Would Shareholders Who Purchased CorePoint Lodging's (NYSE:CPLG) Stock Year Be Happy With The Share price Today?

While not a mind-blowing move, it is good to see that the CorePoint Lodging Inc. (NYSE:CPLG) share price has gained 29% in the last three months. But in truth the last year hasn't been good for the share price. In fact the stock is down 19% in the last year, well below the market return.

View our latest analysis for CorePoint Lodging

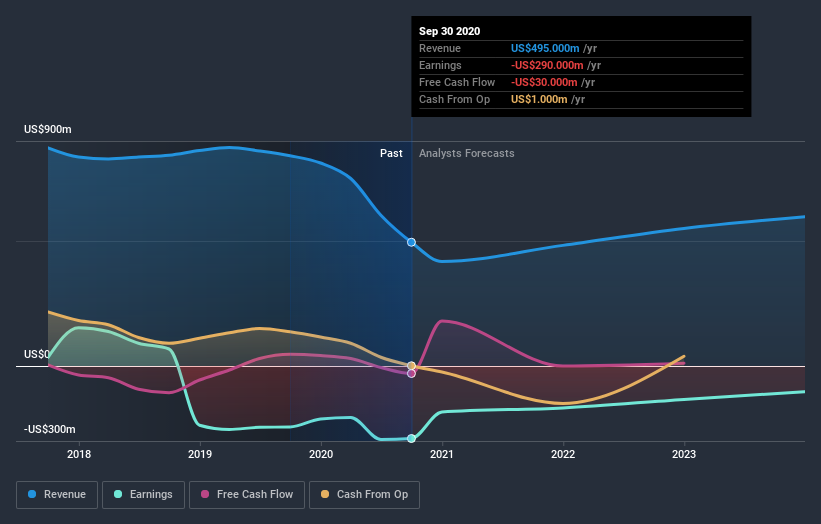

Because CorePoint Lodging made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

CorePoint Lodging's revenue didn't grow at all in the last year. In fact, it fell 41%. That looks pretty grim, at a glance. Shareholders have seen the share price drop 19% in that time. That seems pretty reasonable given the lack of both profits and revenue growth. We think most holders must believe revenue growth will improve, or else costs will decline.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between CorePoint Lodging's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. CorePoint Lodging's TSR of was a loss of 15% for the year. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

While CorePoint Lodging shareholders are down 15% for the year, the market itself is up 27%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. It's great to see a nice little 29% rebound in the last three months. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for CorePoint Lodging you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance