Shelf-Stable Food Stocks Q1 Teardown: Hormel Foods (NYSE:HRL) Vs The Rest

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Hormel Foods (NYSE:HRL) and the best and worst performers in the shelf-stable food industry.

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

The 21 shelf-stable food stocks we track reported a decent Q1; on average, revenues beat analyst consensus estimates by 0.5%. while next quarter's revenue guidance was 1.6% below consensus. Valuation multiples for many growth stocks have not yet reverted to their early 2021 highs, but the market was optimistic at the end of 2023 due to cooling inflation. The start of 2024 has been a different story as mixed signals have led to market volatility, and while some of the shelf-stable food stocks have fared somewhat better than others, they collectively declined, with share prices falling 2.9% on average since the previous earnings results.

Hormel Foods (NYSE:HRL)

Best known for its SPAM brand, Hormel (NYSE:HRL) is a packaged foods company with products that span meat, poultry, shelf-stable foods, and spreads.

Hormel Foods reported revenues of $2.89 billion, down 3% year on year, falling short of analysts' expectations by 2.7%. It was an ok quarter for the company, with an impressive beat of analysts' gross margin estimates but a miss of analysts' operating margin estimates.

The stock is down 9.9% since the results and currently trades at $30.74.

Is now the time to buy Hormel Foods? Access our full analysis of the earnings results here, it's free.

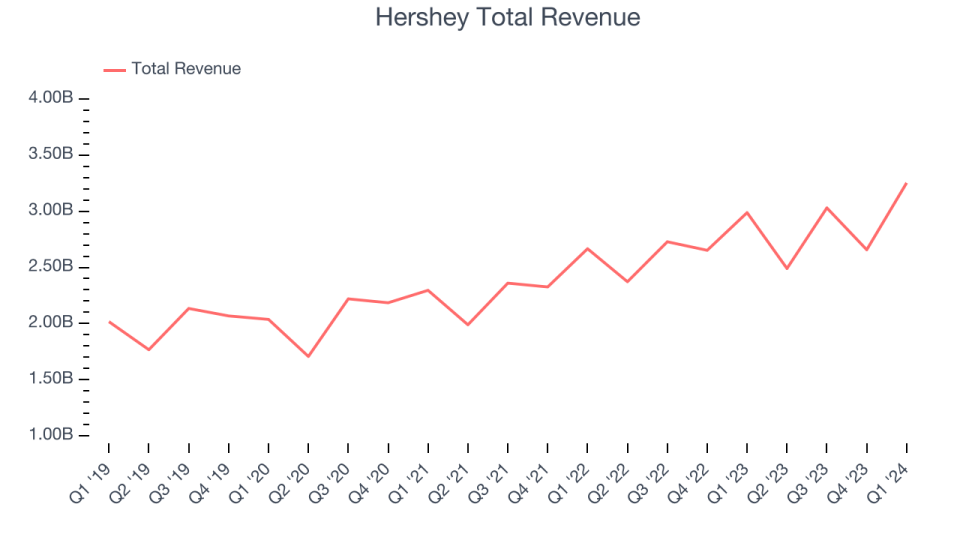

Best Q1: Hershey (NYSE:HSY)

Best known for its milk chocolate bar and Hershey's Kisses, Hershey (NYSE:HSY) is an iconic company known for its chocolate products.

Hershey reported revenues of $3.25 billion, up 8.9% year on year, outperforming analysts' expectations by 4.5%. It was a stunning quarter for the company, with an impressive beat of analysts' gross margin estimates.

The stock is down 7.1% since the results and currently trades at $182.09.

Is now the time to buy Hershey? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Lamb Weston (NYSE:LW)

Best known for its Grown in Idaho brand, Lamb Weston (NYSE:LW) produces and distributes potato products such as frozen french fries and mashed potatoes.

Lamb Weston reported revenues of $1.46 billion, up 16.3% year on year, falling short of analysts' expectations by 11.8%. It was a weak quarter for the company, with full-year revenue guidance missing analysts' expectations and a miss of analysts' operating margin estimates.

Lamb Weston had the weakest performance against analyst estimates and weakest full-year guidance update in the group. The stock is down 13.4% since the results and currently trades at $87.49.

Read our full analysis of Lamb Weston's results here.

Post (NYSE:POST)

Founded in 1895, Post (NYSE:POST) is a packaged food company known for its namesake breakfast cereal and healthier-for-you snacks.

Post reported revenues of $2.00 billion, up 23.4% year on year, falling short of analysts' expectations by 1.5%. It was a solid quarter for the company, with an impressive beat of analysts' gross margin estimates and a decent beat of analysts' earnings estimates.

The stock is up 0.2% since the results and currently trades at $105.

Read our full, actionable report on Post here, it's free.

BellRing Brands (NYSE:BRBR)

Spun out of Post Holdings in 2019, Bellring Brands (NYSE:BRBR) offers protein shakes, nutrition bars, and other products under the PowerBar, Premier Protein, and Dymatize brands.

BellRing Brands reported revenues of $494.6 million, up 28.3% year on year, surpassing analysts' expectations by 5.9%. It was an exceptional quarter for the company, with an impressive beat of analysts' organic revenue growth estimates.

BellRing Brands delivered the fastest revenue growth among its peers. The stock is down 2% since the results and currently trades at $56.04.

Read our full, actionable report on BellRing Brands here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance