Southeast Asia Food Delivery Market Slows in Risk to Grab, GoTo

(Bloomberg) -- Southeast Asia’s food delivery spending grew at the slowest pace in at least four years in 2022, highlighting the challenges faced by regional internet giants Grab Holdings Ltd. and GoTo Group.

Most Read from Bloomberg

Google to Cut 12,000 Jobs in 6% Reduction of Global Workforce

Holmes Should Be in Prison, Not $13,000-a-Month Estate, US Says

Treasury Taps Retirement Funds to Avoid Breaching US Debt Limit

New Zealand Prime Minister Ardern Announces Shock Resignation

Online food delivery spending rose 5% to $16.3 billion, according to an annual report by Singapore-based consultancy Momentum Works. That was the smallest gain since 2018, when the company started tracking data. Growth in the Philippines, Malaysia and Vietnam offset declines in Singapore, Indonesia and Thailand.

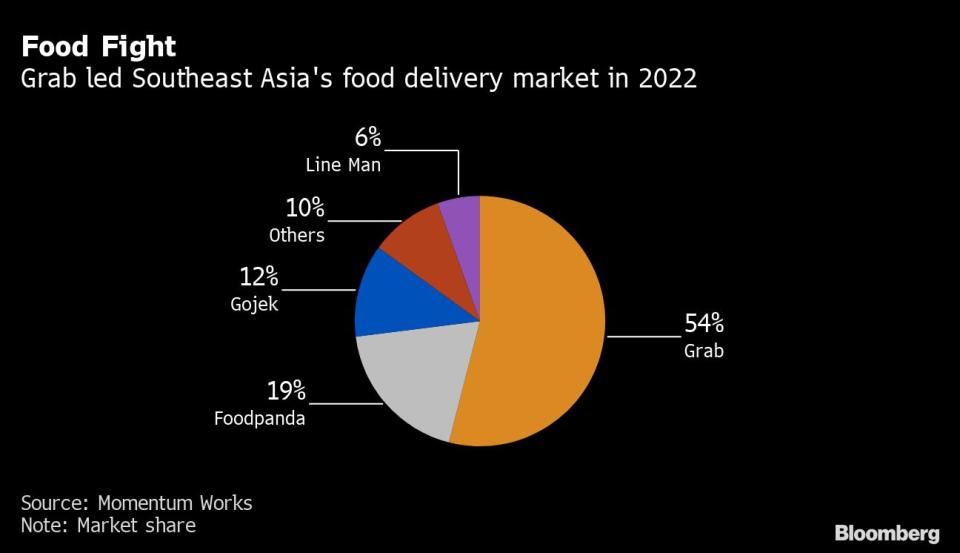

Singapore-based Grab extended its lead in Southeast Asia’s food delivery market. The company, with operations in eight countries, posted gross merchandise value of $8.8 billion last year, accounting for 54% of the market. Delivery Hero SE’s Foodpanda, which operates across Asia, posted GMV of $3.1 billion in Southeast Asia, making up 19% of the total, followed by GoTo’s Gojek and Line Man, the report showed.

Most Read from Bloomberg Businessweek

Fake Meat Was Supposed to Save the World. It Became Just Another Fad

What Tech Job Cuts Say About Silicon Valley—and the Rest of the Economy

It’s a Business Free-for-All in a Russia Transformed by Sanctions

©2023 Bloomberg L.P.

Yahoo Finance

Yahoo Finance