Small Cap Summer: 3 Top Ranked Stocks to Buy Now

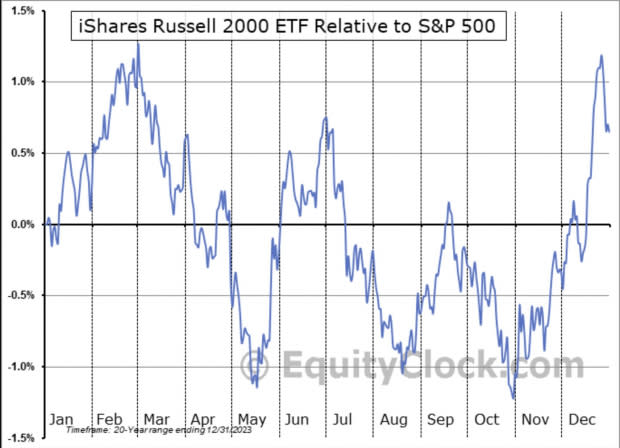

The underperformance of the Russell 2000 Small-Cap Index relative to the rest of the market has been weighing on investors’ minds for the better part of a year now. While some think the index is destined for long-term underperformance, others think that it will play catchup sometime this year.

Although nothing is certain, I do think there will be some sort of convergence between the performance of the S&P 500 and the Russell 2000 in the near future.

Bullish Catalysts for Small-Cap Stocks

While persistently elevated interest rates over the last two years have held down small caps, there is a light at the end of the tunnel. Although it has been pushed a few months down the road, interest rate cuts are expected to come before the year end, which should be a spark for small caps.

Additionally, there are some seasonal factors that also lend to the possibility of a convergence in performance. Below we can see that the period from mid-May to the end of June is marked by strong relative outperformance for the Russell 2000 vs the S&P 500.

Finally, legendary hedge fund manager Stanley Druckenmiller seems to also like the small-cap trade, as he has elevated the position to the largest in his equity portfolio.

Because of the potential for small-cap stocks in the coming months, I have picked three such stocks that I believe will rally going forward. PubMatic PUBM, MoneyLion ML, and Universal Technical Institute UTI all enjoy strong growth and top Zacks Ranks among other bullish characteristics.

Image Source: EquityClock

MoneyLion Posts Record Revenue

MoneyLion ML is a financial technology company headquartered in New York City that offers a comprehensive suite of financial products and services through its mobile app. Founded in 2013, MoneyLion provides banking, lending, investment and credit-building solutions designed to help users manage their finances and improve their financial health.

The platform features tools like personalized financial advice, budgeting assistance, and cashback rewards, aiming to empower consumers with greater financial control and accessibility. The company makes money through its loan business, lead generation for other services and monthly subscription service.

At its most recent quarterly earnings meeting, MoneyLion brought in record revenue of $121 million, showing a 29% YoY increase. The company also expanded margins by 480 basis points and grew total customers to 15.5 million, a 98% YoY increase.

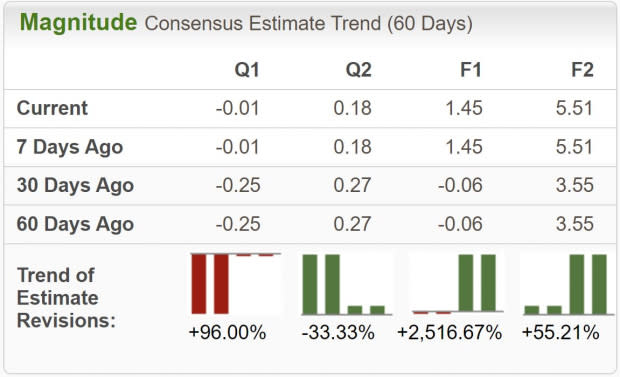

These stellar results have prompted analysts to raise earnings estimates, giving MoneyLion a Zacks Rank #1 (Strong Buy) rating.

Although there was a downgrade in next quarter’s earnings estimates, all other timeframes have seen significant increases, with this year’s earnings estimate climbing 2,500% in the last month.

Also notable is the flip to net profitability, which is of course a very welcome development.

Image Source: Zacks Investment Research

In addition to momentum in sales growth, which is expected to increase 20% this year and next year, the stock price is also experiencing significant momentum. In the chart below we can see that ML stock just broke out to new YTD and two-year highs.

Image Source: TradingView

MoneyLion is trading at just 18x FY25 earnings, which seems like a reasonable valuation for a company growing at its pace.

PubMatic: Strong Earnings Estimates

PubMatic PUBM is a leading digital advertising technology company headquartered in Redwood City, California. Founded in 2006, PubMatic provides a cloud-based platform that enables publishers to maximize their ad revenue through real-time programmatic advertising solutions.

The platform offers advanced tools for managing, optimizing and analyzing ad inventory, ensuring that publishers can effectively monetize their content across various digital channels, including mobile, video and display. By facilitating efficient and transparent transactions between advertisers and publishers, PubMatic plays a crucial role in the digital advertising ecosystem.

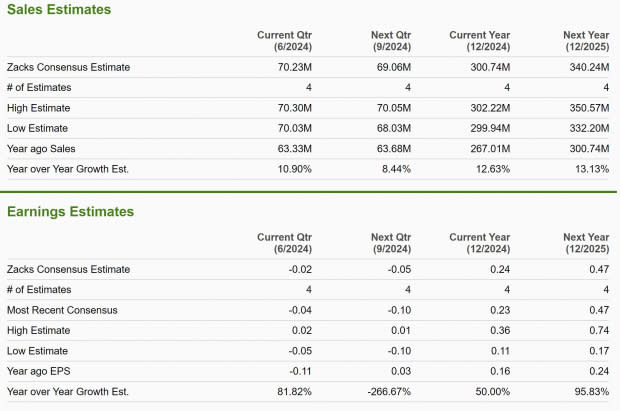

Because PubMatic sits in the rapidly expanding digital advertising industry, it enjoys sales growth in the teens, and profit growth much higher than that thanks to improving business fundamentals.

Analysts have also taken a favorable view on PUBM, as they have upgraded FY24 earnings estimates by 41% and FY25 earnings estimates by 34%, giving it a Zacks Rank #1 (Strong Buy) rating.

Image Source: Zacks Investment Research

PubMatic has also been benefiting from some considerable momentum, driving the stock nearly 50% higher YTD. That momentum looks like it may carry the stock even further, as this technical bull consolidation indicates a breakout should instigate another leg higher.

Image Source: TradingView

Universal Technical Institute: Stock Up 25% YTD

Universal Technical Institute UTI is a prominent provider of post-secondary education focused on training students for careers in the automotive, diesel, collision repair, motorcycle, and marine industries. UTI operates campuses across the US, offering hands-on training programs that combine classroom instruction with real-world experience.

Established in 1965, the institute collaborates with leading industry manufacturers to ensure its curriculum is aligned with current industry standards and technologies. UTI aims to equip students with the skills and knowledge necessary for successful technical careers, emphasizing practical training and industry partnerships.

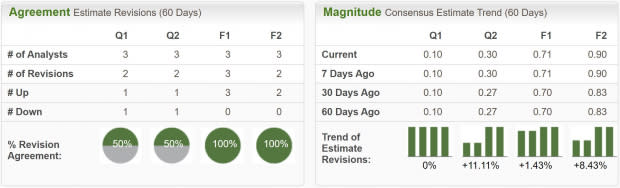

Reflecting some steady increases in its earnings estimates, Universal Technical Institute boasts a Zacks Rank #2 (Buy) rating.

UTI also sits in the Top 13% (33 out of 250) of the Zacks Industry Rank, and is expected to beat next quarter’s earnings estimates by 13.8% based on the Zacks ESP.

Image Source: Zacks Investment Research

Like the others, Universal Technical Institute has enjoyed some strong relative performance and momentum. The stock is already up 25% YTD, and if it can hold this $14 level of support, should continue to see higher prices.

UTI is trading at a one year forward earnings multiple of 21.5x, which is well below its 10-year median of 29.2x.

Image Source: TradingView

Stanley Druckenmiller Likes this Trade, too

According to the most recent 13f report, which discloses the stock holdings of money managers with more than $100 million, Druckenmiller’s firm Duquesne Family Office added a huge new position in the last quarter.

The report says that Russell 2000 ETF IWM call options are currently the largest position in Stan Druckenmiller’s equity portfolio, making up 15% of the total holdings. Although I had the idea before consulting with one of the macro trading greats, I was extremely encouraged by his huge position.

However, I should note that these 13f reports only share the long holdings of a portfolio and none of the shorts, so it is unclear if this is a naked long position or one leg of a long/short trade.

Thus, I don’t think the trade should be followed exclusively because Stanley Druckenmiller holds it, additionally, we don’t know which strikes or at what price he bought the options.

Bottom Line

Based on the shifting interest rate policy expectations and seasonal factors, I tend to think we may finally see the Russell 2000 catch up to the rest of the market.

But to improve the odds of making money even further I have selected three stocks with strong price momentum, top Zacks Ranks, and robust business fundamentals.

For investors who like the idea of small cap investing, MoneyLion, PubMatic and Universal Technical Institute may be worthy additions to your portfolios.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Universal Technical Institute Inc (UTI) : Free Stock Analysis Report

iShares Russell 2000 ETF (IWM): ETF Research Reports

MoneyLion Inc. (ML) : Free Stock Analysis Report

PubMatic, Inc. (PUBM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance