Shareholders in Madison Square Garden Sports (NYSE:MSGS) are in the red if they invested five years ago

The main aim of stock picking is to find the market-beating stocks. But in any portfolio, there will be mixed results between individual stocks. At this point some shareholders may be questioning their investment in Madison Square Garden Sports Corp. (NYSE:MSGS), since the last five years saw the share price fall 38%.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

View our latest analysis for Madison Square Garden Sports

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Madison Square Garden Sports became profitable within the last five years. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics might give us a better handle on how its value is changing over time.

It could be that the revenue decline of 8.2% per year is viewed as evidence that Madison Square Garden Sports is shrinking. That could explain the weak share price.

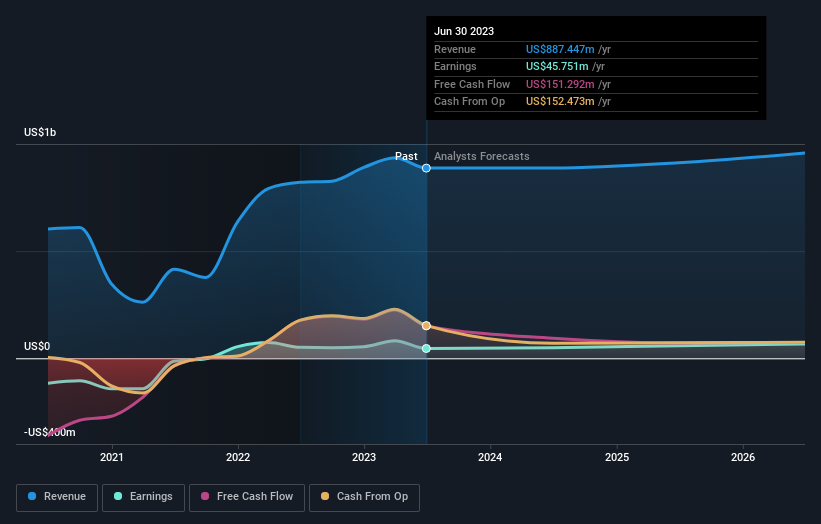

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It is of course excellent to see how Madison Square Garden Sports has grown profits over the years, but the future is more important for shareholders. You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Madison Square Garden Sports' total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Madison Square Garden Sports hasn't been paying dividends, but its TSR of -9.0% exceeds its share price return of -38%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's nice to see that Madison Square Garden Sports shareholders have received a total shareholder return of 28% over the last year. There's no doubt those recent returns are much better than the TSR loss of 1.7% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand Madison Square Garden Sports better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Madison Square Garden Sports (of which 1 is a bit unpleasant!) you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance