Silicon Motion (SIMO) Beats Q4 Earnings & Revenue Estimates

Silicon Motion Technology Corporation SIMO reported fourth-quarter 2021 non-GAAP earnings of $1.90 per American Depositary Share (ADS), which surpassed the Zacks Consensus Estimate by 7.3%. The bottom line increased 120.9% from the year-ago quarter and 11.8% sequentially.

Net sales (non-GAAP) of $264.4 million beat the Zacks Consensus Estimate by 0.2%. On a year-over-year basis, sales rallied 83.7% as sales of SSD controllers reached a new record high. Net sales also increased 4% sequentially in the fourth quarter.

Though the company was supply-constrained for most of 2021, it created significant incremental value by optimizing its limited foundry wafer supply.

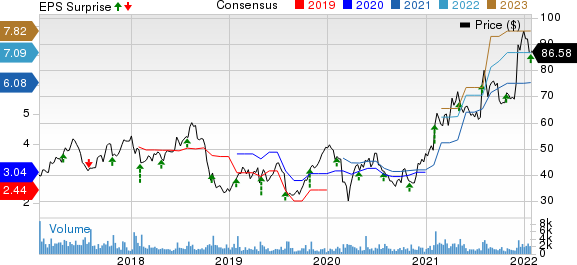

Silicon Motion Technology Corporation Price, Consensus and EPS Surprise

Silicon Motion Technology Corporation price-consensus-eps-surprise-chart | Silicon Motion Technology Corporation Quote

Performance in Detail

Management noted that sales of SSD controllers increased 15-20% sequentially. Revenues from SSD solutions increased 5-10% quarter over quarter. Revenues from eMMC+UFS controllers declined 5-10% sequentially.

In 2021, sales of SSD controllers surged 75-80% year over year. Sales of eMMC+UFS controllers increased 105-110% on a year-over-year basis. SSD solutions’ sales declined 5-10%.

Margins

Non-GAAP gross margin of 49.9% expanded 60 basis points (bps) on a year-over-year basis but contracted 30 bps sequentially. Non-GAAP operating expenses, as a percentage of revenues, totaled 19%, expanding 1,080 bps year over year but contracting 270 bps sequentially. Non-GAAP operating margin expanded 900 bps on a year-over-year basis and 150 bps sequentially to 30.9%.

Cash Flow & Liquidity

As of Dec 31, 2021, Silicon Motion had cash and cash equivalents of $360 million, with $156.6 million of accrued expenses and other current liabilities. The company generated $176.9 million of cash from operations in 2021 compared with $117.2 million in 2020.

On Dec 7, 2021, Silicon Motion’s board of directors authorized a new program to repurchase up to $200 million of its ADS over a six-month period. In December 2021, the company repurchased $50 million of its ADS at an average price of $89.85.

Outlook

Silicon Motion expanded its SSD controller program engagements with PC OEMs and eMMC/UFS controllers for smartphones, automotive applications and IoT/smart devices. The company is adding to this momentum with the upcoming launch of its next-generation enterprise-class SSD controllers.

For the first quarter of 2022, management expects non-GAAP revenues in the range of $225-$238 million. Non-GAAP gross margin is anticipated in the range of 49.5-51.5%. Non-GAAP operating margin is projected in the 27.5-29.5% band.

For full-year 2022, management expects non-GAAP revenues in the range of $1,110-$1,200 million. Non-GAAP gross margin is anticipated in the band of 49-51%. Non-GAAP operating margin is estimated to be 29-31%.

Zacks Rank & Stocks to Consider

Silicon Motion currently has a Zacks Rank #5 (Strong Sell).

Vocera Communications, Inc. VCRA is a better-ranked stock in the broader Zacks Computer and Technology sector that sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for its current-year earnings has been revised 6.2% upward over the past 60 days.

Vocera Communications delivered a trailing four-quarter earnings surprise of 109.6%, on average. The stock has returned 77.3% in the past year.

SeaChange International, Inc. SEAC carries a Zacks Rank #2 (Buy). The consensus estimate for current-year earnings has been revised 10% upward over the past 60 days.

SeaChange International delivered a trailing four-quarter earnings surprise of 37.2%, on average. The stock has, however, moved down 6.6% in the past year.

Qualcomm, Inc. QCOM, carrying a Zacks Rank #2, is another solid pick for investors. The consensus estimate for current-year earnings has been revised 0.7% upward over the past 60 days.

Qualcomm delivered a trailing four-quarter earnings surprise of 11.2%, on average. It has appreciated 7.3% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

QUALCOMM Incorporated (QCOM) : Free Stock Analysis Report

Silicon Motion Technology Corporation (SIMO) : Free Stock Analysis Report

SeaChange International, Inc. (SEAC) : Free Stock Analysis Report

Vocera Communications, Inc. (VCRA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance