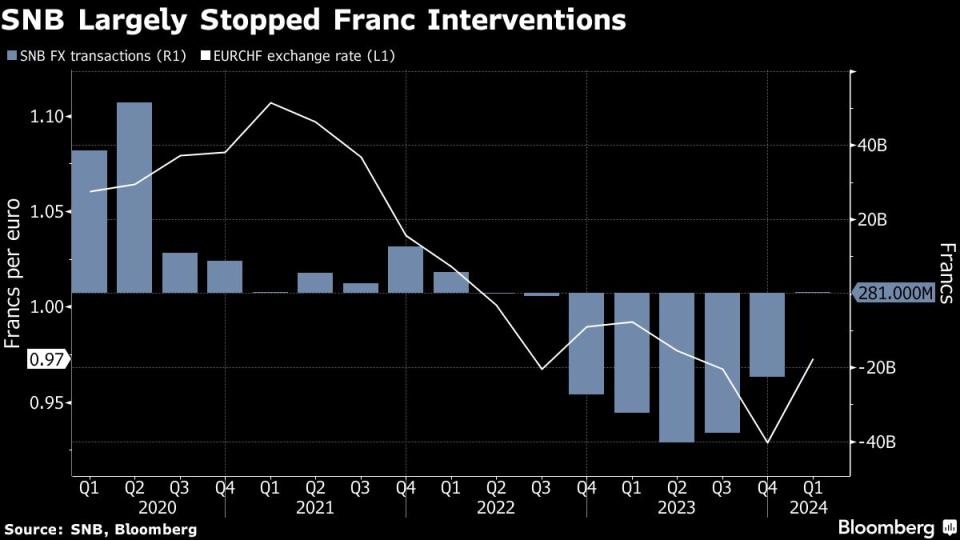

SNB Held Off on Interventions in First Quarter Amid Franc Slump

(Bloomberg) -- The Swiss National Bank largely refrained from interventions to influence the franc in the first quarter as it depreciated against the dollar and the euro.

Most Read from Bloomberg

Democrats Question Replacing Biden: Here’s How It Could Work

Biden Struggles as He Spars With Trump on Economy: Debate Takeaways

Supreme Court Overturns Chevron Rule in Blow to Agency Power

Switzerland’s central bank bought currencies worth just 281 million francs ($313 million) from January to March, after sales of 22.7 billion francs the previous quarter, it said on Friday.

This suggests that Swiss officials didn’t see much reason to steer the franc in either direction and instead were happy with the currency falling against major peers.

By selling foreign-exchange reserves and buying its own currency, the SNB in 2022 started to prop up the exchange rate and simultaneously reduced its large balance sheet. This stance allowed it to shield the Swiss economy from a global inflation surge.

Since then, officials seem to have lost their appetite for a stronger franc. This change was foreshadowed by an announcement late last year that interventions can now happen in both directions.

The franc lost some 7% against the dollar and some 5% against the euro during the first quarter, after it had hit its strongest level in nearly a decade against the common currency late last year.

The SNB publishes a tally of its transactions on a quarterly basis and with a three-month delay. Data for the period from April to June are due on Sept. 30.

--With assistance from Joel Rinneby and Kristian Siedenburg.

Most Read from Bloomberg Businessweek

The FBI’s Star Cooperator May Have Been Running New Scams All Along

Japan’s Tiny Kei-Trucks Have a Cult Following in the US, and Some States Are Pushing Back

RTO Mandates Are Killing the Euphoric Work-Life Balance Some Moms Found

How Glossier Turned a Viral Moment for ‘You’ Perfume Into a Lasting Business

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance