Southwest Airlines approves 'poison pill' as Elliott Investment gains more shares

July 3 (UPI) -- Southwest Airlines said Wednesday it decided to adopt a limited-duration shareholder rights plan that will expire in one year in an effort to counter an attempt by Elliott Investment Management L.P. to acquire a controlling interest in the airline.

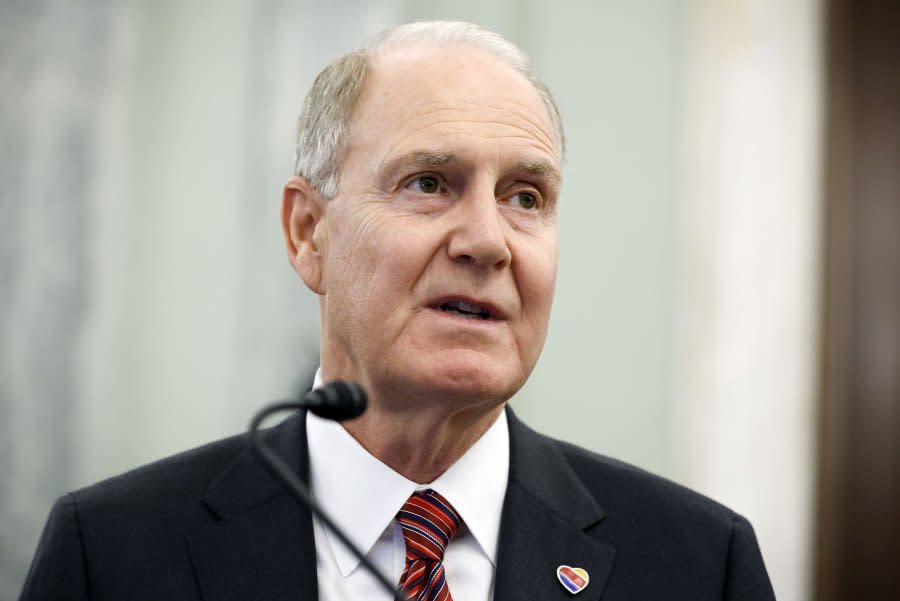

The plan is considered a "poison pill" and is a response to stop Elliott's push to replace Southwest CEO Bob Jordan and Chairman Gary Kelly.

It will only activate if Elliott gets at least 12.5% of Southwest Airlines' outstanding common stock.

In a statement, Southwest Airlines said Wednesday that Elliott "has made regulatory filings with U.S. antitrust authorities that would provide it the flexibility to acquire a significantly greater percentage of Southwest Airlines' voting power across two of its funds starting as early as July 11, 2024,"

The shareholder rights provision would protect Southwest from hostile takeovers by forcing negotiations with the company's board instead of directly with shareholders.

If triggered, the shareholder plan would dilute Elliott Investment's direct voting power within Southwest Airlines.

If the plan goes into effect Southwest said "all holders of rights (other than the person or group triggering the Rights Plan, whose rights would become void) will be entitled to acquire shares of common stock at a 50% discount to the then-current market price or the company may exchange each right held by such holders for one share of common stock."

"In light of the potential for Elliott to significantly increase its position in Southwest Airlines, the board determined that adopting the rights plan is prudent to fulfill its fiduciary duties to all shareholders," Kelly said in a statement. "Southwest Airlines has made a good faith effort to engage constructively with Elliott Investment Management since its initial investment and remains open to any ideas for lasting value creation."

In a June 26 statement, Elliott Investments said "Southwest is led by a team that has proven unable to adapt to the modern airline industry."

Elliott Investments added that it is "committed to delivering the leadership changes that the Company requires."

The investment firm has conducted other campaigns to assert more control over management at AT&T, Texas Instruments and Salesforce.

Southwest has experienced financial losses that led in April to suspension of service to four cities.

"To improve our financial performance, we have intensified our network optimization efforts to address underperforming markets," CEO Bob Jordan said then.

Yahoo Finance

Yahoo Finance