Smart Money Clues: Buy these 5 Stocks

Preview: Today, we will discuss the catalysts and the “smart money” buying the MSCI Argentina ETF (ARGT), Russell 2000 Index ETF (IWM), iShares Bitcoin Trust ETF (IBIT), Alibaba (BABA), and JD.com (JD).

Follow the Smart Money

On Wall Street, a plethora of distractions exist. There are the talking heads on financial television, news items flashing across trading platforms, and an investor’s own psychology to contend with. For these reasons, investors should develop their own system, optimize the system, and look to block out as much noise as possible. That said, there is no need to completely “reinvent the wheel” either. Investors can gain valuable insights from insiders and the world’s most profitable traders to gain even further conviction. Below are two ways to follow the “smart money.”

1) Watch 13F Filings

A 13F filing is a quarterly report that institutional money managers with $100 million in assets under management (AUM) must file with the U.S. Securities and Exchange Commission (SEC) within 15 days of the end of the quarter. Though everyday investors won’t get to buy at the exact time the smart money does, they can gain a valuable look into the reasoning behind these trades and understand the investor’s conviction based on how large a portion of the portfolio it takes up.

2) Look at Insider Buys

Investors can also gain an edge by watching for insider buying. However, investors need to understand that insider buying tends to have a more significant weight than insider selling, all else equal. That’s because insider selling is often planned or scheduled in advance, while insiders only buy for one reason – they believe the stock will go up.

Stanley Druckenmiller: Argentina & U.S. Small Caps

George Soros prodigy Stanley Druckenmiller is best known for his thirty-year track record as an institutional investor in which he never lost money in a calendar year. Druckenmiller’s consistency, ability to anticipate, and knowledge across asset classes separate him from almost any investor. The seasoned veteran is coming off one of his best quarterly performances ever after catching the move in chip leader Nvidia (NVDA).

Argentina Thesis: A New Free Market Government

In a recent CNBC interview, Druckenmiller revealed that he was inspired to invest in Argentina after witnessing new Argentine President Javier Milei speak on TV about his free-market policy ideas at the Davos conference. Druckenmiller revealed that he used AI to look for the top five Argentine ADRs and immediately invested in them. Druckenmiller is betting that after years of socialism, free market policies will drive Argentinian stocks higher.

ARGT ETF: Strength Begets Strength

The ARGT ETF offers a basket of Argentine stocks for U.S. retail investors and a way to piggyback on Druckenmiller’s thesis. ARGT is exhibiting relative strength versus the rest of the world, gaining some 23% year-to-date.

Small Caps: Reversion to the Mean?

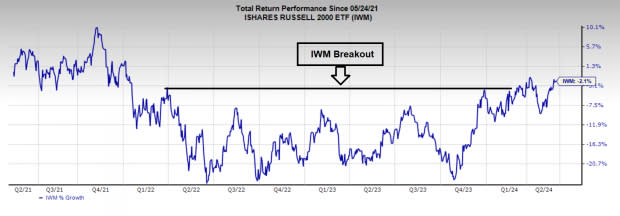

Druckenmiller’s new largest position is a call options play in the Russell 2000 Index ETF (IWM).

Catalyst: Lower Interest Rates

Higher interest rates have acted as the proverbial “pebble in the shoe” for small-cap investors. However, the odds of interest rate cuts late in 2024 have recently increased as inflation numbers have cooled. After underperforming for years, do small caps finally revert to the mean? The chart suggests that the answer is yes. IWM is knocking on the door of a singifcant technical breakout. As the old Wall Street adage goes, “The longer the base, the higher in space.”

Image Source: Zacks Investment Research

Spot Bitcoin ETFs Spark Institutional Adoption

Early this year, the landmark approval of several spot Bitcoin ETFs sparked hope that big institutions would begin to adopt the world’s largest cryptocurrency. After the recent batch of 13F disclosures came through, the result of the BTC ETFs is clear. More than 600 institutions disclosed positions in Bitcoin ETFs, such as IBIT (which we own). Meanwhile, Bitcoin stands to benefit from several tailwinds, such as the “halving.”

Michael Burry & David Tepper: Bold and Often Correct

Michael Burry and David Tepper are best known for their large contrarian bets, which are often proven correct. Burry rose to fame after correctly predicting and shorting the market during the Global Financial Crisis of 2008. Christian Bale played him in the movie “The Wolf of Wall Street.” After the smoke cleared from the GFC, David Tepper made monster investments in banks like Bank of America (BAC), betting the government would deem them “too big to fail” (he was correct). Tepper ended up making billions and enough to buy the Carolina Panthers.

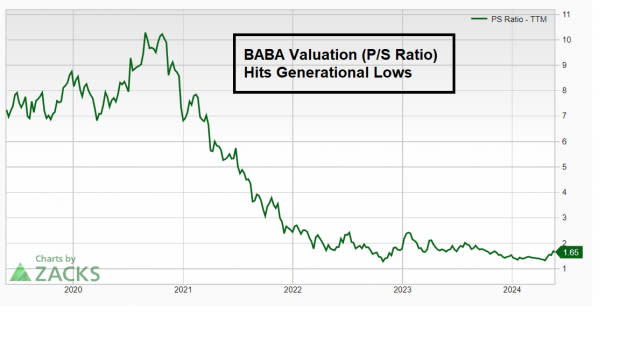

China and Alibaba (BABA): A Contrarian Bet

Burry and Tepper are betting on a turnaround in China, specifically in the e-commerce space. Burry’s largest position is JD.com (JD) and his second-largest is Alibaba (BABA). Tepper’s largest open position is BABA. BABA, in particular, is interesting because insiders like Founder and CEO Jack Ma have purchased more than $100 million in BABA stock. Meanwhile, the company has a bargain basement valuation.

Image Source: Zacks Investment Research

Bottom Line

This quarter’s 13Fs and insider buys offer vital clues about what the smart money is betting on. Argentina, small caps, Bitcoin, and China are essential market areas to track.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bank of America Corporation (BAC) : Free Stock Analysis Report

iShares Russell 2000 ETF (IWM): ETF Research Reports

JD.com, Inc. (JD) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

Global X MSCI Argentina ETF (ARGT): ETF Research Reports

iShares Bitcoin Trust (IBIT): ETF Research Reports

Yahoo Finance

Yahoo Finance