Slumping Freight Rates Telegraph Warning on Asian Crude Demand

(Bloomberg) -- The cost of shipping crude oil along key routes to Asia is slumping as supertankers take shorter trips and demand softens in China.

Most Read from Bloomberg

Microsoft Orders China Staff to Use iPhones for Work and Drop Android

Biden’s Biggest Donors Left Powerless to Sway Him to End Bid

Saudis Warned G-7 Against Russia Seizures With Debt Sale Threat

Zyn Imitators Rush In as Online Sales Halt Worsens US Shortage

Rich Chinese Return to Hong Kong as Singapore Steps Up Scrutiny

Freight rates for a Very Large Crude Carrier from the US to the key Asian market tumbled more than 20% since late May, while earnings on the benchmark Middle East-to-China route sank 57% in the same period, Baltic Exchange data show. Each vessel can haul a cargo totaling about 2 million barrels.

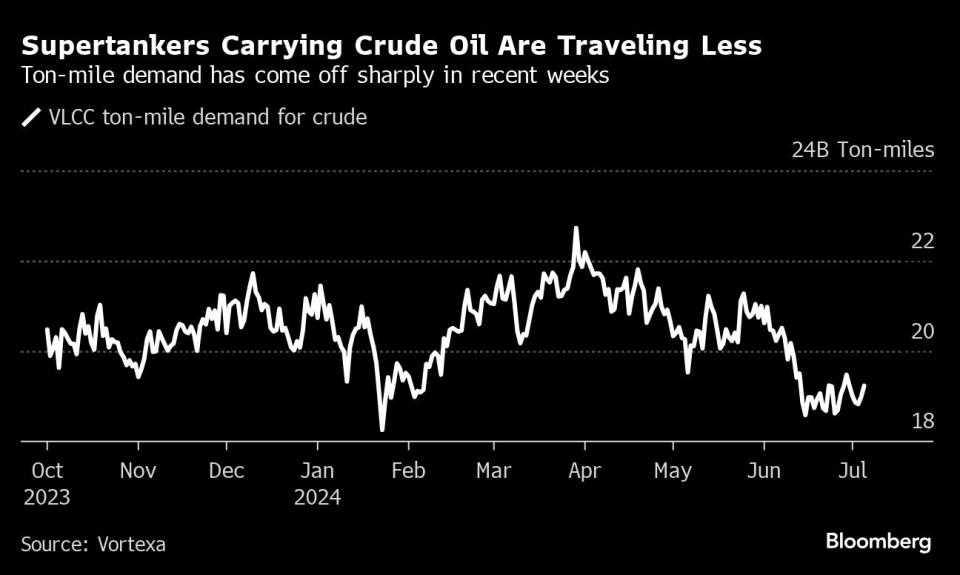

The softness comes as demand for VLCCs has fallen in recent weeks, with an industry gauge known as ton-miles dropping sharply, according to data analytics firm Vortexa Ltd. The measure multiplies cargo by how far it is transported, giving a sense of how heavily used the global shipping fleet is.

Cheaper shipping costs for the world’s most important commodity pose a challenge for tanker operators, who’ve already been forced this year to deal with the fallout from Houthi attacks on vessels in Red Sea that forced substantial rerouting and a surge in congestion at some key Asian ports. The drop may also be a significant signal for the crude market given that it flags softer consumption in China, the world’s largest oil importer.

“VLCC freight rates have come under immense pressure in recent months due to lackluster crude imports from Northeast Asia, particularly China,” said Serena Huang, lead Asia analyst at Vortexa. Deliveries of newly-built supertankers over the past two years have also led to a glut of supply, she added.

China’s oil demand may have weakened in recent months, with a slower-than-forecast return of some refineries from seasonal maintenance, as well as reduced purchases from key suppliers. Reflecting that shift, the number of supertankers headed to China has fallen to the lowest in nearly two years.

On a global basis, supertankers are also traveling fewer long-distance voyages, with transits from the US and Brazil to Asia declining 10% and 52%, respectively, on-month in June, according to data intelligence company Kpler. In addition, cargoes shipped from Saudi Arabia, the top crude exporter, tumbled last month to the lowest since 2015.

Read also: Global Oil Outlook Faces Test as Softness in China Surfaces

The lower demand for supertankers has so far prompted at least three VLCCs to switch from loadings of crude oil to diesel for transit to Europe, according to Kpler.

Separately, Goldman Sach Group Inc. forecast that disruptions from the Houthi attacks in the Red Sea may ease, allowing more vessels to be available and hurting freight rates. In turn, the cheaper freight may give Brent-linked crude prices a boost relative to the Middle Eastern marker Dubai, it said in a note.

Most Read from Bloomberg Businessweek

At SpaceX, Elon Musk’s Own Brand of Cancel Culture Is Thriving

How Stocks Became the Game That Record Numbers of Americans Are Playing

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance