Sit-Down Dining Stocks Q1 Recap: Benchmarking Dine Brands (NYSE:DIN)

Wrapping up Q1 earnings, we look at the numbers and key takeaways for the sit-down dining stocks, including Dine Brands (NYSE:DIN) and its peers.

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

The 12 sit-down dining stocks we track reported a mixed Q1; on average, revenues missed analyst consensus estimates by 1%. Stocks--especially those trading at higher multiples--had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, and while some of the sit-down dining stocks have fared somewhat better than others, they collectively declined, with share prices falling 2.7% on average since the previous earnings results.

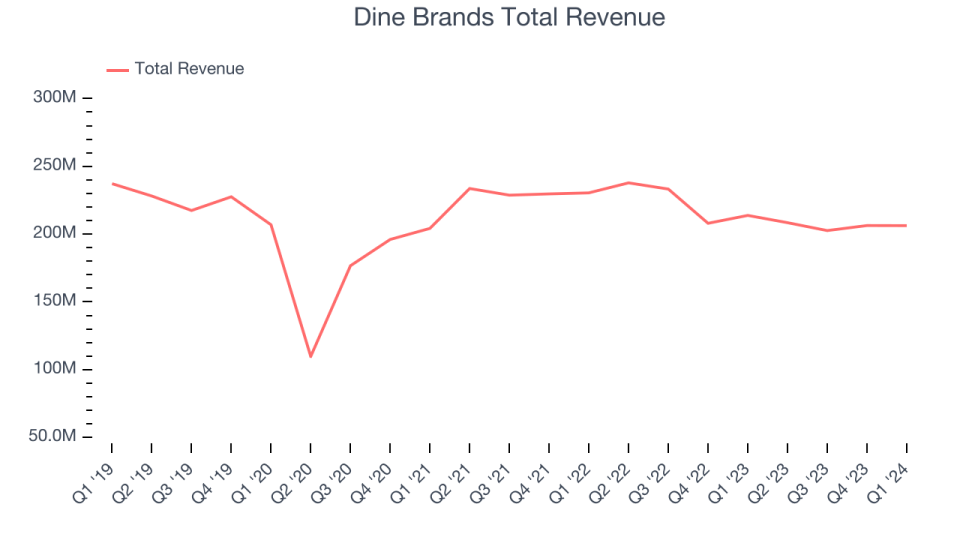

Weakest Q1: Dine Brands (NYSE:DIN)

Operating a franchise model, Dine Brands (NYSE:DIN) is a casual restaurant chain that owns the Applebee’s and IHOP banners.

Dine Brands reported revenues of $206.2 million, down 3.5% year on year, falling short of analysts' expectations by 2%. It was a weak quarter for the company, with a miss of analysts' revenue and earnings estimates.

“While we are not content with the start of the year, we are encouraged by the response of our value offerings and targeted promotions which drove improved performance as the quarter progressed,” said John Peyton, chief executive officer,

The stock is down 10.6% since the results and currently trades at $39.04.

Read our full report on Dine Brands here, it's free.

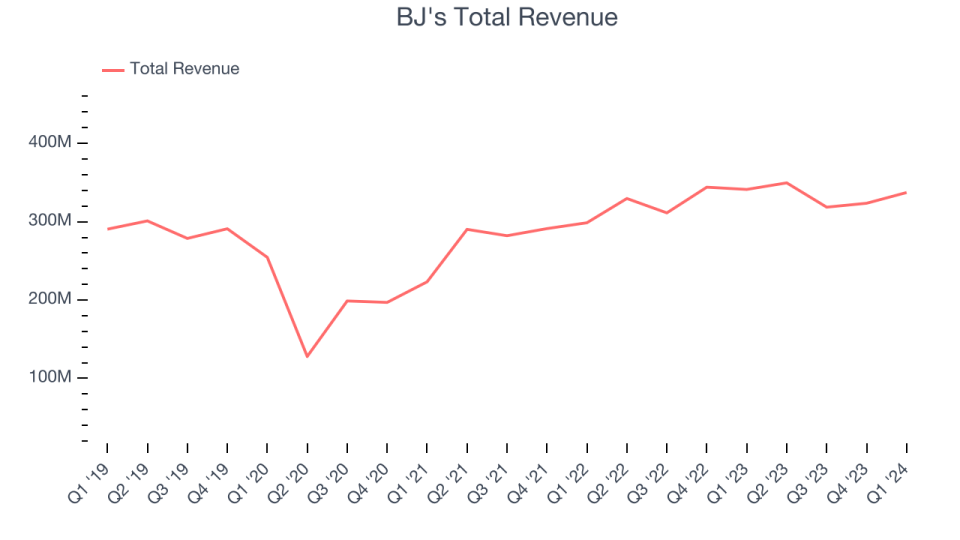

Best Q1: BJ's (NASDAQ:BJRI)

Founded in 1978 in California, BJ’s Restaurants (NASDAQ:BJRI) is a chain of restaurants whose menu features classic American dishes, often with a twist.

BJ's reported revenues of $337.3 million, down 1.2% year on year, in line with analysts' expectations. It was an exceptional quarter for the company, with an impressive beat of analysts' same store sales, gross margin, and EPS estimates.

The stock is up 6.4% since the results and currently trades at $34.85.

Is now the time to buy BJ's? Access our full analysis of the earnings results here, it's free.

Kura Sushi (NASDAQ:KRUS)

Known for its conveyor belt that transports dishes to diners, Kura Sushi (NASDAQ:KRUS) is a chain of sushi restaurants serving traditional Japanese fare with a touch of modernity and technology.

Kura Sushi reported revenues of $57.29 million, up 30.4% year on year, exceeding analysts' expectations by 1.1%. It was a weak quarter for the company, with a miss of analysts' earnings estimates.

Kura Sushi scored the biggest analyst estimates beat and fastest revenue growth in the group. The stock is down 8.6% since the results and currently trades at $95.24.

Read our full analysis of Kura Sushi's results here.

Chuy's (NASDAQ:CHUY)

Known for its ‘Big As Yo' Face’ burritos, Chuy’s (NASDAQ:CHUY) is a casual restaurant chain that specializes in Tex-Mex fare, which combines elements of traditional Mexican cuisine with Southern American cooking.

Chuy's reported revenues of $110.5 million, down 1.8% year on year, falling short of analysts' expectations by 1.1%. It was a solid quarter for the company, with a decent beat of analysts' earnings estimates.

The stock is down 13.3% since the results and currently trades at $25.84.

Read our full, actionable report on Chuy's here, it's free.

Darden (NYSE:DRI)

Started in 1968 as the famous seafood joint, Red Lobster, Darden (NYSE:DRI) is a leading American restaurant company that owns and operates a portfolio of popular restaurant brands.

Darden reported revenues of $2.97 billion, up 6.8% year on year, falling short of analysts' expectations by 1.7%. It was a slower quarter for the company, with a miss of analysts' revenue estimates and full-year revenue guidance missing analysts' expectations.

Darden had the weakest full-year guidance update among its peers. The stock is down 15% since the results and currently trades at $148.44.

Read our full, actionable report on Darden here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance