Skechers' Share Buybacks Aren't Enough

After years of letting its cash flow strengthen its balance sheet, footwear company Skechers (NYSE: SKX) finally began to send some of its excess cash to shareholders last year. The company announced a $150 million share buyback program in February 2018.

Unfortunately, the pace of that buyback program has been anemic. The company spent $100 million on its own shares in 2018, enough to reduce the outstanding share count only slightly. Skechers' diluted share count was down just 0.7% year over year at the end of 2018.

Image source: Getty Images.

To Skechers' credit, the buyback was ramped up in the fourth quarter as the stock market was melting down. Skechers spent $41.9 million on buybacks in the fourth quarter alone, paying an average price below $25 per share. Instead of blindly buying back shares at any price, Skechers is being opportunistic. That's a good thing.

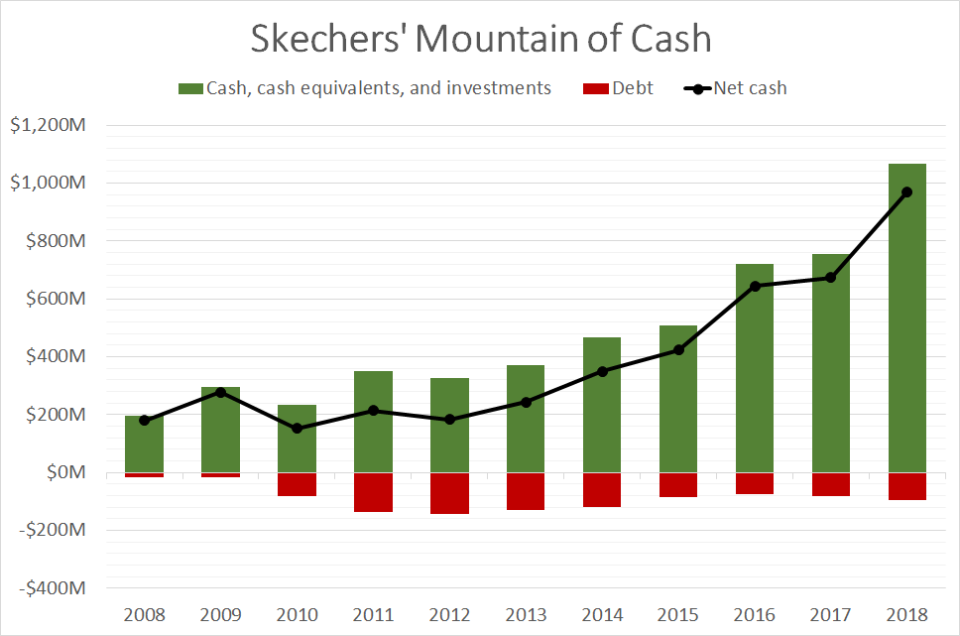

But the scale of the buyback program just isn't enough. This is a company worth $5 billion, with nearly $1 billion of cash, short-term investments, and long-term investments net of debt on the balance sheet as of the end of 2018. A $150 million buyback program spanning multiple years won't move the needle, and it won't stop cash from piling up. Over the past five years, Skechers has averaged around $180 million of annual free cash flow.

The company needs to put more firepower behind its buyback program, or it needs to start paying a dividend.

A mountain of cash

Skechers has greatly improved its balance sheet over the past decade, particularly in the past five years. The company has been able to largely avoid debt, and its cash balance has soared.

Data source: Skechers.

The company has enjoyed a growth spurt over the past five years, driven by its international business. Total revenue has doubled since 2014, and operating income has more than doubled. Skechers has been investing in growth as it expands its international presence and its direct-to-consumer business, but the company is still generating more cash than it knows what to do with.

Based on the average analyst estimate for 2019 earnings, Skechers stock trades at a P/E of about 15. But that ratio doesn't factor in the net cash on the balance sheet at all. If you back out the net cash, the enterprise value-to-earnings ratio is roughly 12. I'm using numbers from the end of 2018, not the first quarter of 2019, since seasonality leads to swings in Skechers' cash throughout the year.

Given the company's growth prospects, a EV/E of 12 doesn't seem right. The S&P 500 currently trades for more than 20 times trailing-12-month earnings, so Skechers is trading at a significant discount to the market, even ignoring the excess cash.

More buybacks, a dividend, or both

One way to remove this complication is to use some of that excess cash that's skewing the valuation metrics. Skechers should absolutely maintain a fortress balance sheet, but it doesn't need anywhere near as much cash as it currently has. A much bigger buyback would do the trick.

Skechers could buy back 10% of its outstanding shares, and it would still have more net cash on the books than it had five years ago. That would reduce how much its cash-rich balance sheet skews its valuation metrics, and it would give a nice boost to per-share earnings.

A dividend is another option. If Skechers wanted to pay investors a 2% yield, that would cost the company $0.63 per share, or less than $100 million, annually. The payout ratio would be around 30% based on earnings estimates for 2019, and the cash on the balance sheet would provide a backstop in case earnings deteriorated. A dividend would also make the stock more palatable to a wider swath of investors.

Skechers can easily afford to continue to invest in growth while ramping up capital returns to shareholders. The current buyback program is a start, but it's not enough to move the needle.

More From The Motley Fool

Timothy Green owns shares of Skechers. The Motley Fool owns shares of and recommends Skechers. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance