Shareholders Are Thrilled That The Beacon Roofing Supply (NASDAQ:BECN) Share Price Increased 221%

When you buy shares in a company, there is always a risk that the price drops to zero. But if you pick the right stock, you can make a lot more than 100%. For example, the Beacon Roofing Supply, Inc. (NASDAQ:BECN) share price has soared 221% in the last year. Most would be very happy with that, especially in just one year! Also pleasing for shareholders was the 30% gain in the last three months. The longer term returns have not been as good, with the stock price only 12% higher than it was three years ago.

Check out our latest analysis for Beacon Roofing Supply

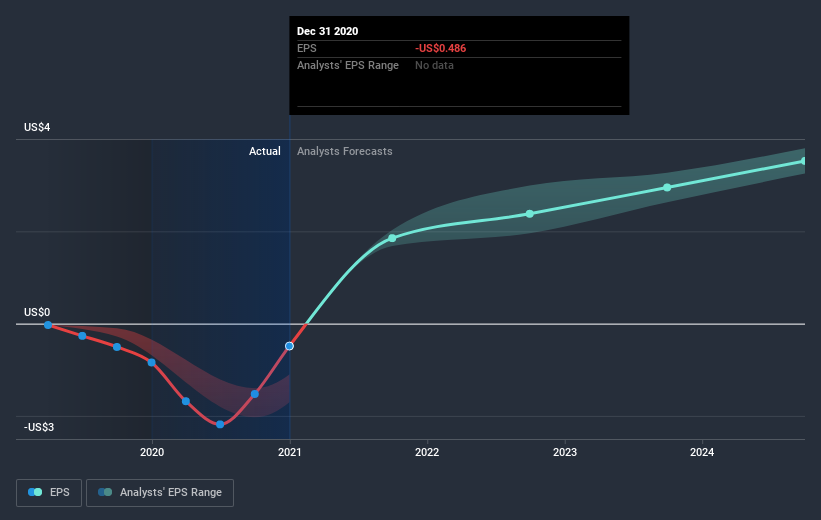

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Beacon Roofing Supply was able to grow EPS by 43% in the last twelve months. Though we do note extraordinary items affected the bottom line. This EPS growth is significantly lower than the 221% increase in the share price. This indicates that the market is now more optimistic about the stock.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

It's good to see that Beacon Roofing Supply has rewarded shareholders with a total shareholder return of 221% in the last twelve months. That gain is better than the annual TSR over five years, which is 5%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Beacon Roofing Supply better, we need to consider many other factors. Even so, be aware that Beacon Roofing Supply is showing 3 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance