Will Slowing Services Growth Hurt Apple's (AAPL) Q2 Earnings?

Apple’s AAPL second-quarter fiscal 2023 results, to be reported on May 4, are expected to reflect the impacts of the sluggishness in the Services business.

The segment, which includes revenues from the App Store, Apple Music, iCloud, Apple Arcade, Apple TV+, Apple News+ and Apple Card, accounted for 17.7% of sales in first-quarter fiscal 2023.

Although Apple’s business primarily runs around its flagship iPhone, the Services portfolio has emerged as the company’s new cash cow.

Apple currently has more than 935 million paid subscribers across its Services portfolio. The App Store has been continuing to draw the attention of prominent developers from around the world, helping the company offer appealing apps to drive the App Store traffic, thereby expanding the subscriber base.

The company expected Services revenue growth to be negatively impacted by challenging macroeconomic conditions, unfavorable forex, as well as weakness in digital advertising and gaming. Services revenues grew 6.4% year over year to $20.77 billion in the fiscal first quarter.

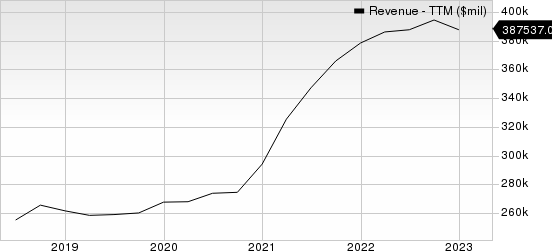

Apple Inc. Revenue (TTM)

Apple Inc. revenue-ttm | Apple Inc. Quote

Click here to know how Apple’s overall fiscal second-quarter results are likely to be.

Apple’s Non-iPhone Revenues to Decline in Q2

Apple’s non-iPhone portfolio, which comprises Mac, iPad and Wearables, is expected to have declined in the fiscal second quarter.

This Zacks Rank #3 (Hold) company expects Mac and iPad revenues to decline in the double digits on a year-over-year basis due to challenging comparisons and macroeconomic headwinds. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Mac revenues are expected to have suffered from weak PC demand. Per Gartner’s latest report, 55.2 million PCs were shipped in the first quarter (March-end) of 2023, down 30% from the year-ago period. Shipments from Lenovo LNVGY, HP HPQ and Dell Technologies DELL declined 30.2%, 24.2% and 30.9%, respectively. Apple witnessed a 34.2% decline, worse than Lenovo, HP and Dell’s figures.

Overall, Lenovo remained the top vendor, with a market share of 23.3%. HP holds the second spot, with a market share of 21.8% in worldwide PC shipments. Dell’s market share was 17.3% in the first quarter of 2023.

Apple’s market share decreased from 9.3% in first-quarter 2022 to 8.7% in first-quarter 2023.

The Zacks Consensus Estimate for Mac revenues for the fiscal second quarter is pegged at $8.03 billion, implying a 23% decline from the figure reported in the year-ago quarter.

Moreover, the Zacks Consensus Estimate for iPad is pegged at $6.72 billion, suggesting a 12.1% decline from the figure reported in the year-ago quarter.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

HP Inc. (HPQ) : Free Stock Analysis Report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

Lenovo Group Ltd. (LNVGY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance