SkyWest (SKYW) Surpasses Q1 Earnings and Revenue Estimates

SkyWest Inc SKYW reported first-quarter 2024 earnings of $1.45 per share, which beat the Zacks Consensus Estimate of $1.24. The company reported a loss of 45 cents per share in the first quarter of 2023.

Revenues of $804 million surpassed the Zacks Consensus Estimate of $781 million. The top line grew 16.16% year over year due to higher revenues from flying agreements.

Total operating expenses in the reported quarter increased by $7 million to $704 million. The increase in operating expenses was primarily driven by the 5% rise in block hour production year over year, offset by lower aircraft rent expenses from early lease buyouts SkyWest executed during 2023.

Labor costs (salaries, wages and benefits), which account for roughly 50% of total operating expenses, increased 4.73% on a year-over-year basis.

SKYW exited the quarter with cash and cash equivalents of $821 million, down from $835 million at the December-end quarter of 2023. The total debt in the first quarter of 2024 was $2.9 billion, down from $3 billion in the fourth quarter of 2023.

In the first quarter of 2024, SKYW’s total available liquidity was $82 million under its current share repurchase program.

Capital expenditures during the first quarter of 2024 were $38 million for the purchase of spare engines and other fixed assets.

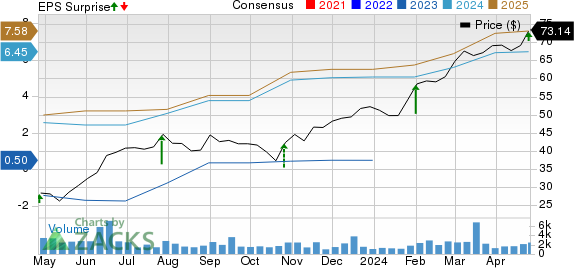

SkyWest, Inc. Price, Consensus and EPS Surprise

SkyWest, Inc. price-consensus-eps-surprise-chart | SkyWest, Inc. Quote

Other Highlights

Revenues from flying agreements, which account for 96.85% of total operating revenues, improved 17.241% to $778.3 million.

SkyWest recognized $1 million of previously deferred revenues during the first quarter of 2024 under its flying contracts compared to deferring $63 million of revenues under its flying contracts during the March-end quarter of 2023.

During the quarter, SkyWest delivered three of the 20 E175 partner-financed aircraft under a previously announced agreement with United Airlines (UAL). As of Mar 31, 2024, SkyWest leased 35 CRJ700s and five CRJ900s to third parties and had 16 CRJ200s that are ready for service under SkyWest Charter operations.

Block hour production increased 5% in the first quarter of 2024 compared to the first quarter of 2023. The passenger load factor (%of seats filled by passengers) improved 0.6 pts to 80.8% when the total number of passengers carried was 9,149,453, indicating a 6.7% increase on a year-over-year basis.

Currently, SkyWest carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Outlook

SkyWest is coordinating with its major airline partners to optimize the timing of upcoming announced fleet deliveries. By the end of 2026, SkyWest is scheduled to operate a total of 278 E175 aircraft.

Q1 Performances of Some Other Transportation Companies

Delta Air Lines’ DAL first-quarter 2024 earnings (excluding 39 cents from non-recurring items) of 45 cents per share comfortably beat the Zacks Consensus Estimate of $0.36 and improved 7.75% year over year.

Revenues of $13.75 billion surpassed the Zacks Consensus Estimate of $12.84 billion and increased 7.75% on a year-over-year basis. Adjusted operating revenues (excluding third-party refinery sales) came in at $12.6 billion, up 6% year over year.

United Airlines UAL reported a first-quarter 2024 loss (excluding 23 cents from non-recurring items) of 15 cents per share, narrower than the Zacks Consensus Estimate of 53 cents and improved 76.19% year over year.

Operating revenues of $12.54 billion beat the Zacks Consensus Estimate of $12.43 billion. The top line increased 9.71% year over year due to upbeat air travel demand. Cargo revenues fell 1.8% year over year to $391 million. Revenues from other sources jumped 10.3% year over year to $835 million.

J.B. Hunt Transport Services’ JBHT first-quarter 2024 earnings per share of $1.22 missed the Zacks Consensus Estimate of $1.53 and declined 35.45% year over year.

Total operating revenues of $2.94 billion lagged the Zacks Consensus Estimate of $3.12 billion and fell 9% year over year. Total operating revenues, excluding fuel surcharge revenues, decreased approximately 6.5% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

J.B. Hunt Transport Services, Inc. (JBHT) : Free Stock Analysis Report

SkyWest, Inc. (SKYW) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance