Sleep Number (NASDAQ:SNBR) Misses Q1 Sales Targets

Bedding manufacturer and retailer Sleep Number (NASDAQ:SNBR) missed analysts' expectations in Q1 CY2024, with revenue down 10.7% year on year to $470.4 million. It made a GAAP loss of $0.33 per share, down from its profit of $0.51 per share in the same quarter last year.

Is now the time to buy Sleep Number? Find out in our full research report.

Sleep Number (SNBR) Q1 CY2024 Highlights:

Revenue: $470.4 million vs analyst estimates of $474.3 million (0.8% miss)

EPS: -$0.33 vs analyst expectations of -$0.31 (5.8% miss)

Gross Margin (GAAP): 58.7%, in line with the same quarter last year

Free Cash Flow of $24.44 million, up from $3.03 million in the same quarter last year

Same-Store Sales were down 11% year on year

Store Locations: 661 at quarter end, decreasing by 10 over the last 12 months

Market Capitalization: $326 million

“Our actions to increase operating model efficiencies drove first quarter adjusted EBITDA and gross margin rate ahead of our expectations. We also generated a significant year-over-year increase in free cash flow, as planned, and continue to prioritize paying down debt and reducing leverage,” said Shelly Ibach, Chair, President and CEO.

Known for mattresses that can be adjusted with regards to firmness, Sleep Number (NASDAQ:SNBR) manufactures and sells its own brand of bedding products such as mattresses, bed frames, and pillows.

Home Furniture Retailer

Furniture retailers understand that ‘home is where the heart is’ but that no home is complete without that comfy sofa to kick back on or a dreamy bed to rest in. These stores focus on providing not only what is practically needed in a house but also aesthetics, style, and charm in the form of tables, lamps, and mirrors. Decades ago, it was thought that furniture would resist e-commerce because of the logistical challenges of shipping large furniture, but now you can buy a mattress online and get it in a box a few days later; so just like other retailers, furniture stores need to adapt to new realities and consumer behaviors.

Sales Growth

Sleep Number is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale.

As you can see below, the company's annualized revenue growth rate of 3.1% over the last five years was weak , but to its credit, it opened new stores and grew sales at existing, established stores.

This quarter, Sleep Number missed Wall Street's estimates and reported a rather uninspiring 10.7% year-on-year revenue decline, generating $470.4 million in revenue. Looking ahead, Wall Street expects revenue to decline 1.1% over the next 12 months.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

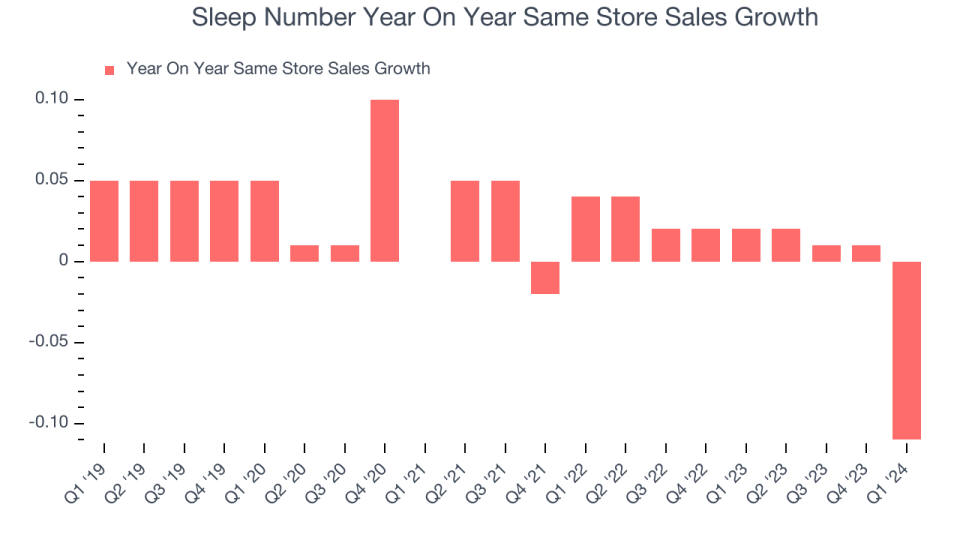

Same-Store Sales

Same-store sales growth is an important metric that tracks demand for a retailer's established brick-and-mortar stores and e-commerce platform.

Sleep Number's demand within its existing stores has barely increased over the last eight quarters. On average, the company's same-store sales growth has been flat.

In the latest quarter, Sleep Number's same-store sales fell 11% year on year. This decline was a reversal from the 2% year-on-year increase it posted 12 months ago. We'll be keeping a close eye on the company to see if this turns into a longer-term trend.

Key Takeaways from Sleep Number's Q1 Results

It was good to see Sleep Number beat analysts' gross margin expectations this quarter. On the other hand, its revenue and EPS unfortunately missed Wall Street's estimates as its same-store sales declined 11%. Overall, this was a mixed quarter for Sleep Number. The stock is up 1.3% after reporting and currently trades at $13.75 per share.

So should you invest in Sleep Number right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance