SM Energy (SM) Q1 Earnings Top Estimates, Revenues Decline Y/Y

SM Energy Company SM reported first-quarter 2024 adjusted earnings of $1.41 per share, which surpassed the Zacks Consensus Estimate of $1.28. The bottom line also increased from the year-ago quarter’s figure of $1.33.

Total quarterly revenues of $559.9 million declined from $573.5 million in the year-ago quarter and missed the Zacks Consensus Estimate of $568 million.

Strong quarterly earnings resulted from declining hydrocarbon production expenses.

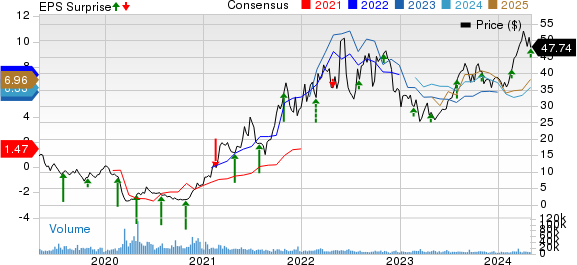

SM Energy Company Price, Consensus and EPS Surprise

SM Energy Company price-consensus-eps-surprise-chart | SM Energy Company Quote

Operational Performance

Production

SM Energy’s first-quarter production totaled 145.1 thousand barrels of oil equivalent per day (MBoe/d) (almost 44% oil), down 1% from the year-ago level of 146.4 MBoe/d. The Zacks Consensus Estimate for the same was pinned at 145 MBoe/d.

Oil production increased 1% year over year to 63.7 thousand barrels per day (MBbls/d). The figure marginally surpassed the Zacks Consensus Estimate of 63 MBbls/d.

The company produced 342.3 million cubic feet per day of natural gas in the quarter, down 4% year over year. Natural gas liquids contributed 24.4 MBbls/d to the total production volume, which jumped 2% on a year-over-year basis.

Realized Prices

Before the effects of derivative settlements, the average realized price per Boe was $42.39 compared with $43.31 in the year-ago quarter. The average realized oil price jumped 2% to $76.09 per barrel. The Zacks Consensus Estimate for the same was pegged at $76 per barrel.

The average realized price of natural gas declined 25% year over year to $2.18 per thousand cubic feet, while that for natural gas liquids fell 13% to $22.94 per barrel.

Costs & Expenses

On the cost front, unit lease operating expenses increased 7% year over year to $5.54 per Boe. General and administrative expenses increased 9% to $2.29 per Boe from the prior-year level of $2.10. Transportation expenses slipped 26% to $2.07 per Boe.

Total hydrocarbon production expenses in the quarter were $137.4 million compared with the year-ago level of $142.3 million. Total exploration expenses were $18.6 million, higher than the year-ago figure of $18.4 million.

Capex

The capital expenditure in the March-end quarter totaled $332.4 million. Adjusted free cash flow amounted to $67.9 million.

Balance Sheet

As of Mar 31, 2024, SM Energy had cash and cash equivalents of $506.3 million, and a net debt of $1.08 billion.

Guidance

For the second quarter of 2024, SM Energy projects production in the band of 14.1-14.3 MMBoe. Of the total production, oil will probably contribute 44%. Capital expenditures (net of the change in capital accruals), excluding acquisitions,is estimated to be in the $315-$325 million range for the same time frame.

For full-year 2024, the company anticipates net production volumes in the range of 57-60 million barrels of oil equivalent (MMBoe), with oil accounting for 44% of the total figure. This projection implies a 3-4% year-over-year increase in production. The full-year capital expenditure guidance, excluding acquisitions and accounting for the change in capital accruals, is adjusted downward by 2% at the midpoint to a range of $1.14-$1.18 billion.

Zacks Rank & Other Stocks to Consider

Currently, SM Energy carries a Zacks Rank #1 (Strong Buy).

Investors interested in the energy sector may look at some other top-ranked stocks like Hess Corporation HES, EOG Resources Inc. EOG and Valero Energy Corporation VLO. While Hess sports a Zacks Rank #1 (Strong Buy), EOG Resources and Valero Energy carry a Zacks Rank #2 (Buy) each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Hess operates primarily in two areas — the Bakken shale and the Stabroek project offshore Guyana. It is currently in the process of being acquired by supermajor Chevron in an all-stock deal worth $53 billion. HES currently has a Growth Score of B.

The Zacks Consensus Estimate for 2024 and 2025 EPS is pegged at $9.17 and $11.08, respectively. The company has witnessed upward earnings estimate revisions for 2024 in the past seven days.

EOG Resources, an oil and gas exploration company, boasts attractive growth prospects, top-tier returns, and a disciplined management team, leveraging highly productive acreages in prime oil shale plays like the Permian and Eagle Ford.

The Zacks Consensus Estimate for EOG’s 2024 EPS is pegged at $12.14. The company has a Zacks Style Score of B for Value and A for Momentum. It has witnessed upward earnings estimate revisions for 2024 in the past 30 days.

Valero Energy is a premier refining player with a presence across North America and the Caribbean. Its diverse network favors robust refining margins, utilizing cost-effective crude for more than half of its needs.

The Zacks Consensus Estimate for VLO’s 2024 EPS is pegged at $18.11. The company has a Zacks Style Score of A for Value. It has witnessed upward earnings estimate revisions for 2025 in the past seven days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hess Corporation (HES) : Free Stock Analysis Report

Valero Energy Corporation (VLO) : Free Stock Analysis Report

EOG Resources, Inc. (EOG) : Free Stock Analysis Report

SM Energy Company (SM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance