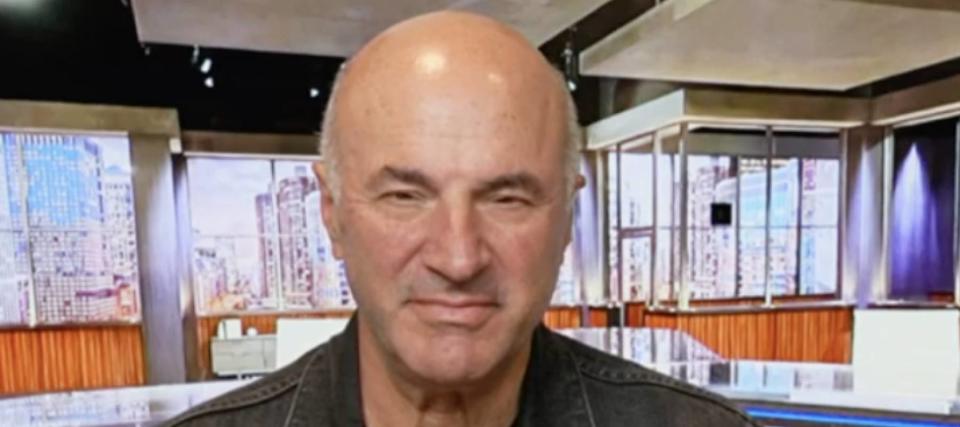

‘Shark Tank’ star Kevin O'Leary explains what changed the cost of housing in America

Is the American Dream of owning a home dead? If you ask today’s buyers, they might say yes.

Higher costs have been pushing many would-be homeowners out of the market. And it hasn’t been a short-term problem. Home prices have been on a tear since 2021, and there isn’t much near-term relief in sight.

Don't miss

Car insurance rates have spiked in the US to a stunning $2,150/year — but you can be smarter than that. Here's how you can save yourself as much as $820 annually in minutes (it's 100% free)

'You didn't want to risk it': 80-year-old woman from South Carolina is looking for the safest place for her family's $250,000 savings. Here's Dave Ramsey's response

These 5 magic money moves will boost you up America's net worth ladder in 2024 — and you can complete each step within minutes. Here's how

So what’s the culprit? If you ask “Shark Tank” personality and investor Kevin O'Leary, it boils down to interest rates.

In a recent Fox News interview, O'Leary said, “What's changed the cost of housing is the rapid increase two years ago in interest rates."

Interest rates have remained elevated following a string of hikes on the part of the Federal Reserve that took place in 2022 and 2023.

“The anticipation was that rates would come down. Only 12 months ago we were thinking seven rate cuts of which none have appeared, because inflation has remained rampant, we’re still north of 3%,” said O’Leary.

The Fed has yet to start cutting rates, and projected only one rate cut for the remainder of this year. The average 30-year mortgage rate today is close to 7%, according to Fed data, up from less than 4% five years ago.

By O’Leary’s estimates, housing costs have gone up 30%-40% when you account for today's mortgage rates compared to pre-pandemic rates.

He also cited a “weird” outcome of the pandemic where people left cities and moved to rural regions.

"It's a new America, it’s a digitized America, and housing's more expensive," O’Leary summed it up.

How high are today’s mortgage rates?

Today’s mortgage rates are far from the highest they’ve ever been.

Back in the early 1980s, it wasn't uncommon to see mortgage rates in the 18% range. However, back then, home values were also much lower. So all told, average earners were still in a better position to buy.

Read more: 'It's not taxed at all': Warren Buffett shares the 'best investment' you can make when battling rising costs — take advantage today

When we compare today's mortgage rates to pre-pandemic rates (because the record-low rates that emerged during the pandemic were truly not the norm), we can see that there's been a huge increase. In June of 2019, the average 30-year mortgage rate was a notch under 4%.

But mortgage rates play a huge role in home affordability. A $400,000 home bought with a 20% downpayment and a 30-year fixed mortgage at 7% would result in monthly payments of $2,879. That same loan with a 4% interest rate costs $2,277 in monthly payments.

How much higher are home prices today?

It’s not just that mortgage rates are higher today. Home prices are higher as well – largely, at this point, due to a lack of inventory. Zillow says the U.S. housing shortage grew to 4.5 million homes in 2022, up from 4.3 million in 2021. In 2022, the number of U.S. families increased by 1.8 million, while only 1.4 million housing units were built.

"The simple fact is there are not enough homes in this country, and that's pushing homeownership out of reach for too many families," said Orphe Divounguy, senior economist at Zillow. "The affordability crisis extends to renters as well, with nearly half of renter households being cost burdened. Filling the housing shortage is the long-term answer to making housing more affordable. We are in a big hole, and it is going to take more than the status quo to dig ourselves out of it."

During the first quarter of 2019, the median U.S. home sale price was $313,000, per the Federal Reserve. During the first quarter of 2024, it was $420,800.

What if the dream is unrealized?

It’s true that now’s a very difficult time to buy a home. But interest rates are likely to fall at some point, whether it’s 2025, 2026, or beyond. That should ease some of the burden on homebuyers.

That said, homeownership is not the only ticket to attaining financial success. It’s possible to rent a home and invest the money you’re not spending on property taxes and upkeep. So if you decide not to pursue homeownership, do not assume that you’re doomed financially. If you want to include real estate in your portfolio without owning property, you can consider real estate investment trusts (REITs).

What to read next

Thanks to Jeff Bezos, you can now use $100 to cash in on prime real estate — without the headache of being a landlord. Here's how

Beating the market is no myth: These expert stock-pickers' recent success could help you build generational wealth

BlackRock CEO Larry Fink has an important message for the next wave of US retirees — here's how he wants to solve the country's retirement crisis

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

Yahoo Finance

Yahoo Finance