Solid Demand to Drive Lincoln Electric (LECO) Amid High Costs

Lincoln Electric Holdings, Inc. LECO is benefiting from improving demand across its end markets, robust backlog levels, acquisitions and pricing actions. Focus on developing new products, and utilization of digital platforms to engage customers will continue to drive the company’s top-line performance. It has been implementing cost control measures, which will boost margins and help negate the impact of escalating labor, freight and raw material costs.

Solid Demand Bodes Well for 2021 Results

On Oct 28, 2021, Lincoln Electric reported record third-quarter 2021 adjusted earnings of $1.56 per share. The bottom line improved 42% year over year on robust demand across end markets and strong execution of its 2025 Higher Standard Strategy initiatives. The company beat the Zacks Consensus Estimate of $1.54. The company has surpassed the earnings estimates in each of the trailing four quarters, the average surprise being 11.9%.

Lincoln Electric has witnessed improving order rates across all segments as its end markets continue to recover. Both consumables and equipment sales are improving year over year. While Heavy industries led the pack with a low to mid-30% growth rate followed by Construction/Infrastructure, Automotive/Transportation and General Industries rose in the mid-teens to 20% rate. Robust backlog and acquisitions are expected to benefit the company’s performance in the rest of the year.

Lincoln Electric is focused on its cost-reduction actions to sustain margins. After yielding cost-saving benefits of $88 million in 2020, the company anticipates incremental cost savings between $25 million and $30 million in the current year.

The Zacks Consensus Estimate for the company’s earnings for 2021 is currently pegged at $6.16, suggesting year-over-year growth of 48%. The same for 2022 stands at $7.04, indicating a year-over-year improvement of 14%.

Innovation, Acquisitions to Fuel Growth

The company is committed to new product development and utilizing digital platforms to engage customers. Lincoln Electric’s product launches in the automation solutions market are likely to aid growth. Focus on its new additive services business will position the company as a manufacturer of large-scale 3D-printed metal spell parts, prototypes and tooling for industrial customers, which is a major growth prospect.

Meanwhile, the company is continuously evaluating acquisition options focused primarily on tuck-in assets, supporting its Higher Standard 2025 strategy. Lincoln Electric’s recent acquisition of Fabricated Tube Products and Shoals positions it well to capitalize on the growth prospects in the HVAC (Heating, ventilation and air conditioning) market. Earlier this year, the company acquired Zeman Bauelemente Produktionsgesellschaftm.b.H., a Zeman Group unit, to drive automation growth in structural steel applications. The buyout will boost the company’s annual automation sales by around 10% and expand its international automation capabilities.

Balanced Capital Allocation Strategy

As of Sep 30, 2021, Lincoln Electric had liquidity of $718 million. The company ended the third quarter of 2021 with cash in hand of around $160 million. Total debt as of Sep 30, 2021 was $759 million. Its total debt to total capital ratio was 0.47 as of Sep 30, 2021, lower than 0.48 as of Dec 31, 2020. Its times interest earned ratio was 16.3 at the end of third-quarter 2021. Lincoln Electric expects strong cash flow generation and cash conversion in excess of 90% in 2021. Lincoln Electric has a balanced capital allocation strategy, prioritizing growth investment while returning cash to shareholders.

High Costs, Supply Chain Issues Persist

The company expects inflationary headwinds in 2021 stemming from escalating labor, freight and raw material costs to dent its margins. Ongoing supply chain disruption remains a concern. Lincoln Electric is implementing pricing actions to mitigate these impacts.

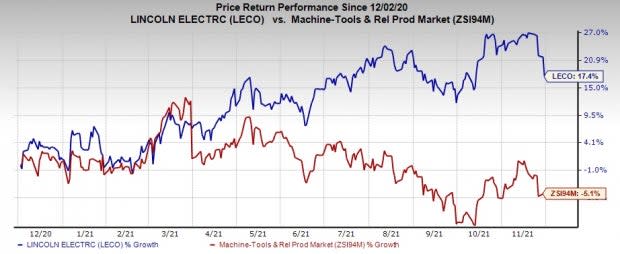

Price Performance

Lincoln Electric’s shares have gained 17.4% over the past year against the industry’s decline of 5.1%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Lincoln Electric currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Industrial Products sector are A. O. Smith Corporation AOS, ScanSource, Inc. SCSC and SiteOne Landscape Supply SITE. All of these stocks carry a Zacks Rank #2 (Buy), at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

A. O. Smith has an expected earnings growth rate of around 35% for the current year. The Zacks Consensus Estimate for current-year earnings has been revised upward by 1% in the past 30 days.

A. O. Smith’s shares have surged 44% in the past year. The company has a trailing four-quarters earnings surprise of 16.8%, on average.

ScanSource has a projected earnings growth rate of around 19% for 2021. The Zacks Consensus Estimate for current-year earnings has been revised upward by 1% in the past 30 days.

The company’s shares have appreciated 22% in a year. ScanSource has a trailing four-quarter earnings surprise of 34.6%, on average.

SiteOne Landscape has an estimated earnings growth rate of around 77.2% for the current year. In the past 30 days, the Zacks Consensus Estimate for current-year earnings has been revised upward by 14%.

The company’s shares have increased 75% in the past year. SiteOne Landscape has a trailing four-quarter earnings surprise of 130.9%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lincoln Electric Holdings, Inc. (LECO) : Free Stock Analysis Report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

ScanSource, Inc. (SCSC) : Free Stock Analysis Report

SiteOne Landscape Supply, Inc. (SITE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance