Skechers (SKX) Omni-Channel Capabilities Appear Encouraging

Skechers U.S.A., Inc. SKX is focused on boosting its omnichannel capabilities by expanding its direct-to-consumer (DTC) business and enhancing its foothold internationally. SKX has been gaining from growth in its domestic and international channels for a while now. Management is also focused on designing and developing new products. In a nutshell, SKX is committed to introducing more innovative and comfortable technology products, building multi-platform marketing campaigns and launching more e-commerce sites around the world.

Skechers has been directing resources to enhance its digital capabilities, including augmenting website features, mobile applications and loyalty programs. Investments made to integrate store and digital ecosystems for developing a seamless omnichannel experience are likely to attain incremental sales. The company has updated its point-of-sale systems to better engage with customers, both offline and online. Initiatives such as “Buy Online, Pick-Up in Store” and “Buy Online, Pickup at Curbside” are worth mentioning.

In addition, management has been enhancing the distribution facilities and supply-chain production capabilities. SKX has planned additional e-commerce sites, including Peru and Colombia and an update to its existing platform in Chile. The company has also launched its Sketch + loyalty program in Canada and is on track to roll out this program to more countries ahead. These investments highlight SKX’s progress as an omnichannel retailer. SKX has been enhancing its online presence for a while by further investing in digital and omnichannel capabilities.

What’s More?

Recently, Skechers reported sturdy fourth-quarter 2022 results with the top and the bottom lines exceeding the Zacks Consensus Estimate and improving year over year. Results gained from strength in SKX’s comfort technology products and sturdy demand for the innovative product portfolio coupled with higher wholesale and DTC sales. Growth across the company’s segments and increases in almost every market reflect the sturdy demand for comfort technology products.

SKX posted fourth-quarter earnings of 48 cents a share, outpacing the Zacks Consensus Estimate of 38 cents and increasing 11.6% from the year-earlier quarter’s tally. It generated sales of $1,878.8 million, which surpassed the Zacks Consensus Estimate of $1,776 million and grew 13.5% year over year owing to a 22.3% increase in domestic sales and an 8.7% rise in international sales. Region-wise, sales increased 22.5% year over year in the Americas and 28.9% in EMEA. Further, wholesale sales jumped 15.7% in the reported quarter.

We note that DTC sales grew 10.8% year over year to $829.6 million, backed by 30% growth domestically with a triple-digit increase in e-commerce and a double-digit increase in retail stores. Both these channels gained from solid inventory levels. International DTC sales were flat year over year owing to a decline in China. However, excluding China, sales rose 22% on double-digit increases across the company’s stores and online.

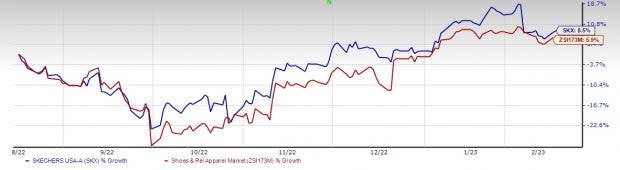

Image Source: Zacks Investment Research

The 2023 outlook reflects sales momentum across most of the company’s international markets throughout the year. A China market recovery with a steady improvement in the course of the year, better distribution operating efficiency on enhanced capacity and remediation endeavors. The gross margin is likely to benefit from lower logistics costs mainly in freight. For 2023, management believes in accomplishing sales between $7.75 billion and $8 billion and earnings per share between $2.80 and $3.00. For the first quarter of 2023, SKX is likely to achieve sales between $1.80 billion and $1.85 billion and earnings per share of between 55 cents and 60 cents.

Additionally, analysts look optimistic about the stock. The Zacks Consensus Estimate for Skechers’ 2023 sales and earnings per share (EPS) is currently pegged at $7.92 billion and $2.95 each, suggesting respective growth of 6.4% and 24% from the corresponding year-ago reported figures. Also, the consensus mark for 2024 sales and EPS is currently pegged at $8.80 billion and $3.66 each, suggesting respective growth of 11.1% and 24.2% from the corresponding year-ago reported figures.

Amid a challenging operating backdrop, shares of this footwear leader have gained 12.5% in the past six months, thanks to this currently Zacks Rank #3 (Hold) player’s aforesaid strengths. The industry has gained 5% over the same time frame.

Eye These Solid Picks

Here we highlighted three better-ranked stocks, namely, Ralph Lauren RL, Oxford Industries OXM and lululemon athletica LULU.

Ralph Lauren, a footwear and accessories dealer, has a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Ralph Lauren’s next financial-year sales and EPS suggests growth of 5% and 12.8%, respectively, from the year-ago corresponding figures. RL has a trailing four-quarter earnings surprise of 23.6%, on average.

Oxford Industries, which designs, sources, markets, and distributes products of lifestyle and other brands, carries a Zacks Rank #2 (Buy). Oxford Industries has a trailing four-quarter earnings surprise of 18.9%, on average.

The Zacks Consensus Estimate for OXM’s current financial-year EPS suggests growth of 10.4% from the year-ago reported number.

lululemon athletica is a yoga-inspired athletic apparel company. LULU has a Zacks Rank of 2 at present.

The Zacks Consensus Estimate for lululemon athletica’s current financial-year sales and EPS suggests growth of 14.4% and 14.9%, respectively, from the year-ago corresponding figures. LULU has a trailing four-quarter earnings surprise of 6.7%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Skechers U.S.A., Inc. (SKX) : Free Stock Analysis Report

Ralph Lauren Corporation (RL) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

Oxford Industries, Inc. (OXM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance