Smart Investors Are Buying and Holding These 2 Supercharged Stocks

Written by Kay Ng at The Motley Fool Canada

Smart investors could do well by buying and holding these two supercharged stocks that are capital-light businesses.

Dye & Durham: Diamond in the rough?

Through its cloud-based platform, Dye & Durham (TSX:DND) allows legal and business professionals to access public records in real time, thereby improving their efficiency and productivity. It operates in Canada, the U.K., Ireland, and Australia, and serves law firms, financial service institutions, and government organizations. The tech stock has fallen drastically by two-thirds in the last year.

Dye & Durham could be a diamond in the rough, though. It has increased its operating cash flow over time, including a 133% increase to $185.4 million in fiscal 2022 — growth that was supported from the acquisition of the TELUS Financial Solutions Business. This translated to free cash flow of $161.6 million.

Management certainly thinks the stock is cheap. First, the company announced that it would repurchase and cancel up to 5% of its outstanding shares over the next 12 months from September 22. The shares would be worth just under $47.7 million if all bought at the current quotation of $13.79 per share. On top of this, this month, Dye & Durham also announced a substantial issuer bid to repurchase from shareholders up to $150 million worth of shares (between $12.50 and $15 per share) for cancellation.

Based on the consensus price target of $23.90 across five analysts, the undervalued stock can potentially appreciate 73% over the next 12 months. In summary, DND stock can be supercharged from continued strong cash flow generation, valuation expansion, and potentially from a drop in interest rates when inflation is under control again.

What’s the risk? Unfortunately, the company has increased its debt levels in a higher interest rate environment. In fiscal 2021, its debt-to-equity ratio was 1.1 times. In the last reported quarter, it was two times.

For a surer investment in a tech stock, smart investors can consider Constellation Software (TSX:CSU).

Constellation Software creates shareholder value

Constellation Software is a well-established multi-billion-dollar tech company. It is an even more capital-light business than Dye & Durham, whose trailing-12-month (TTM) capital spending was 12.4% of its operating cash flow. Constellation Software’s was only 3%.

Where does Constellation Software’s free cash flow go? In the TTM, about 10% went into debt repayment and dividends, respectively. Its core focus is allocating capital strategically in acquisitions. Indeed, in a higher interest rate environment, tech company valuations have been compressed and the company was able to place an outsized amount of cash of US$2.05 billion (3.5 times that of 2020) into attractive acquisitions.

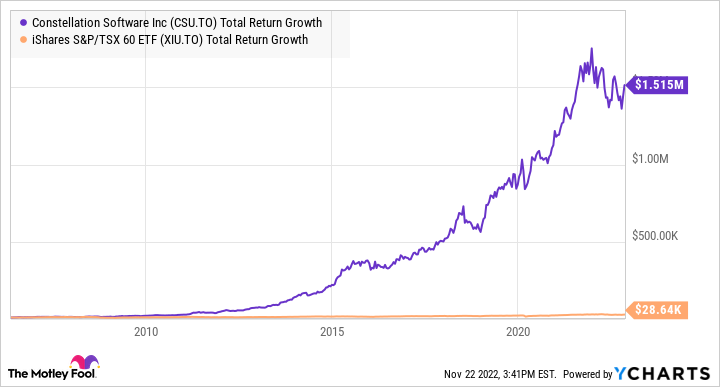

Importantly, Constellation Software has a proven track record of delivering long-term shareholder value. Its five-year return on assets, return on invested capital, and return on equity are 10%, 27%, and 47%, respectively. The very long-term wealth creation it provided investors has been astounding, turning some loyal investors into millionaires!

CSU vs XIU Total Return Level from $10,000 data by YCharts

Seven analysts believe the tech stock is discounted by 16% at $2,064 per share. The fact that the company is much larger than it was 15 years ago would likely dampen its growth rate versus its historical levels. So, although its long-term returns will likely be solid, they’ll probably be lower than they were in the past.

The post Smart Investors Are Buying and Holding These 2 Supercharged Stocks appeared first on The Motley Fool Canada.

Should You Invest $1,000 In Constellation Software?

Before you consider Constellation Software, you'll want to hear this.

Our market-beating analyst team just revealed what they believe are the 5 best stocks for investors to buy in November 2022 ... and Constellation Software wasn't on the list.

The online investing service they've run for nearly a decade, Motley Fool Stock Advisor Canada, is beating the TSX by 15 percentage points. And right now, they think there are 5 stocks that are better buys.

See the 5 Stocks * Returns as of 11/4/22

More reading

4 TSX Dividend Stocks Offering Big Income in a Bearish Market

Just Released: The 5 Best Stocks to Buy in November 2022 [PREMIUM PICKS]

The 3 Best Dividend Stocks to Buy in November 2022 [PREMIUM PICKS]

Fool contributor Kay Ng has no position in any of the stocks mentioned. The Motley Fool recommends Constellation Software. The Motley Fool has a disclosure policy.

2022

Yahoo Finance

Yahoo Finance