Snap (SNAP) to Report Q4 Earnings: What's in the Cards?

Snap SNAP is set to report fourth-quarter 2019 results on Feb 4.

For the quarter, the company expects revenues between $540 million and $560 million. The Zacks Consensus Estimate for revenues is currently pegged at $560.4 million, which indicates growth of 43.8% from the year-ago quarter’s reported figure.

Notably, in the last reported quarter, Snap’s subscriber growth reflected by Daily Active Users (DAUs) increased 7 million sequentially to 210 million. DAUs are expected between 214 million and 215 million, up 4-5 million sequentially for the fourth quarter.

The Zacks Consensus Estimate for DAUs is currently pegged at 215 million.

Meanwhile, the consensus mark is pegged at break-even for the past 30 days.

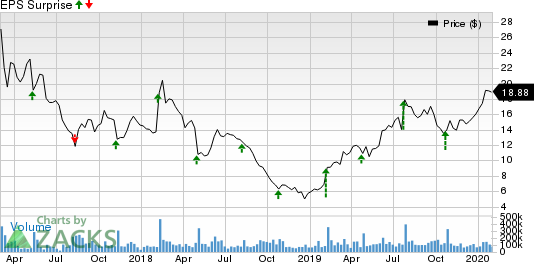

Snap Inc. Price and EPS Surprise

Snap Inc. price-eps-surprise | Snap Inc. Quote

The company beat the Zacks Consensus Estimate in the trailing four quarters, with average positive earnings surprise of 31.7%.

Let’s see how things are shaping up for the upcoming announcement.

Factors to Influence Results

Snap’s focus on continuously adding innovative features, like Lens Studio 2.0, is making the Snapchat platform more attractive for users and advertisers.

Moreover, the successful rollout of the Android app of Snapchat (in April 2019) is likely to have continued to draw more users to the platform in the fourth quarter.

Further, the growing adoption of the platform among the millennials and the Gen Z is expected to have driven DAUs and in turn, the top line in the to-be-reported quarter. Additionally, ARPU improved 32.5% year over year in the third quarter, a trend that most likely continued in the fourth quarter.

The launch of Snap Games, Tab feature on Friends, the expansion of its Discover platform and the addition of several AR features are also likely to have boosted user engagement in the quarter.

Further, the growing popularity of original shows — Snap’s three-five-minute premium episodes that are vertically shot and quickly paced — is expected to have driven user engagement in the to-be-reported quarter.

Notably, Snap expanded its original content portfolio with the announcement of new shows — Tekashi69 VS The World, Nikita Unfiltered, The Honeybeez, Driven, Mind Yourself, Everything’s Fine, Players and Save Me — in the third quarter. The company also renewed shows like Bringing Up Bhabie by Invent TV, Two Sides by New Form and Kappa Crypto.

Moreover, the company unveiled Duck Duck by Harmony Korine, an experimental short film shot using Spectacles 3, to explore storytelling in 3D. Spectacles 3 is built with a strong, lightweight steel frame and circular lenses, and has two HD cameras on either side of the frame.

Snap also introduced Cameos, which are looping videos a user can send to friends in Chat, during the quarter.

However, a persistent decline in price per ad impression, which was down 6% sequentially in the last reported quarter, is likely to have negatively impacted advertising revenues in the fourth quarter. Notably, advertising is Snap’s only source of revenues and the company faces significant competition from the likes of Facebook FB, Google and Pinterest for ad dollars.

Per App Annie data, Snapchat trails Facebook’s Messenger, WhatsApp and Instagram as the most downloaded app of the last decade.

Moreover, increasing infrastructure costs and higher investments in content, sales and marketing are lingering overhangs on profitability. Hence, the fourth-quarter bottom line is expected to reflect the negative impact of rising expenses.

What Our Model Says

According to the proven Zacks model, a company with a positive Earnings ESP along with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) has a good chance of beating estimates. But that’s not the case here.

Snap has an Earnings ESP of 0.00% and a Zacks Rank #3. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks That Warrant a Look

Here are a couple of stocks you may want to consider, as our model shows that these have the right combination of elements to deliver an earnings beat.

Advanced Energy Industries AEIS has an Earnings ESP of +10.80% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Perion Network Ltd PERI has an Earnings ESP of +22.58% and a Zacks Rank #1.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Perion Network Ltd (PERI) : Free Stock Analysis Report

Facebook, Inc. (FB) : Free Stock Analysis Report

Snap Inc. (SNAP) : Free Stock Analysis Report

Advanced Energy Industries, Inc. (AEIS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance