Social Networking Stocks Q1 Results: Benchmarking Meta (NASDAQ:META)

Wrapping up Q1 earnings, we look at the numbers and key takeaways for the social networking stocks, including Meta (NASDAQ:META) and its peers.

Businesses must meet their customers where they are, which over the past decade has come to mean on social networks. In 2020, users spent over 2.5 hours a day on social networks, a figure that has increased every year since measurement began. As a result, businesses continue to shift their advertising and marketing dollars online.

The 5 social networking stocks we track reported an ok Q1; on average, revenues beat analyst consensus estimates by 3.5%. while next quarter's revenue guidance was 1.3% above consensus. Stocks--especially those trading at higher multiples--had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, but social networking stocks have performed well, with the share prices up 18.3% on average since the previous earnings results.

Meta (NASDAQ:META)

Famously founded by Mark Zuckerberg in his Harvard dorm, Meta Platforms (NASDAQ:META) operates a collection of the largest social networks in the world - Facebook, Instagram, WhatsApp, and Messenger, along with its metaverse focused Reality Labs.

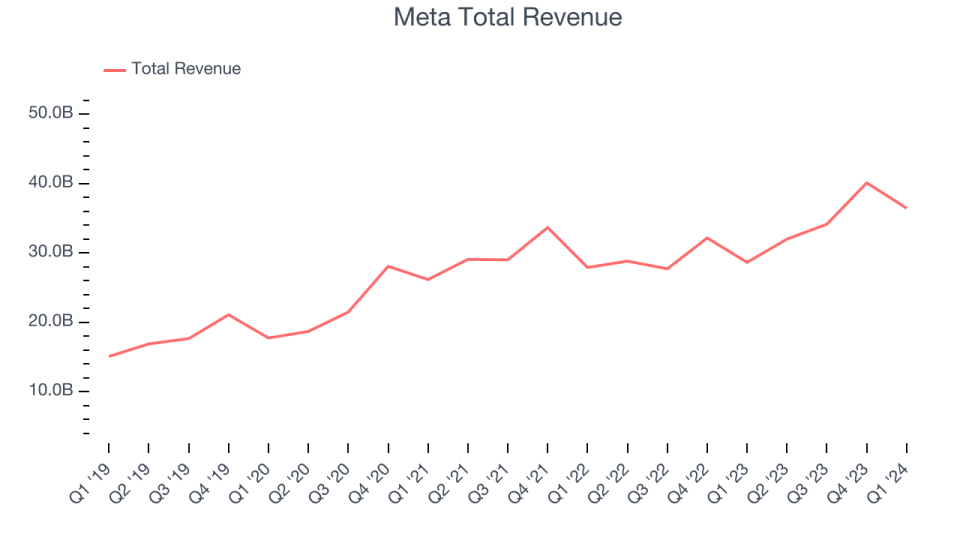

Meta reported revenues of $36.46 billion, up 27.3% year on year, in line with analysts' expectations. It was a decent quarter for the company: Meta delivered solid revenue, operating profit, and EPS growth, which beat analysts' estimates. On the other hand, its revenue guidance for next quarter missed analysts' expectations and it took up its forecasted operating expenses and capital expenditures for the full year. The increased costs are related to the company's AI infrastructure.

"It's been a good start to the year," said Mark Zuckerberg, Meta founder and CEO.

Meta scored the fastest revenue growth of the whole group. The stock is up 7.6% since reporting and currently trades at $531.23.

Is now the time to buy Meta? Access our full analysis of the earnings results here, it's free.

Best Q1: Snap (NYSE:SNAP)

Founded by Stanford University students Evan Spiegel, Reggie Brown, and Bobby Murphy, and originally called Picaboo, Snapchat (NYSE: SNAP) is an image centric social media network.

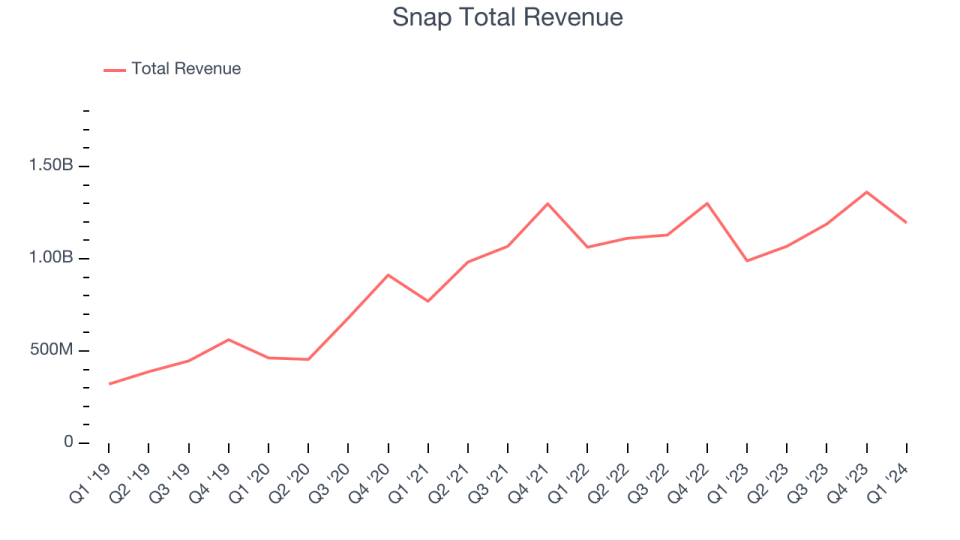

Snap reported revenues of $1.19 billion, up 20.9% year on year, outperforming analysts' expectations by 6.6%. It was a very good quarter for the company with strong sales guidance for the next quarter and solid growth in its users.

Snap delivered the biggest analyst estimates beat among its peers. The company reported 422 million daily active users, up 10.2% year on year. The market seems happy with the results as the stock is up 47.3% since reporting. It currently trades at $16.79.

Is now the time to buy Snap? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Yelp (NYSE:YELP)

Founded by PayPal alumni Jeremy Stoppelman and Russel Simmons, Yelp (NYSE:YELP) is an online platform that helps people discover local businesses through crowd-sourced reviews.

Yelp reported revenues of $332.8 million, up 6.5% year on year, in line with analysts' expectations. It was a weak quarter for the company with slow revenue growth.

Yelp had the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 8.1% since the results and currently trades at $36.43.

Read our full analysis of Yelp's results here.

Nextdoor (NYSE:KIND)

Helping residents figure out what's happening on their block in real time, Nextdoor (NYSE:KIND) is a social network that connects neighbors with each other and with local businesses.

Nextdoor reported revenues of $53.15 million, up 6.8% year on year, surpassing analysts' expectations by 4.6%. Looking more broadly, it was a decent quarter for the company with optimistic revenue guidance for the next quarter but slow revenue growth.

The company reported 43.4 million monthly active users, up 2.4% year on year. The stock is up 14.9% since reporting and currently trades at $2.59.

Read our full, actionable report on Nextdoor here, it's free.

Pinterest (NYSE:PINS)

Created with the idea of virtually replacing paper catalogues, Pinterest (NYSE: PINS) is an online image and social discovery platform.

Pinterest reported revenues of $740 million, up 22.8% year on year, surpassing analysts' expectations by 5.7%. Looking more broadly, it was a very good quarter for the company with strong sales guidance for the next quarter and solid growth in its users.

The company reported 518 million monthly active users, up 11.9% year on year. The stock is up 29.7% since reporting and currently trades at $43.4.

Read our full, actionable report on Pinterest here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance