Softening Gas Prices Hurt TotalEnergies' Quarterly Results

France-based TotalEnergies SE (NYSE:TTE) released its first-quarter 2024 earnings on April 26.

In a nutshell, the energy company reported a 22% decrease in earnings for the first quarter of 2024, largely attributed to reduced profits from natural gas. The company partially offset this decline with a stronger-than-expected performance in the oil segment. However, the recent rise in crude oil prices may hurt refining margins in the coming months.

Most of TotalEnergies' peers have experienced declining profits in the past few quarters as the boosting effect of the Russia-Ukraine war begins to wane.

Results snapshot

TotalEnergies reported net income of $2.40 per share ($5.72 billion), up from $2.21 per share ($5.55 billion) the previous year, mainly due to declining commodity prices.

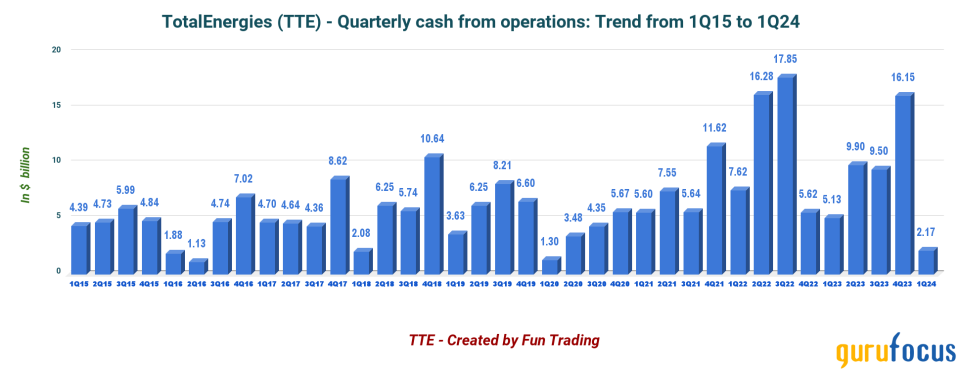

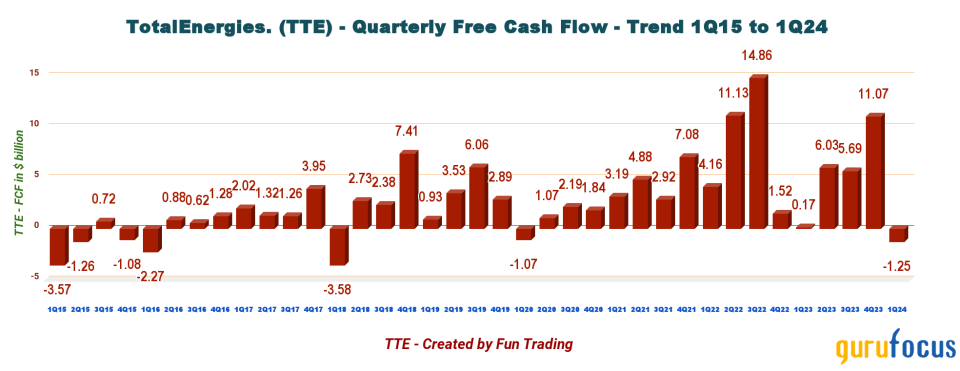

However, the cash from operations was down significantly compared to the preceding quarters, as shown below:

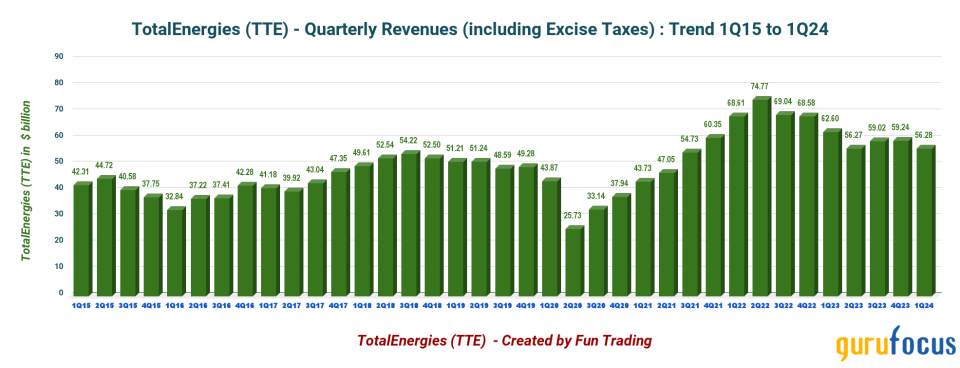

The total revenue came in at $56.27 billion, down 10.10% from $62.60 billion in the year-ago quarter due mainly to lower commodity prices.

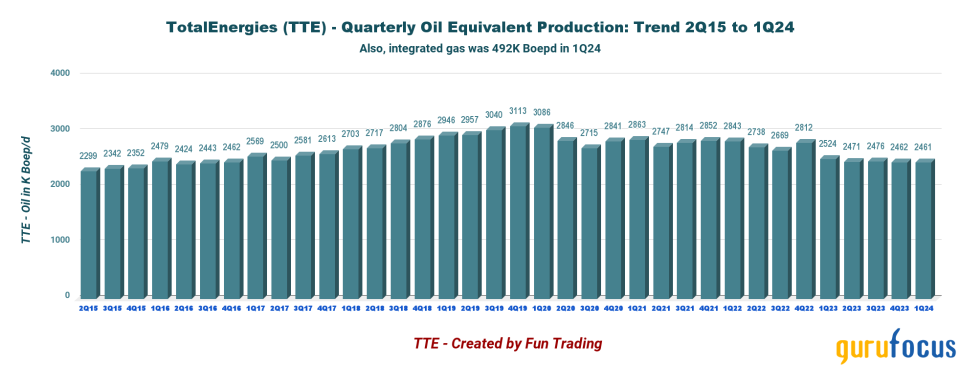

First-quarter upstream equivalent production averaged 2,461,000 barrels of oil equivalent per day, down 2.5% from 2,524,000 Boepd realized last year.

Liquids output averaged 1,322,000 Boepd in the first quarter, a 5.4% decrease from a year ago. Gas production was 1,139,000 Boepd, 1.20% more than the previous year. The increase was due to two startups in Brazil and West Africa and a growing LNG market. Production remained consistent from quarter to quarter.

The integrated gas, renewables and power division produced 492,000 Boepd.

TotalEnergies also reported $1.07 billion was spent on acquisitions and $1.57 billion was spent on divestitures.

Investment thesis

TotalEnergies is considered a secure investment in the oil sector, especially regarding dividends. The dividends have consistently increased without interruption for years. The last quarterly dividend was set at 0.79 euros (86 cents), which represents a dividend yield of 4.70% (or about 3.5% for U.S. investors). This compared to 3.20% for ExxonMobil (NYSE:XOM) and $4% for Chevron (NYSE:CVX).

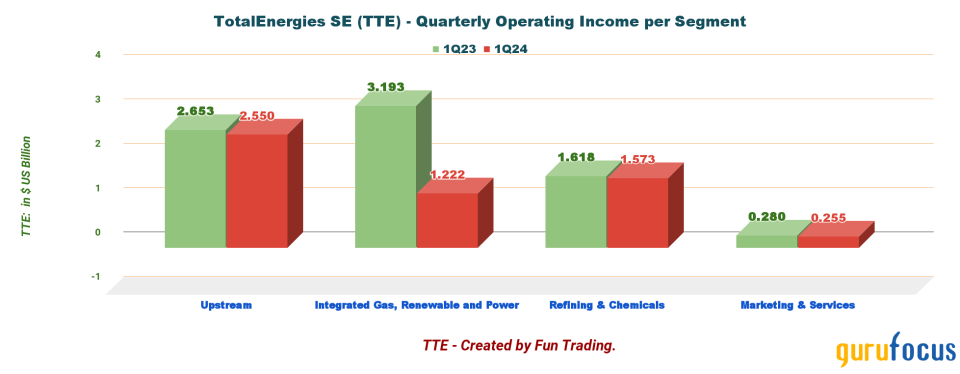

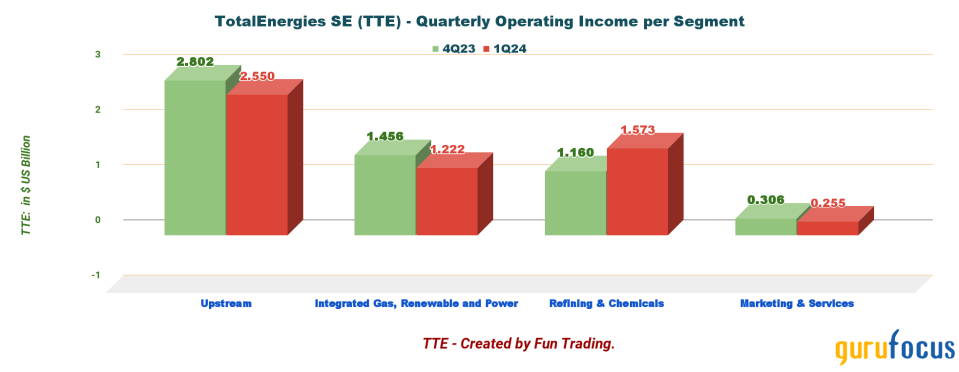

However, TotalEnergies is more than producing energy; it generates revenue from five distinct segments. Let's compare the first quarter of 2023 to the first quarter of 2024. We can see clearly that integrated gas, renewable energy and power were down year over year.

TotalEnergies is a major oil and gas producer, gradually transitioning to renewables. This sector now represents a significant and growing part of its business model, with around one-third of its 2024 capital expenditure, or $5 billion, earmarked for integrated power and "green electricity generation." The company indicated that the net power production was 9.6 TWh, up about 20% quarter over quarter.

The issue isn't whether transitioning from traditional oil and gas production to renewable energy is a good idea because we know it is long term, but rather how to do it without breaking the business model.

I believe TotalEnergies is successfully navigating this challenging transition, unlike other companies that either disregard this new approach or move too quickly without a clear understanding of what is required.

TotalEnergies has found a balanced approach that doesn't jeopardize its business. I recently covered the first-quarter results of BP (NYSE:BP), and it's very evident how different and unclear its strategy is in comparison. If you invest in an oil supermajor for the long term, you must ensure the business will survive the ups and downs in the energy market without hurting your investment.

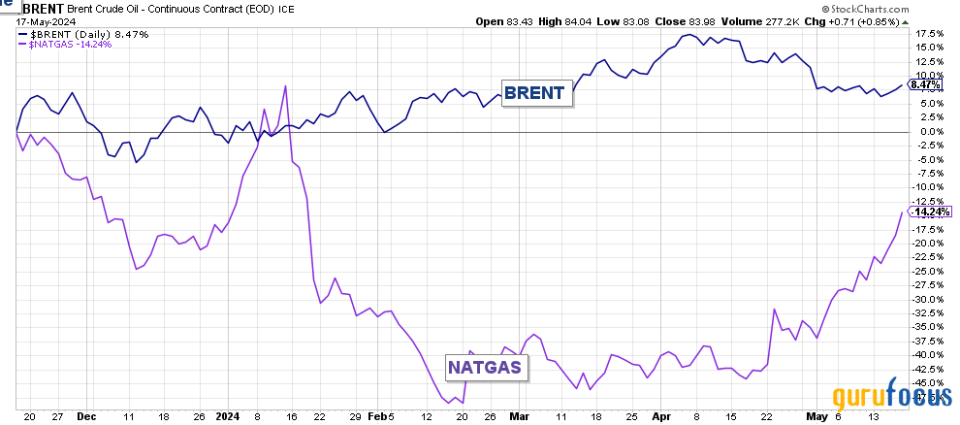

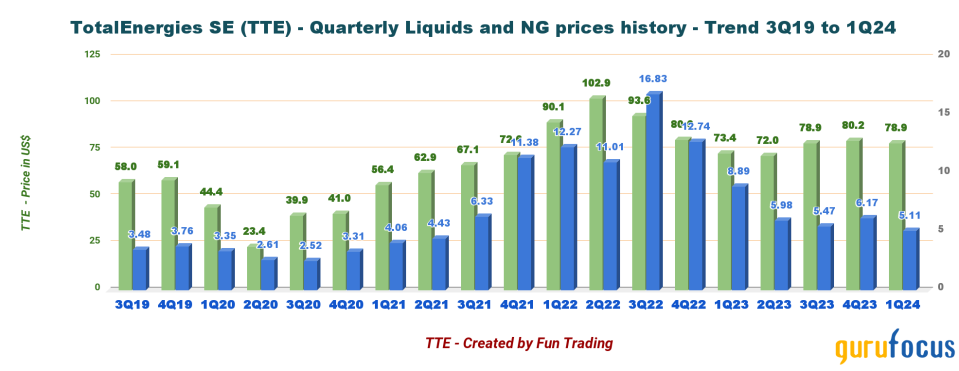

Oil and gas prices remain the primary source of TotalEnergies' revenue, with renewable and green electricity gaining importance but remaining marginal. The Brent price has decreased by over 8% year over year, while natural gas (U.S. only) is down by 14%.

Thus, it is important to consider trading short-term LIFO for about 40% to 50% of your holding while maintaining a long-term core position for a higher target or enjoying a good and secure dividend. This dual strategy allows you to take full advantage of the oil and gas sector's high volatility and inherent cyclical nature while enjoying an appealing dividend.

Stock performance

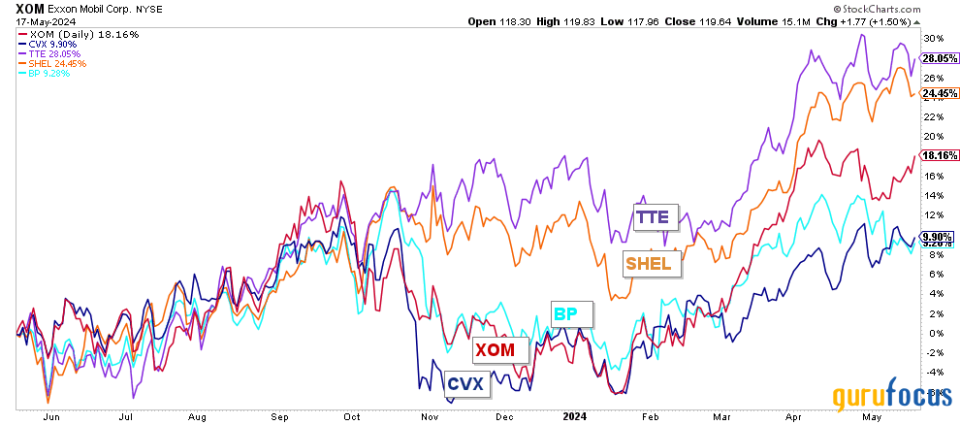

Shares of TotalEnergies have risen 28% over the past year, outperforming the sector.

Balance sheet and production history: The raw numbers

Note that TotalEnergies is an American depositaru receipt or ADR. The foreign withholding taxes reduce the dividend paid to American investors by 12.80% or 25% (talk to your broker). However, the foreign tax paid can be deducted from your income tax. In my case, I am paying 25%, but I do not know why.

TotalEnergies SE | 1Q23 | 2Q23 | 3Q23 | 4Q23 | 1Q24 |

Total Revenues in $ Billion | 74.77 | 69.04 | 68.58 | 62.60 | 56.28 |

Total Revenues (minus excise tax) in $ Billion | 70.45 | 64.96 | 63.95 | 58.23 | 51.88 |

Net income in $ Billion | 5.69 | 6.63 | 3.26 | 5.56 | 5.72 |

EBITDA $ Billion | 14.98 | 16.49 | 12.99 | 13.60 | 12.49 |

EPS diluted in $/share | 2.16 | 2.56 | 1.26 | 2.21 | 2.40 |

Cash from operating activities in $ Billion | 16.28 | 17.85 | 5.62 | 5.13 | 2.17 |

Capital Expenditures in $ Billion | 5.15 | 2.99 | 4.10 | 4.97 | 3.42 |

Free Cash Flow in $ Billion | 11.13 | 14.86 | 1.52 | 0.165 | -1.25 |

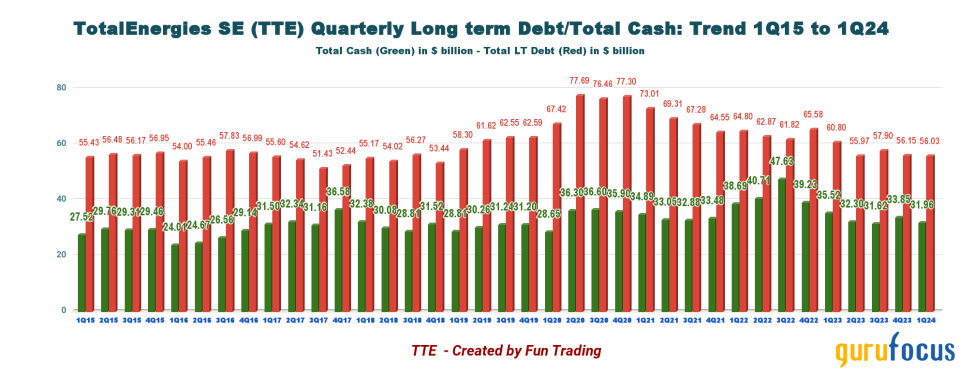

Total Cash: $ Billion | 40.71 | 47.63 | 41.77 | 35.52 | 31.96 |

Long-term Debt in $ Billion | 62.87 | 61.82 | 60.77 | 60.80 | 56.03 |

Dividend per share in /sh (including Foreign withholding tax 12.8%/25%) | 0.69 | 0.69 | 0.69 | 0.74 | 0.79 |

Shares outstanding (diluted) in billions | 2.611 | 2.588 | 2.510 | 2.492 | 2.364 |

Oil Production | 1Q23 | 2Q23 | 3Q23 | 4Q23 | 1Q24 |

Oil Equivalent Production in K Boepd | 2,738 | 2,669 | 2,812 | 2,524 | 2,461 |

Americas Production in K Boepd | 463 | 438 | 433 | 464 | 492 |

Average price liquids: $/Boe | 102.9 | 93.6 | 80.6 | 73.4 | 72.0 |

Average gas price: $/Mbtu | 11.01 | 16.83 | 12.74 | 8.89 | 5.98 |

Source: Company filings and Fun Trading.

Analysis: Balance sheet and production discussion

Total revenue was $56.27 billion (including excise tax) in the first quarter.

TotalEnergies' revenue amounted to $56.27 billion (including excise taxes) or $51.88 billion net, showing a significant decrease from the $62.60 billion generated in the same quarter last year. The company reported a profit of $2.40 per diluted share, with adjusted net income at $5.11 billion, down from $6.54 billion in the prior-year quarter. Net earnings were $5.72 billion, compared to $5.55 billion.

The company disclosed an adjusted Ebitda of $11.49 billion, down from $14.20 billion a year ago.

Finally, acquisitions were $1.07 billion and divestments were $1.57 billion.

TotalEnergies' trailing 12-month free cash flow is now $21.54 billion, with -$1.25 billion realized for the first quarter. The cash flow from operating activities was $2.16 billion, down from $5.13 billion in the year-ago period.

The company paid a quarterly dividend of 0.79 euros per share for fiscal 2024, resulting in a dividend yield of 4.46% before French tax automatic withdrawal (12.80% or 25%). The company intends to buy back up to $2 billion worth of shares in the second quarter.

Net debt was $24.07 billion as of the end of March.

Further, cash, cash equivalents and marketable securities were $31.96 billion, compared with $35.52 billion in the prior-year quarter.

The debt-to-equity ratio is now 0.47. Gearing, including leases, was 15.50% at the end of the first quarter of 2024, compared with 16.50% a year ago.

Using another method (based on long-term debt including current minus cash and cash equivalents and marketable securities), TotalEnergies indicates a net debt of $14.21 billion ($15.35 billion in the first quarter of 2023). However, my calculation is quite different and is $24.06 billion compared to $25.27 billion last year.

By segment, Exploration & Production (Upstream) recorded an operating gain of $2.55 billion, down significantly from $2.80 billion last year. Operating income in Integrated Gas, Renewable and Power was $1.22 billion, down from $1.45 billion. In Refining and Chemicals, operating income was $1.57 billion, up from $1.16 billion. As for Marketing and Services, operating income was $255 million, down slightly from $306 million.

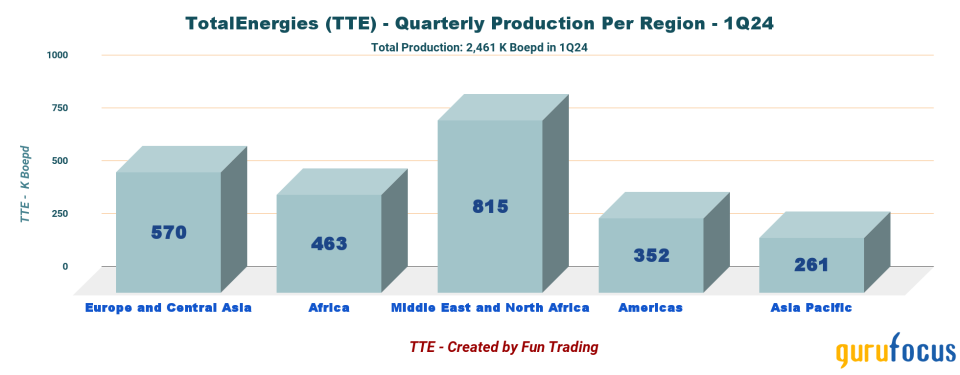

The total hydrocarbon production during the first quarter averaged 2,461,000 Boepd, a decrease from 2,524,000 Boepd in the same quarter last year. In the fourth quarter of 2023, production was 2,462,000 Boepd.

This quarter's average realized liquids prices were $78.90, a 7.5% increase from the year-ago price. Natural gas prices were $5.11, down from $8.89 per thousand British thermal units last year.

Upstream output primarily originates from Europe and the Middle East, with TotalEnergies having smaller production from the Americas and Asia Pacific.

Liquid production averaged 1,322 thousand barrels of oil per day for the first quarter, while quarterly gas production was 1,139 thousand barrels of oil equivalent per day.

Technical analysis and commentary

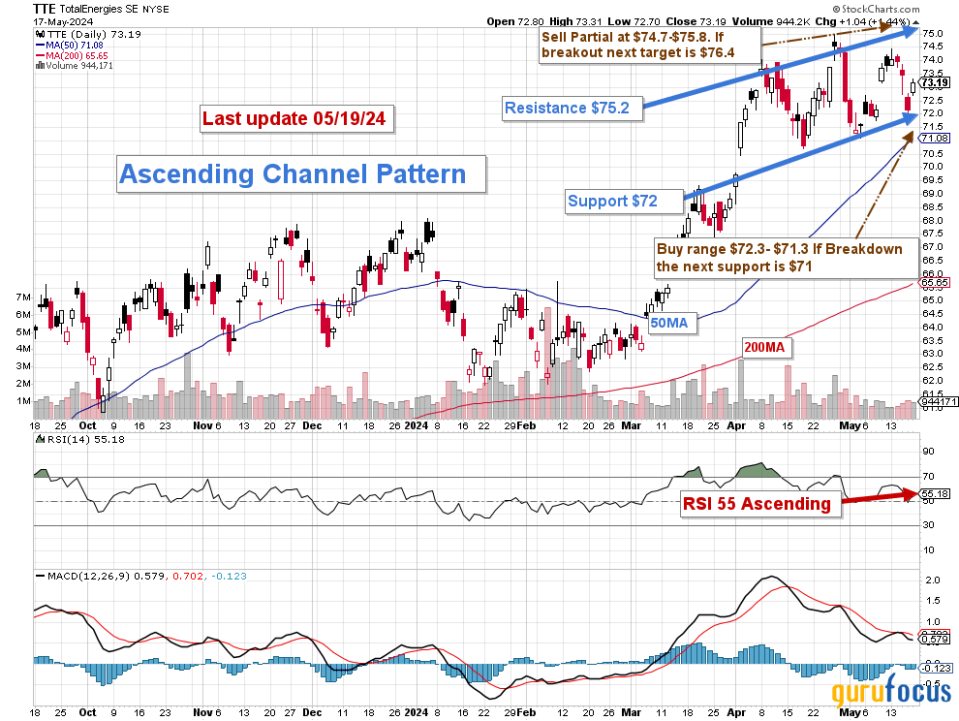

Note: The chart is adjusted for the dividend.

TotalEnergies forms an ascending channel pattern with resistance at $75.20 and support at $72. While an ascending channel is considered bullish in the short term, the pattern often ends with a breakdown. Therefore, taking partial short-term LIFO profit is important, expecting a retracement to lower support, potentially below $70.

As we all know, the stock is highly correlated to oil and gas prices, which are notoriously volatile.

Thus, the trading strategy is to sell about 40% to 50% of your position LIFO between $74.70 and $75.80, with possible higher resistance at $76.40 and wait for a retracement between $72.30 and $71.30, with potential first lower support at $71.

Warning: The TA chart must be updated frequently to be relevant.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance