South Korea ETFs: Is Samsung the Next Apple?

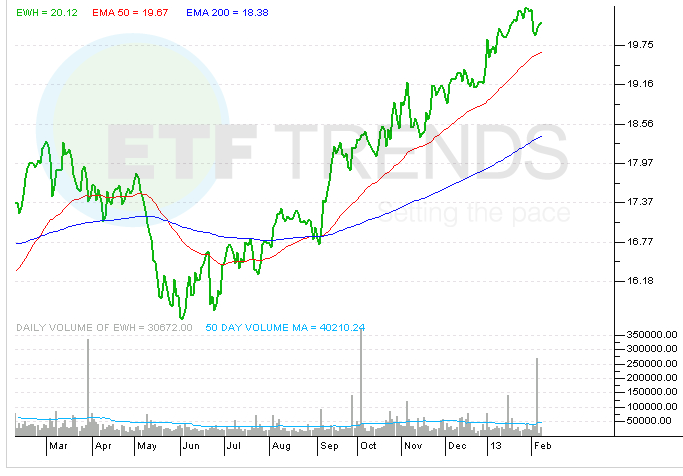

An exchange traded fund pegged to South Korea is enjoying a multi-month rally as Samsung continues to gain ground in the smartphone business on Apple.

“Apple, for the first time in years, is hearing footsteps.The maker of iPhones, iPads and iPods has never faced a challenger able to make a truly popular and profitable smartphone or tablet — not Dell, not Hewlett-Packard, not Nokia, not BlackBerry — until Samsung Electronics,” The New York Times reports.

“The South Korean manufacturer’s Galaxy S III smartphone is the first device to run neck and neck with Apple’s iPhone in sales. Armed with other Galaxy phones and tablets, Samsung has emerged as a potent challenger to Apple, the top consumer electronics maker,” the newspaper said.

After the rare Apple (AAPL) earnings miss and the rising demand for Samgsung products, tech observers may be looking for exchange traded funds with a more Samsung-centric weighting.

Apple recently revealed that quarterly revenue slightly missed Wall Street expectations due to lower iPhone sales, Reuters reports. [Apple Continues to Weigh on Tech Sector, Nasdaq-100 ETF]

On the other hand, in the weeks following the iPhone 5′s launch last year, Samsung’s Galaxy S III saw a record-breaking number of new sales, writes Michal Lev-Ram for Fortune.

According to ABI Research, Samsung smartphone sales topped 33% market share, compared to Apple’s 30%.

Perhaps, Samsung’s marketing strategy is having a great effect on our youth. Maybe there are some out there who can relate; this Christmas, my gamer 15-year old asked if he could give up his iPhone, adding, “Dad, Apple is old.” Considering that my mother switched to the iPhone, my kid may have a point.

Tech related ETF like the PowerShares QQQ (QQQ) have been weighed down by their large weighting toward AAPL.

ETF investors can gain exposure to Samsung through international ETFs:

iShares MSCI South Korea Index (EWY) : Samsung is 21.4%

iShares MSCI AC Asia Information Tech (AAIT) : Samsung is 19.6%

iShares S&P Asia 50 Index (AIA) : Samsung is 14.2%

iShares MSCI South Korea Index

For more information on the tech sector, visit our technology category.

Max Chen contributed to this article.

Full disclosure: Tom Lydon’s clients own AAPL and QQQ.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.

Yahoo Finance

Yahoo Finance