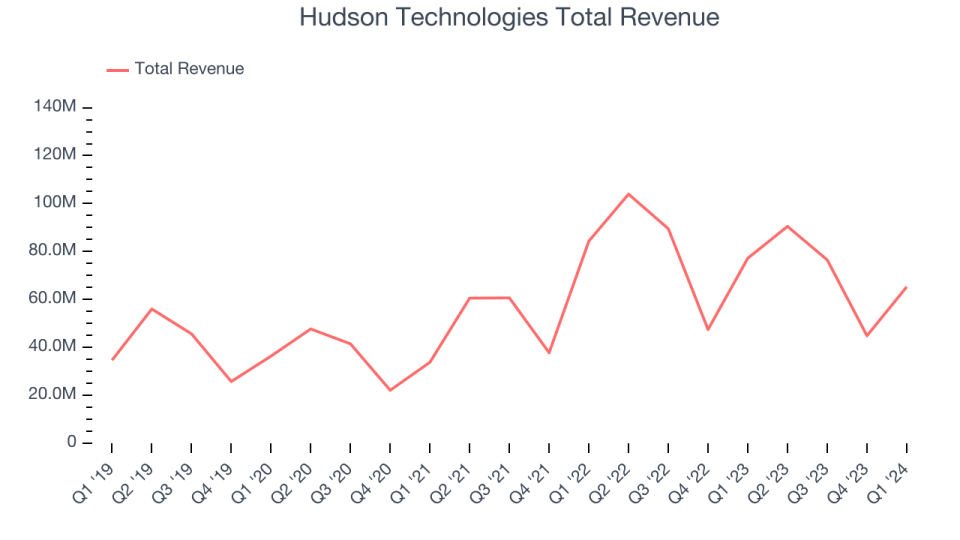

Founded in 1991, Hudson Technologies (NASDAQ:HDSN) specializes in refrigerant services and solutions, providing refrigerant sales, reclamation, and recycling.

Hudson Technologies reported revenues of $65.25 million, down 15.5% year on year, outperforming analysts' expectations by 7.5%. It was an exceptional quarter for the company with a solid beat of analysts' earnings estimates.

Hudson Technologies delivered the biggest analyst estimates beat among its peers. Although it had a great quarter compared its peers, the market seems unhappy with the results as the stock is down 14.6% since reporting. It currently trades at $8.35.

Is now the time to buy Hudson Technologies? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Karat Packaging (NASDAQ:KRT)

Founded as Lollicup, Karat Packaging (NASDAQ: KRT) distributes and manufactures environmentally-friendly disposable foodservice packaging solutions.

Karat Packaging reported revenues of $95.61 million, flat year on year, falling short of analysts' expectations by 4.2%. It was a weak quarter for the company with a miss of analysts' earnings estimates.

As expected, the stock is down 6.3% since the results and currently trades at $27.08.

Read our full analysis of Karat Packaging's results here.

Herc (NYSE:HRI)

Formerly a subsidiary of Hertz Corporation and with a logo that still bears some similarities to its former parent, Herc Holdings (NYSE:HRI) provides equipment rental and related services to a wide range of industries.

Herc reported revenues of $804 million, up 8.6% year on year, surpassing analysts' expectations by 2.4%. Looking more broadly, it was an exceptional quarter for the company with an impressive beat of analysts' Equipment rentals revenue estimates and a decent beat of analysts' earnings estimates.

The stock is down 14.1% since reporting and currently trades at $127.39.

Read our full, actionable report on Herc here, it's free.

SiteOne (NYSE:SITE)

Known for distributing John Deere tractors and LESCO turf care products, SiteOne Landscape Supply (NYSE:SITE) provides landscaping products and services to professionals, including irrigation, lighting, and nursery supplies.

SiteOne reported revenues of $904.8 million, up 8% year on year, surpassing analysts' expectations by 4.6%. Looking more broadly, it was a very strong quarter for the company with an impressive beat of analysts' organic revenue estimates.

The stock is down 23.5% since reporting and currently trades at $120.

Read our full, actionable report on SiteOne here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance