Solid 11.3% Revenue Growth for emeis in First-quarter 2024

ORPEA S.A. quarterly revenue

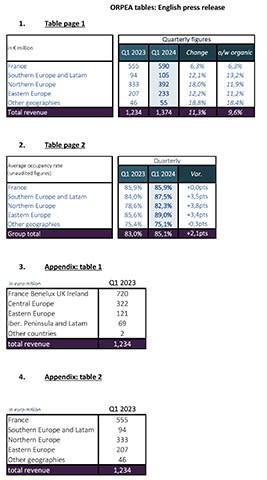

Quarterly revenue growth of 11.3% vs. first-quarter 2023, including 9.6% organic growth

- Solid growth of 6.3% in France

- Strong momentum in international revenue, up 15.5%

Continued overall improvement in the average occupancy rate, which rose by +2.1 points over the period to 85.1%:

- International : up 3.5 points, to 84.6%

- France: stable at 85.9%

PUTEAUX, France, May 14, 2024--(BUSINESS WIRE)--Regulatory News:

ORPEA (Paris:ORP):

Consolidated revenue for Q1 2024 reached 1,374 million euros, up 11.3%. The high level of organic growth (9.6%) was driven by a 2.1-point increase in the average occupancy rate, sustained effect of price increases, and the positive impact of the contribution from the opening of new facilities.

Solid growth across all the Group's geographies:

Organic growth in Group revenue reflects the following factors: 1. The year-on-year change in revenue of existing facilities as a result of changes in their occupancy and per diem rates; 2. The year-on-year change in revenue of refurbished facilities or facilities where capacity was increased in the current or previous year; 3. The year-on-year change in revenue generated in the current period by facilities created, and 4. the change in revenue of recently acquired facilities in comparison with the previous equivalent period.

Sharp rise in occupancy rate, driven by international operations:

In accordance with IAS 1 "Presentation of financial statements" and IFRS 8 "Operating segments", the Company now presents its financial statements according to a new geographical breakdown reflecting changes in its internal organization:

- France;

- Southern Europe and Latam: Spain, Italy, Portugal and Latin America;

- Northern Europe: Germany, Netherlands, Belgium and Luxembourg;

- Eastern Europe: Austria, Switzerland, Czech Republic, Slovenia and Croatia;

- Other geographies: Ireland, Poland, United Kingdom, China and United Arab Emirates.

1- Overview of operations in first-quarter 2024

All geographic regions reported dynamic growth in the first quarter of 2024, driven by a sustained price and care allowances effect (approx. 5.8%), reinforced internationally by a strong recovery in occupancy rates and the opening of new facilities.

The above-mentioned price effect is mainly due to tariff increases, particularly outside France, in an inflationary environment that has impacted the main operating expense line items since 2022.

The number of facilities (nursing homes + clinics + assisted living facilities) in operation stood at 1,040 at the end of the first quarter 2024. This compares with 1,003 facilities at the end of the first quarter 2023, the increase resulting from the inclusion in the scope of consolidation of 25 facilities (mainly in Belgium and the Netherlands in the second quarter of 2023) and the net balance of new facilities opened (mainly smaller facilities in the Netherlands).

The number of beds in operation (retirement homes + clinics + assisted living apartments) stood at 93,297 at the end of the first quarter of 2024, compared with 93,470 beds at the end of December 2023 and 92,185 beds at the end of March 2023. The decrease in the number of beds was mainly due to the closure and combination of facilities, particularly in Belgium.

2- Key highlights by geographical area

In France, revenue rose by +6.3% to 590 million euros. This trend is mainly due to rate increases, which do not fully offset inflation, one-off financial allocations, and, to a lesser extent, to higher occupancy rates in clinics (medical and rehabilitation care, mental health).

The occupancy rate in France remained stable compared with the first quarter of 2023 at 85.9%, with an increase of +0.6 point in clinics and a slight decline in nursing homes (-0.4 points to 83.1%). The nursing homes activity in France remains far from its historical normative levels and has not yet benefitted, in the early part of this year, from the favourable impact of the many structural initiatives undertaken, including those presented at the 2023 annual results.

Revenue for Southern Europe and Latam (Spain, Italy, Portugal and Latin America) totaled 105 million euros, up +13.2% organically. Reported growth, which includes the closure of facilities in Spain, Portugal and Latam, was +12.1%.

The average occupancy rate across the area rose sharply over the period, to 87.5% (up 3.5 points). Spain, the area's main contributor, saw strong momentum driven by a significant improvement in its occupancy rate (+5.6 points vs. Q1 2023).

Revenue for the Northern Europe area (Germany, Belgium, Netherlands, Luxembourg) totaled 392 million euros, up +18%, of which +11.9% was organic. This strong rise in organic growth was driven by an increase in the average occupancy rate (+3.8 points), significant rate revisions and the opening of new facilities, mainly in the Netherlands. The difference between the organic growth rate and the published growth rate results from the inclusion in the scope of consolidation, in the second quarter of 2023, of activities in Belgium and the Netherlands.

Revenue in Eastern Europe (Austria, Switzerland, Czech Republic, Slovenia, Croatia) also posted strong growth (+12.2%, of which +11.2% organic), to 233 million euros. The region's two main contributors, Austria and Switzerland, benefited from a combination of higher occupancy rates and major rate revisions. The area's occupancy rate rose by 3.4 points over the period.

The Other geographies area(Ireland, Poland, United Kingdom, China, United Arab Emirates) posted revenue of 55 million euros, up +18.8%, benefiting from solid momentum in the zone's two main contributors, Poland and Ireland.

3- Financial information and calendar

The Company will hold its Annual General Meeting on June 25th and plans to publish its revenue for the 1st half of 2024 on July 25th.

Appendix: changes in geographical segmentation for financial data

The Company previously presented its financial performance as follows:

- France Benelux UK Ireland;

- Central Europe: Germany, Italy, Switzerland;

- Eastern Europe: Austria, Poland, Czech Republic, Slovenia, Latvia, Croatia;

- Iberian Peninsula and Latam: Spain, Portugal, Brazil, Uruguay, Mexico, Chile, Columbia;

- Other countries: China and UAE.

For example, revenue for the 1st quarter of 2023 were as follows:

In accordance with IAS 1 "Presentation of financial statements" and IFRS 8 "Operating segments", the Company reports its financial statements according to a new geographical breakdown reflecting changes in its internal organization:

- France ;

- Southern Europe and Latam: Spain, Italy, Portugal, Latin America;

- Northern Europe: Germany, the Netherlands, Belgium, Luxembourg;

- Eastern Europe: Austria, Switzerland, Czech Republic, Slovenia, Latvia, Croatia;

- Other geographies: Ireland, Poland, United Kingdom, China, UAE.

About emeis

With nearly 78,000 experts and professionals in healthcare, care, and supporting the most vulnerable among us, emeis operates in around twenty countries with five core activities: psychiatric clinics, medical care and rehabilitation clinics, nursing homes, home care services, and assisted-living facilities.

Every year, emeis welcomes around 283,000 residents, patients, and other beneficiaries. emeis is committed and taking action to rise to a major challenge facing our society, i.e. the increase in the number of people placed in a vulnerable position as a result of accidents, old age, or the cases of mental illness.

ORPEA S.A., the Group's parent company, is 50.2% owned by Caisse des Dépôts, CNP Assurances, MAIF, and MACSF Epargne Retraite. It is listed on the Euronext Paris stock exchange (ISIN: FR001400NLM4) and is a member of the SBF 120 and CAC Mid 60 indices.

Website: www.emeis.com

View source version on businesswire.com: https://www.businesswire.com/news/home/20240514577183/en/

Contacts

Press Contacts

Isabelle HERRIER NAUFLE

Medias & e-reputation Director

07 70 29 53 74

isabelle.herrier@emeis.com

IMAGE 7

Charlotte LE BARBIER // Laurence HEILBRONN

06 78 37 27 60 // 06 89 87 61 37

clebarbier@image7.fr//

lheilbronn@image7.fr

Investor Relations

Benoit LESIEUR

Investor Relations Director

benoit.lesieur@emeis.com

Toll-free number for shareholders:

0 805 480 480

NEWCAP

Dusan ORESANSKY

01 44 71 94 94

emeis@newcap.eu

Yahoo Finance

Yahoo Finance