SoFi: A Gateway for Growth Amidst a Downturn

SoFi Technologies Inc. (NASDAQ:SOFI) has become an aggressive competitor within the spectrum of financial service providers, as evidenced by its strong record of refinancing student loans.

However, the Covid-19 pandemic in 2020 made it turn its business strategy at a critical junction with the moratorium on student loans. That strategic change moved the company's focus more toward personal lending and, since then, its loan originations have surged from $2.60 billion to $13.80 billion.

The damage was done, however, as the stock has been moving sideways recently. It is already down around 33% for the year, massively underperforming the S&P 500, which is up over 16%. After its notable dip in its earnings report, SoFi presents a beautiful entry point for long-term investors.

Thus, the market sell-offs driven by macroeconomic concerns have further pressured SoFi's lending segment. Despite this, a 2% decrease in lending revenue and cautious forecasts for 2024, the fundamental shifts in the company's business strategy, along with potential future Federal Reserve rate cuts, positions it for a promising rebound and growth.

SoFi weathers lending storm: Rising profits defy market doubts

The stock's market weakness relates to the company's weakness in the lending segment, where revenue in the first quarter dropped 2% to $330.50 million. The decline came as personal loan origination grew by 11% to $3.30 billion. Likewise, adjusted net revenue remained flat at $325.30 million and the market reacted negatively to the digital financial service company's forecast that revenue in the segment will decline by 5% to 8% this year.

Nevertheless, higher loan balances and substantial net interest margins are helping drive net interest income, which increased by 33% to $65.50 million. Despite revenue in the segment going down, SoFi still generated a net income of $266.50 million, which exceeded the $117.60 million in expenses. Likewise, the lending segment contribution profit was only down by 1% to $207.70 million, which is relatively insignificant to justify the market reaction the stock has received.

Even as SoFi Technologies faces challenges in its lending business, it continues to demonstrate significant momentum in overall revenue growth as it diversifies into its financial services and technology platforms. The Digital financial services company delivered a 37% increase in revenue of $645 million, beating consensus estimates of $556 million.

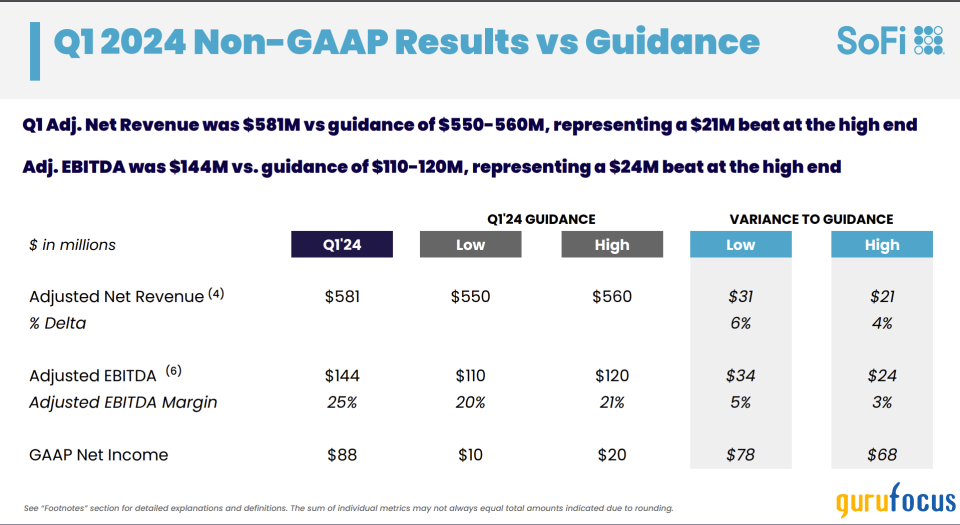

Adjusted net revenue continued to grow, increasing 26% year over year to $581 million, which marked the 12th consecutive quarter of growth over 25% in validating core business growth. Similarly, tangible book value also increased for the seventh quarter to $4.10 billion for the digital financial services company.

At the same time, SoFi Technologies reported an adjusted Ebitda of $144 million, up 91% year over year. On a GAAP basis, the company posted a net income of $88 million, including $59.20 million related to a one-time benefit on the exchange of convertible debt.

Thus, the high-interest rate environment further supported SoFi, with net interest income growing 71% to $402.70 million and the net interest margin improving to 5.91% from 5.48% the previous year.

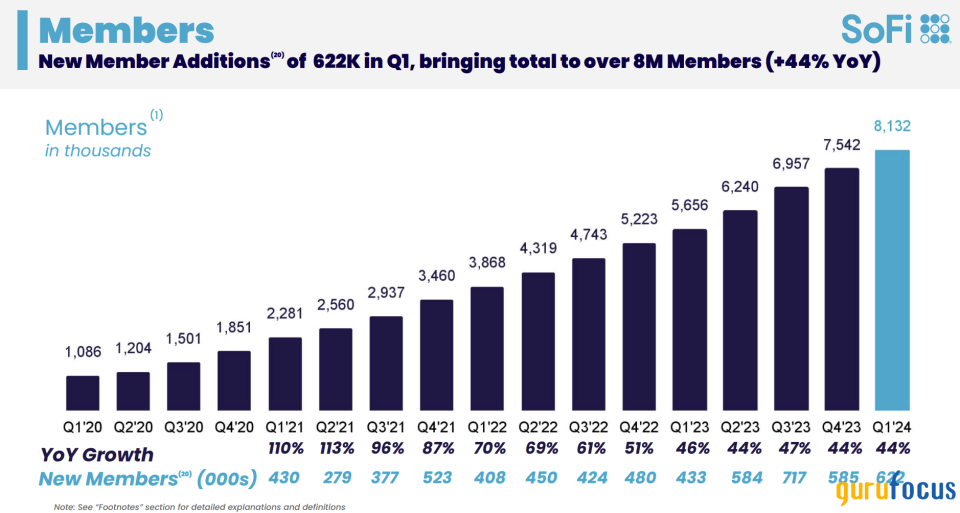

Additionally, SoFi has seen a remarkable surge in new members and product offerings in the first quarter, significantly bolstering its performance metrics. The company added 622,000 new members, a 44% increase from the previous quarter, bringing its total customer base to 8.10 million, an impressive 7.80% uptick. This influx has directly contributed to the company achieving record consumer deposits of $3 billion and robust loan sales totaling $1.90 billion.

The significant growth in new members is a clear indicator of SoFi's successful expansion and its ability to attract and retain customers, driven largely by its diverse range of financial products. In the first quarter alone, the company reported 989,000 new product additions, with 93% of these within the financial services segment. This diversity not only enhances customer engagement, but also bolsters its revenue streams and market presence.

Source: SoFi Technologies

Stellar second-quarter results propel optimistic full-year outlook

SoFi has delivered an impressive set of second-quarter numbers and full-year guidance, bullishly suggesting expectations that other segments will outweigh the expected losses, too. In the second quarter, revenue is expected to be $555 million to $565 million, growing 14% to 16% year over year. The same growth is anticipated for the adjusted Ebitda at an average of $115 million to $125 million, leading to net income between $5 million and $10 million.

For the full year, the company expects financial services net revenue to grow by more than 75%, with tech platform net revenue increasing by 20%, affirming continued growth despite the macroeconomic uncertainty. Consequently, net revenue should be between 92% and 93% in 2023, with an adjusted Ebitda of between $590 million and $600 million. The digital services company expects earnings per share to average between 8 cents and 9 cents. Lastly, SoFi expects to add 2.3 million new members in 2024, representing 30% growth.

Source: SoFi Technologies

From lending leader to financial services powerhouse

SoFi has done an excellent job reducing its reliance on the lending business, which is under pressure amid deteriorating economic conditions. Its shift of focus into becoming a one-stop financial services company following the acquisition of Golden Pacific Bancorp in 2022 is already paying off.

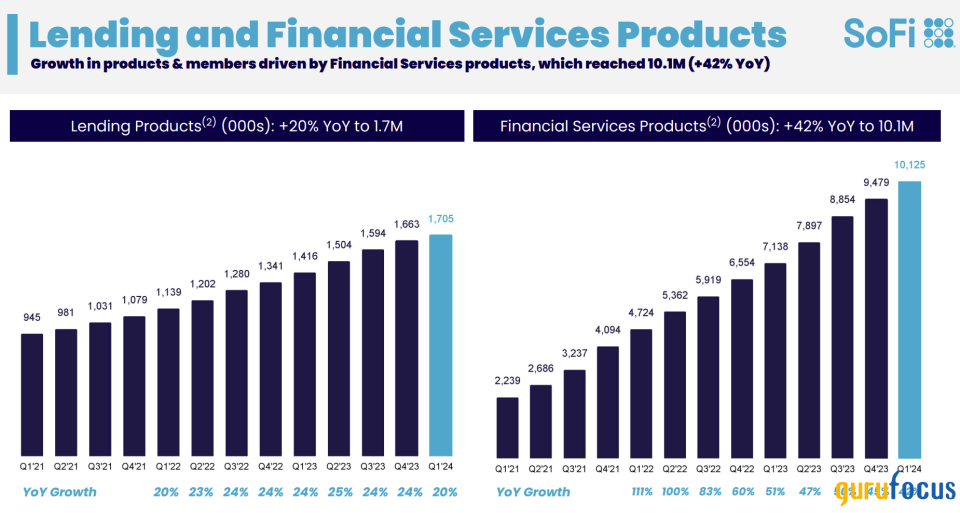

With the acquisition, SoFi has been able to meet various financial needs, including loans, checking and savings accounts and credit cards. The financial services and technology platform make up a growing portion of its revenue, contributing 42% adjusted.

With the integration of various financial services, SoFi Technologies generated $150 million in revenue in the segment in the first quarter, up by 86% year over year. The segment currently accounts for about 25% of the total profit, compared to a $24 million loss last quarter.

According to financial advisor and personal finance expert Michael Dinich, SoFi's transformation into a comprehensive financial services company has been a crucial strategy, significantly boosting its revenue and profitability. This success is further supported by enhanced contribution margins achieved through strategic client onboarding and revenue diversification.

Finally, the impressive results were driven mainly by the high interest rate environment. SoFi offers an industry-leading annual percentage yield of up to 1%, which is 33 times the national average interest on balances. Therefore, it benefited from higher deposits and member spending levels in SoFi Monet, more excellent assets under monetization and robust growth with SoFi Credit Card send.

Source: SoFi Technologies

Valuation

Despite dropping by over 33%, SoFi Technologies trades at a forward price-earnings multiple of 71. In contrast, the median price-earnings ratio of the financial services sector is 9, implying the stock is trading at a premium relative to its peers.

However, it trades at a price-sales multiple of just 2.80, which is relatively cheap compared to its peers. For instance, RobinHood (NASDAQ:HOOD) trades at a ratio of 9.50, Upstart Holdings (NASDAQ:UPST) at 3.60 and Affirm Holdings (NASDAQ:AFRM) at 3.70.

Despite the premium valuation, SoFi Technologies continues to fire from all angles, supported by robust revenue and earnings growth. Revenue growth of more than 30% is a rate that justifies its high valuation compared to other banks.

Takeaway

SoFi has adeptly navigated the financial services landscape, shifting from student loan refinancing to personal lending amid the pandemic, which boosted its loan originations from $2.60 billion to $13.80 billion.

Despite a stock decline this year, SoFi offers a valuable opportunity for long-term investors due to its strategic shifts and robust fundamentals. With significant net income gains and expanding member and product base, SoFi is poised for a rebound, making the current market downturn a potentially overblown reaction to its long-term growth potential.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance