SolarWinds Corp (SWI) Q1 2024 Earnings: Exceeds Revenue Forecasts and Delivers Robust EBITDA Growth

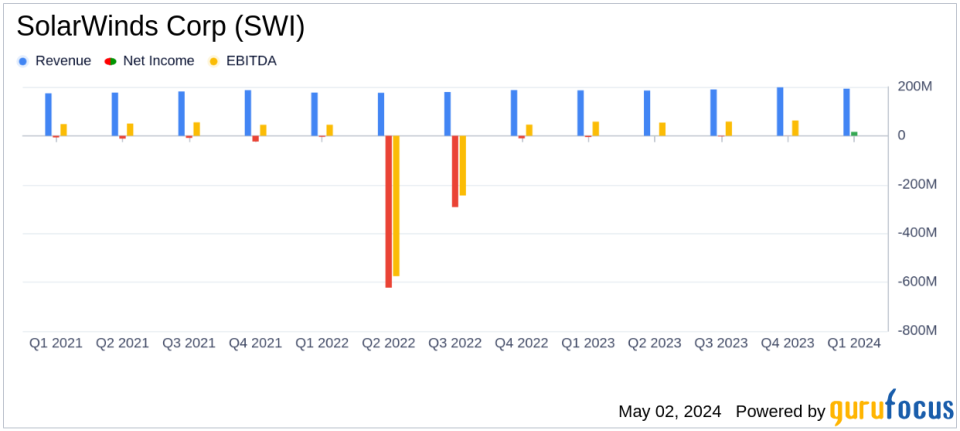

Revenue: Reported $193.3 million, a 4% increase year-over-year, surpassing the estimate of $190.84 million.

Net Income: Achieved $15.6 million, significantly below the estimated $38.24 million.

Earnings Per Share (EPS): Recorded at $0.09, falling short of the estimated $0.22.

Adjusted EBITDA: Reached $92.1 million, demonstrating a 19% increase from the previous year and a margin of 48% of total revenue.

Subscription Annual Recurring Revenue (ARR): Grew by 36% year-over-year to $251.3 million.

Total Annual Recurring Revenue (ARR): Increased by 7% year-over-year to $695.3 million.

Dividend: Announced a special cash dividend of $1.00 per share, reflecting strong cash flow and shareholder return focus.

SolarWinds Corp (NYSE:SWI), a leading provider of IT management software, announced its first-quarter results for 2024 on May 2, 2024, revealing a performance that surpassed revenue expectations and showcased significant adjusted EBITDA growth. The detailed financial outcomes were disclosed in their recent 8-K filing.

About SolarWinds Corp (NYSE:SWI)

SolarWinds is renowned for its comprehensive suite of IT management software solutions, designed to empower technology professionals to effectively monitor and manage network performance. The company's offerings are crucial for ensuring the robust performance of IT environments across various deployment models, including on-premises, cloud, and hybrid systems.

Financial Highlights and Performance

For Q1 2024, SolarWinds reported revenue of $193.3 million, a 4% increase year-over-year, and above the analyst estimate of $190.84 million. This growth is attributed to the company's strong recurring revenue streams, which constituted 93% of the total revenue. Net income stood at $15.6 million, significantly lower than the estimated $38.24 million, reflecting ongoing investments in strategic areas and some operational challenges.

The company's adjusted EBITDA was a standout at $92.1 million, marking a 19% increase from the previous year and demonstrating a robust margin of 48% of total revenue. This performance underscores SolarWinds' operational efficiency and its ability to scale profitably.

Strategic Developments and Future Outlook

During the quarter, SolarWinds made notable strides in enhancing its product offerings, particularly through AI-powered enhancements aimed at providing full-stack observability. This initiative is expected to bolster the company's competitive edge by enabling comprehensive monitoring capabilities across various IT environments.

Looking ahead, SolarWinds provided an optimistic financial outlook for Q2 and the full year of 2024. For the second quarter, the company anticipates revenue between $186 million and $191 million, and adjusted EBITDA between $85 million and $88 million. For the full year, revenue is expected to range from $771 million to $786 million with adjusted EBITDA projected between $360 million and $370 million.

Challenges and Industry Context

Despite its strong performance, SolarWinds faces challenges, including the competitive pressures in the IT management software market and the ongoing need to innovate amidst rapidly evolving technology landscapes. Moreover, the company continues to navigate the repercussions of the December 2020 cyber incident, emphasizing the critical importance of cybersecurity measures in its operations.

Conclusion

SolarWinds' Q1 2024 results reflect a company that is not only growing in terms of revenue but also improving its profitability metrics significantly. The strategic initiatives undertaken by the company, particularly in enhancing product capabilities and expanding its global reach, are poised to support sustained growth. However, investors should also consider the operational challenges and competitive dynamics that could influence the company's performance in future periods.

For detailed insights and ongoing updates, investors and stakeholders are encouraged to monitor SolarWinds' filings and communications.

Explore the complete 8-K earnings release (here) from SolarWinds Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance