Short Sellers Target Air Canada as Costs Rise, Travel Demand Weakens

(Bloomberg) -- Short sellers are targeting Canada’s biggest publicly traded airline as investors expect rising operational costs and weaker post-pandemic consumer demand to weigh on growth.

Most Read from Bloomberg

Biden Struggles to Contain Mounting Pressure to Drop Out of Race

China Can End Russia’s War in Ukraine With One Phone Call, Finland Says

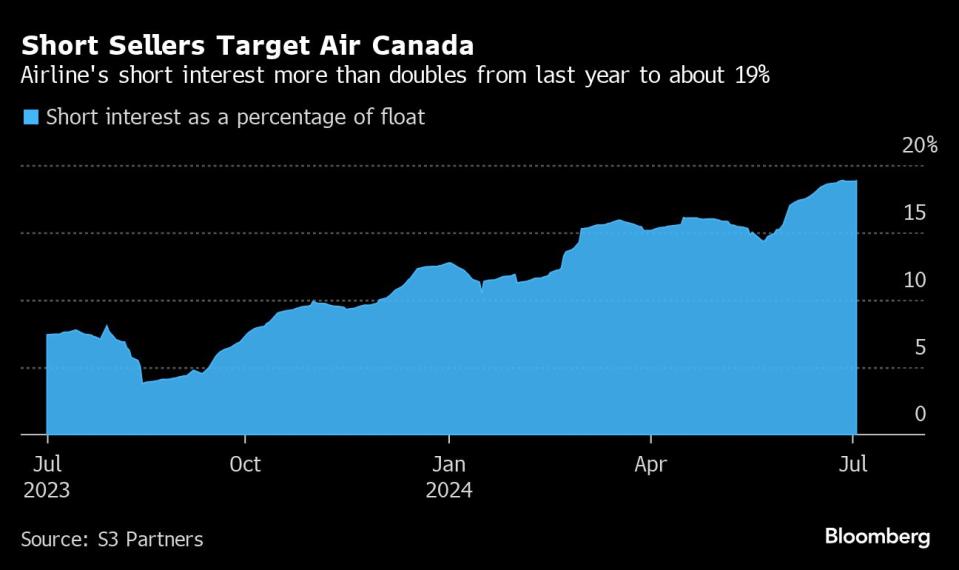

Air Canada’s short interest as a percentage of float — a metric that measures how many traders sold shares compared to the total amount of stock available to trade — stood at nearly 19% in early July, according to financial data firm S3 Partners LLC.

This is more than double the 7.4% rate a year earlier, signaling that investors expect shares to come under further pressure as Canadians allocate more of their pay to cover higher costs of living. It’s also the highest rate recorded since December 2021 when additional COVID-19 travel restrictions were imposed, sending the rate to nearly 21%.

Shares of the Canadian airline operator are trading 4.7% lower this year as economic and industry headwinds have taken their toll. The stock is also trading far below its pre-pandemic range, hitting a high of around C$50.05 ($36.74) in November 2019.

“Canadian investors are concerned about a slowing Canadian economy and a potential increase in pilot pay once they negotiate their contract,” TD Cowen analyst Helane Becker said in an email.

Investors are forecasting a challenging travel season for airlines, with a lack of available aircraft and materials to make them as well as elevated inflation threatening to keep passengers away. While higher interest rates have brought inflation closer to its 2% target, headline inflation quickened to 2.9% in May, up from the 2.7% a month earlier.

Preliminary economic data from Statistics Canada also points to flatter growth ahead as the agency predicts gross domestic product rose 0.1% in May, slower than the 0.3% expansion a month earlier.

Geopolitical uncertainty also is weighing on travel demand, Royal Bank of Canada economist Claire Fan said. An RBC Economics report in June noted that while Canadian residents are taking more trips recently, demand for tourists visiting Canada still hovers 10% below pre-pandemic levels.

Transat A.T. Inc., a tour operator and air carrier, is another publicly traded Canadian aerospace company that has come under pressure since the pandemic. Shares are down 86% since January 2020, before COVID-19 travel restrictions were put in place. Air Canada’s stock has fallen 64% since then.

Air Canada has dominated the Canadian airline market as the country’s largest air carrier, but further growth is being threatened by structurally higher labor costs and increased domestic competition. Its share of capacity is down to 48% from roughly 54% in 2019 as peers including WestJet Airlines Ltd. and Porter Airlines Inc. expand routes, according to Bloomberg Intelligence aerospace and defense analyst Francois Duflot.

“The domestic market is the biggest and most profitable market for Air Canada,” Duflot said. “Everybody is growing, and airlines are really sensitive to this kind of competition and pressure.”

And unlike most US carriers, Air Canada has yet to work out a new labor agreement with its more than 5,000 pilots. The two sides let a negotiated framework with a mediator expire on June 1, setting the path for a possible strike vote during what’s expected to be a busy summer travel season. Labor expenses and fuel are the industry’s two biggest cost drivers.

Air Canada also could be a proxy to how analysts look at the Canadian airline industry as a whole. Morningstar Research Services LLC’s aerospace and defense analyst Nicolas Owens recently argued that most North American airline stocks are overvalued and Air Canada’s lagging performance isn’t particularly unique.

Air Canada, like other airlines, is expected to experience a return to pre-pandemic travel demand, Owens said.“It’s just this dip and rebound that we’re seeing now,” he said.

--With assistance from Geoffrey Morgan.

Most Read from Bloomberg Businessweek

China’s Investment Bankers Join the Communist Party as Morale (and Paychecks) Shrink

Dragons and Sex Are Now a $610 Million Business Sweeping Publishing

The Fried Chicken Sandwich Wars Are More Cutthroat Than Ever Before

For Tesla, a Smaller Drop in Sales Is Something to Celebrate

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance