Shareholders Will Most Likely Find Ohio Valley Banc Corp.'s (NASDAQ:OVBC) CEO Compensation Acceptable

Key Insights

Ohio Valley Banc's Annual General Meeting to take place on 15th of May

Salary of US$340.4k is part of CEO Larry Miller's total remuneration

The overall pay is comparable to the industry average

Ohio Valley Banc's total shareholder return over the past three years was 11% while its EPS was down 3.5% over the past three years

Despite Ohio Valley Banc Corp.'s (NASDAQ:OVBC) share price growing positively in the past few years, the per-share earnings growth has not grown to investors' expectations, suggesting that there could be other factors at play driving the share price. The upcoming AGM on 15th of May may be an opportunity for shareholders to bring up any concerns they may have for the board’s attention. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. From the data that we gathered, we think that shareholders should hold off on a raise on CEO compensation until performance starts to show some improvement.

See our latest analysis for Ohio Valley Banc

Comparing Ohio Valley Banc Corp.'s CEO Compensation With The Industry

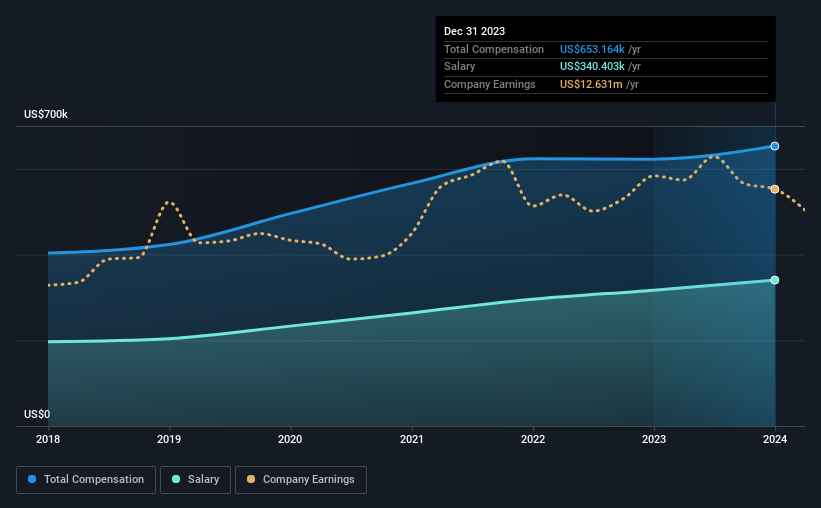

At the time of writing, our data shows that Ohio Valley Banc Corp. has a market capitalization of US$109m, and reported total annual CEO compensation of US$653k for the year to December 2023. That's just a smallish increase of 4.9% on last year. We note that the salary of US$340.4k makes up a sizeable portion of the total compensation received by the CEO.

On comparing similar-sized companies in the American Banks industry with market capitalizations below US$200m, we found that the median total CEO compensation was US$643k. From this we gather that Larry Miller is paid around the median for CEOs in the industry. Furthermore, Larry Miller directly owns US$393k worth of shares in the company.

Component | 2023 | 2022 | Proportion (2023) |

Salary | US$340k | US$317k | 52% |

Other | US$313k | US$306k | 48% |

Total Compensation | US$653k | US$623k | 100% |

On an industry level, around 45% of total compensation represents salary and 55% is other remuneration. According to our research, Ohio Valley Banc has allocated a higher percentage of pay to salary in comparison to the wider industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Ohio Valley Banc Corp.'s Growth

Ohio Valley Banc Corp. has reduced its earnings per share by 3.5% a year over the last three years. Its revenue is up 1.0% over the last year.

Overall this is not a very positive result for shareholders. The modest increase in revenue in the last year isn't enough to make us overlook the disappointing change in EPS. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Ohio Valley Banc Corp. Been A Good Investment?

With a total shareholder return of 11% over three years, Ohio Valley Banc Corp. shareholders would, in general, be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

Despite the positive returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about whether these returns will continue. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at Ohio Valley Banc.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance