SiteMinder Leads Three ASX Growth Companies With High Insider Ownership

The Australian stock market showed resilience today, with the ASX200 climbing 0.76%, led by strong performances in the Materials and Real Estate sectors. Amidst these broader market movements, companies with high insider ownership can offer unique advantages, as insiders' aligned interests with shareholders might influence company performance positively during varying economic conditions.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Cettire (ASX:CTT) | 28.7% | 26.7% |

Acrux (ASX:ACR) | 14.6% | 115.3% |

Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 26.8% |

Develop Global (ASX:DVP) | 22.6% | 120.1% |

Hillgrove Resources (ASX:HGO) | 10.4% | 109.4% |

Catalyst Metals (ASX:CYL) | 17.1% | 75.7% |

Biome Australia (ASX:BIO) | 34.5% | 114.4% |

Liontown Resources (ASX:LTR) | 16.4% | 49.3% |

Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Change Financial (ASX:CCA) | 26.6% | 76.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

SiteMinder

Simply Wall St Growth Rating: ★★★★★☆

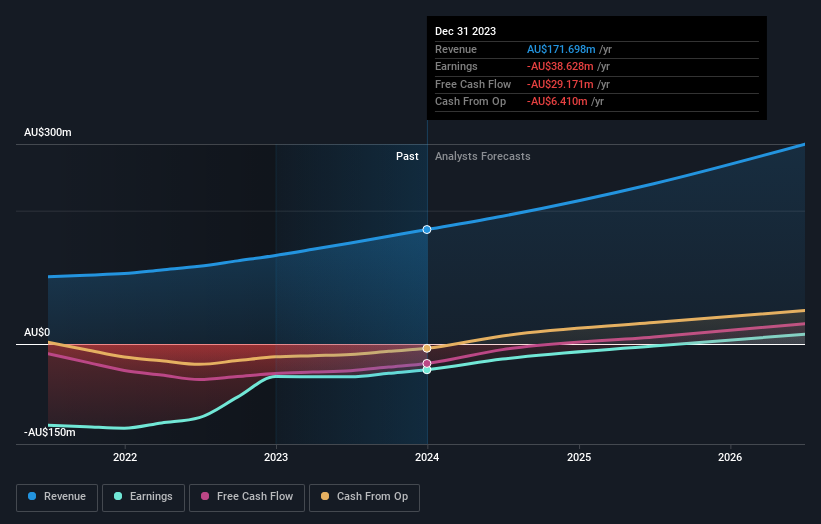

Overview: SiteMinder Limited, operating both in Australia and internationally, develops and markets an online guest acquisition platform and commerce solutions for accommodation providers, with a market capitalization of approximately A$1.50 billion.

Operations: The company generates revenue primarily through its software and programming segment, totaling approximately A$171.70 million.

Insider Ownership: 11.3%

Revenue Growth Forecast: 19.1% p.a.

SiteMinder, a growth-focused company with significant insider ownership, is poised for substantial development. Recently forming a strategic partnership with Cloudbeds, it aims to enhance platform connectivity and revenue capabilities for hoteliers globally. Financially, SiteMinder is trading at 41.3% below its estimated fair value and has demonstrated a robust earnings growth of 14.9% annually over the past five years. Looking ahead, its revenue is expected to outpace the Australian market significantly, with forecasts suggesting strong profitability within three years and a high return on equity projected at 24.5%.

Unlock comprehensive insights into our analysis of SiteMinder stock in this growth report.

Our valuation report unveils the possibility SiteMinder's shares may be trading at a premium.

Technology One

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Technology One Limited is an Australian company that develops, markets, sells, implements, and supports integrated enterprise business software solutions both domestically and internationally, with a market capitalization of approximately A$6.31 billion.

Operations: The company generates revenue primarily through three segments: Software (A$317.24 million), Corporate (A$83.83 million), and Consulting (A$68.13 million).

Insider Ownership: 12.3%

Revenue Growth Forecast: 11.1% p.a.

Technology One, a key player in the Australian software sector with high insider ownership, is positioned for growth. The company's earnings are expected to increase by 14.3% annually, outpacing the broader Australian market's forecast of 13.3%. Despite a price-to-earnings ratio slightly below the industry average at 57.6x, revenue growth projections stand at 11.1% per year—double that of the market rate. The recent appointment of Paul Robson as a Non-Executive Director strengthens its strategic capabilities, underscoring its commitment to innovation and global SaaS expansion.

Dive into the specifics of Technology One here with our thorough growth forecast report.

Our expertly prepared valuation report Technology One implies its share price may be too high.

Temple & Webster Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Temple & Webster Group Ltd operates as an online retailer specializing in furniture, homewares, and home improvement products across Australia, with a market capitalization of approximately A$1.15 billion.

Operations: The company generates its revenue primarily from the online sale of furniture, homewares, and home improvement items, totaling A$442.25 million.

Insider Ownership: 12.9%

Revenue Growth Forecast: 19.3% p.a.

Temple & Webster Group, amidst a robust share repurchase initiative, demonstrates a commitment to shareholder value and capital management. The company's earnings are projected to grow by 35.16% annually, significantly outstripping the Australian market's average. However, its revenue growth at 19.3% per year slightly lags behind the high-growth benchmark of 20%. Despite this, it still exceeds the general market pace substantially. This portrays a mixed but promising growth trajectory with active financial strategies enhancing investor appeal.

Seize The Opportunity

Get an in-depth perspective on all 89 Fast Growing ASX Companies With High Insider Ownership by using our screener here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:SDR ASX:TNE and ASX:TPW.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance