Would Shareholders Who Purchased BEST's (NYSE:BEST) Stock Three Years Be Happy With The Share price Today?

It's nice to see the BEST Inc. (NYSE:BEST) share price up 14% in a week. But only the myopic could ignore the astounding decline over three years. In that time the share price has melted like a snowball in the desert, down 87%. So we're relieved for long term holders to see a bit of uplift. Only time will tell if the company can sustain the turnaround.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Check out our latest analysis for BEST

BEST wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

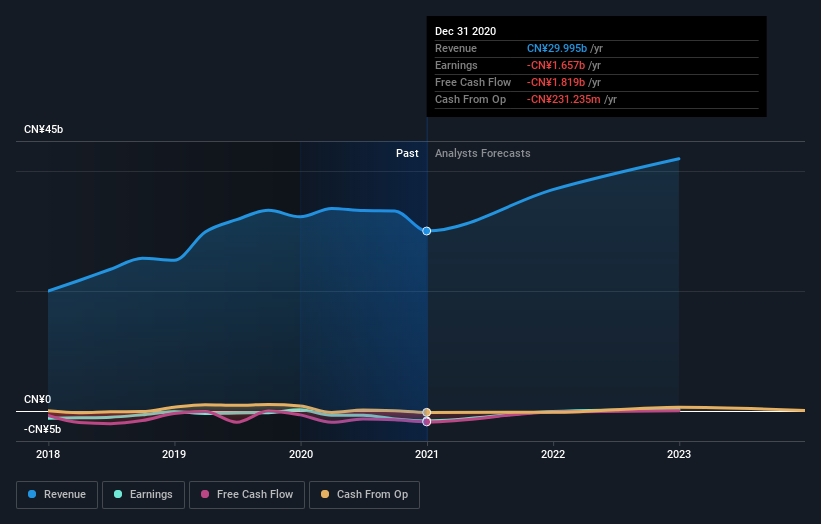

In the last three years, BEST saw its revenue grow by 15% per year, compound. That's a fairly respectable growth rate. So it's hard to believe the share price decline of 23% per year is due to the revenue. More likely, the market was spooked by the cost of that revenue. This is exactly why investors need to diversify - even when a loss making company grows revenue, it can fail to deliver for shareholders.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Over the last year, BEST shareholders took a loss of 73%. In contrast the market gained about 46%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Shareholders have lost 23% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that BEST is showing 2 warning signs in our investment analysis , you should know about...

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance