SLM Corp (SLM) Exceeds Analysts' Q1 Earnings Expectations with Strong Financial Performance

GAAP Diluted Earnings Per Common Share: $1.27, surpassing the estimated $1.07.

Net Income: $285M for Q1 2024, exceeding estimates of $230.72M.

Revenue: Generated $387M in net interest income, aligning closely with the estimated revenue of $387.89M.

Private Education Loan Originations: Reported a 6% growth from the previous year.

Loan Sale Gains: Achieved $143M from the sale of private education loans during the quarter.

Provision for Credit Losses: $12M, significantly reduced from $113M in Q1 2023, reflecting improved credit performance.

Share Repurchase: Repurchased 1.3M shares for $27M under the 2024 Share Repurchase Program, with $623M capacity remaining as of March 31, 2024.

On April 24, 2024, SLM Corp (NASDAQ:SLM), the nation's premier student lending corporation, disclosed its first-quarter financial outcomes for the year, revealing a notable performance that surpassed analyst projections. The detailed earnings report can be accessed through SLM Corp's 8-K filing.

SLM Corp, known widely as Sallie Mae, operates primarily in the private student lending sector. The company not only facilitates educational loans but also manages debt through collection services and runs college savings programs. This quarter, SLM reported a GAAP diluted earnings per common share of $1.27, significantly higher than the estimated $1.07, showcasing a robust financial stance.

Quarterly Financial Highlights

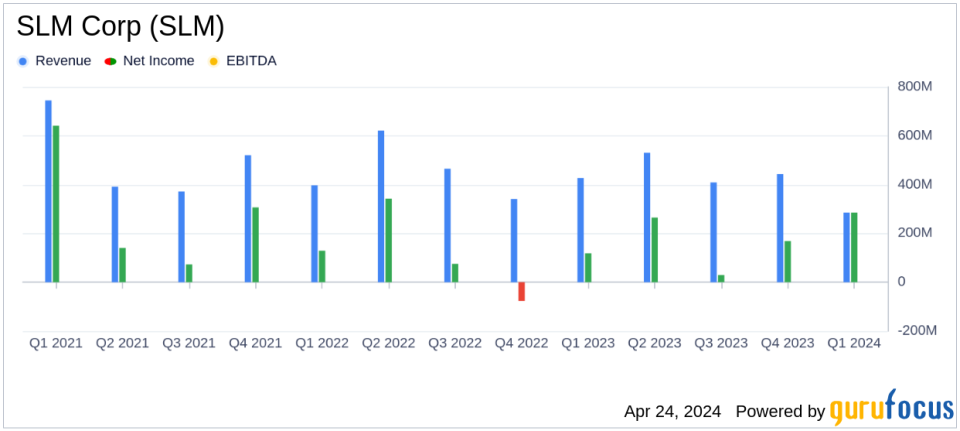

The company's net income for the quarter stood impressively at $285 million, a substantial increase from the previous year's $114 million. This growth is attributed to a strategic execution that includes a $2.1 billion sale of private education loans. The net interest income was reported at $387 million, aligning perfectly with analyst expectations. Moreover, SLM Corp demonstrated a solid credit performance, with total net charge-offs amounting to $83 million, or 2.14% of average loans in repayment (annualized).

Jonathan Witter, CEO of Sallie Mae, commented on the quarter's achievements, stating,

We are off to a solid start in 2024 executing our strategy, delivering strong results, and returning value to our shareholders through our loan sale and share repurchase program. We are encouraged by credit performance trends, and believe we have momentum for continued positive performance throughout the rest of the year."

Operational and Financial Metrics

The company's operational efficiency is reflected in its reduced non-interest expenses, which totaled $162 million, down from $202 million in the previous quarter. The private education loan portfolio showed a slight decrease of 1% year-over-year, settling at $21.4 billion. Despite these challenges, the company maintained a stable hardship forbearance level at 1.0%, and delinquencies decreased from 3.1% to 2.7%.

SLM Corp also demonstrated strong capital allocation strategies, including the repurchase of 1.3 million shares for $27 million under the 2024 Share Repurchase Program, leaving a substantial capacity of $623 million for future repurchases.

Looking Forward

For the full year 2024, SLM Corp anticipates a net income range of $340 million to $370 million and projects a 7% to 8% growth in private education loan originations. The company's forward guidance suggests a continued positive trajectory, supported by a robust operational framework and effective capital management strategies.

In summary, SLM Corp's first-quarter results not only exceeded analyst expectations but also positioned the company for sustained growth and profitability. The strategic sales of private education loans and effective cost management have been pivotal in driving the company's success, making it a noteworthy entity in the credit services industry.

Explore the complete 8-K earnings release (here) from SLM Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance